Ralph Hamers, group chief executive of UBS, said the bank’s strategy will remain unchanged following its acquisition of Credit Suisse which will add scale to the global wealth and asset management franchise; add strategic global banking businesses while exiting trading positions.

Hamers spoke on an investor call on the evening of 19 March following the announcement that Swiss regulators had asked UBS to acquire Credit Suisse.

He said: “We are combining forces with Credit Suisse and will be able to drive scale and boost capabilities across our asset gathering platform, which is the core of our strategy.”

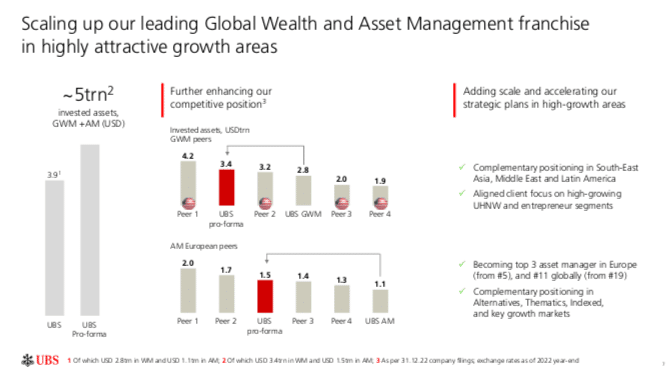

Just over a year ago UBS said it aspired to reach $6 trillion in invested assets, and the acquisition will take the combined firm to $5 trillion and be in leadership positions in Switzerland, EMEA, Asia Pacific and Latin America.

“In Asia Pacific our strength in Hong Kong, Singapore and China will now be complemented by Credit Suisse’s leading position in Southeast Asia,” Hamers added. “We can accelerate our organic strategy by becoming the third largest European asset manager with an attractive and balanced product portfolio across alternatives and traditional capabilities, as well as a better spread across regions.”

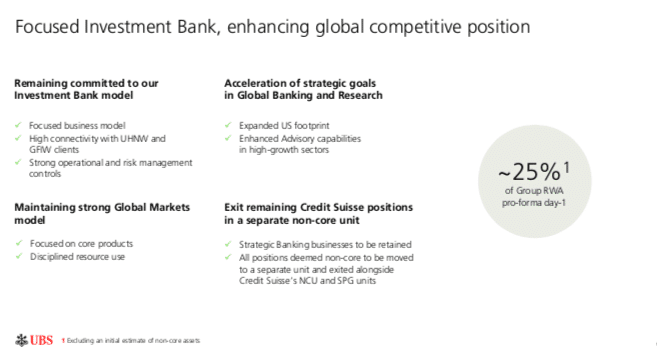

Investment bank

Hamers continued that strategic global banking businesses to be retained, but majority of Credit Suisse markets positions will moved to non-core and exited alongside Credit Suisse’s non-core unit and securitized product group.

“We think of our investment bank as a set of capabilities that supports our role as an investing platform in wealth and asset management,” he added. “We are extremely selective in the trading and derivative assets that we take into our investment bank.”

Hamers highlighted that Credit Suisse ‘strengths, particularly in the US and the technology sector, makes these areas a very good fit for UBS’s strategy as entrepreneurs create wealth. The investment bank will account for around 25% of group risk-weighted assets over time and Hamers said UBS will be very decisive and fast in running down trading assets.

“At the same time, some of the positions are extremely long-dated which is why we also want to be realistic and transparent,” he added. “This is not the type of portfolio which you can simply offload the next morning.

Financials

Colm Kelleher, chairman of UBS, said on the investor call that it was a historic day in Switzerland and the day that UBS hoped would not come, but that the bank is firmly committed to its organic growth strategy.

“Various events over the last few weeks resulted in regulators across the world, urging UBS to consider a takeover of Credit Suisse to preserve global financial stability,” Kelleher said. “Unfortunately, for our shareholders in the near-term this will result in the temporary suspension of our share repurchase programme, although our progressive dividend policy remains intact.”

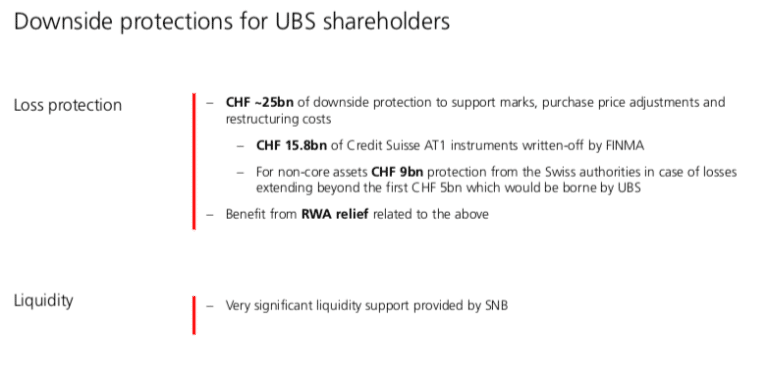

He emphasised that while UBS did not initiate discussions, the bank believes this transaction is financially attractive for shareholders, protects UBS from additional downside and should support earnings growth over time and includes very significant liquidity support provided by the Swiss National Bank.

“We remain fully committed to our existing strategic objectives, including the US and APAC,” Kelleher added.

Hamers said the all-stock transaction and an exchange rate of around 22 Credit Suisse shares for one UBS share, which that represents CHF3bn ($3.24bn) in value, a significant discount to the Credit Suisse market cap as of the previous close on 17 March.

Hamers continued that it was always important to protect UBS shareholders from downside risk. The bank has CHF 25bn of downside protection to support marks, purchase price adjustments and restructuring costs. For non-core assets, UBS will bear the first CHF 5bn but Swiss authorities will bear a further CHF 9bn if needed.

Sarah Youngwood, group chief financial officer of UBS, said on the investor call that the bank expects to realise more than CHF 8bn in run rate cost reductions by 2027 and expects the transaction to be EPS accretive by 2027.

In the near to medium-term the Credit Suisse integration expenses will likely cause shareholder returns to dip below UBS’s 15% to 18% target as the integration is expected to take three to four years. UBS remains committed to a progressive cash dividend, including the 2022 dividend, but will pull its share repurchase programme.

FINMA, the Swiss regulator, also wrote off CHF 15.8bn of Credit Suisse AT1 bonds, so holders will receive less than Credit Suisse shareholders. The “contingent convertibles” or “CoCo” bonds can be written off or converted into equity if a bank’s capital levels fall below a certain level.

Analysts asked on the call whether the AT1 write off could translate into litigation risk for UBS but management said it would not as the decision was taken by FINMA.

Muhammed Demir, head of capital markets at City based multi-asset broker Swiss Finance Corporation (SFC), said in an email: “Markets clearly see the UBS takeover of Credit Suisse as a sticking plaster over someone who has lost their arm, so expect to see a bigger sell-off over the coming weeks. Events in Switzerland also spell trouble for troubled US banks more exposed than their European counterparts. It seems like we are on the cusp of weaker US dollar territory against the euro.”