Why “Best Execution”? 4 Charts Explain

Traders Magazine Online News, May 21, 2019

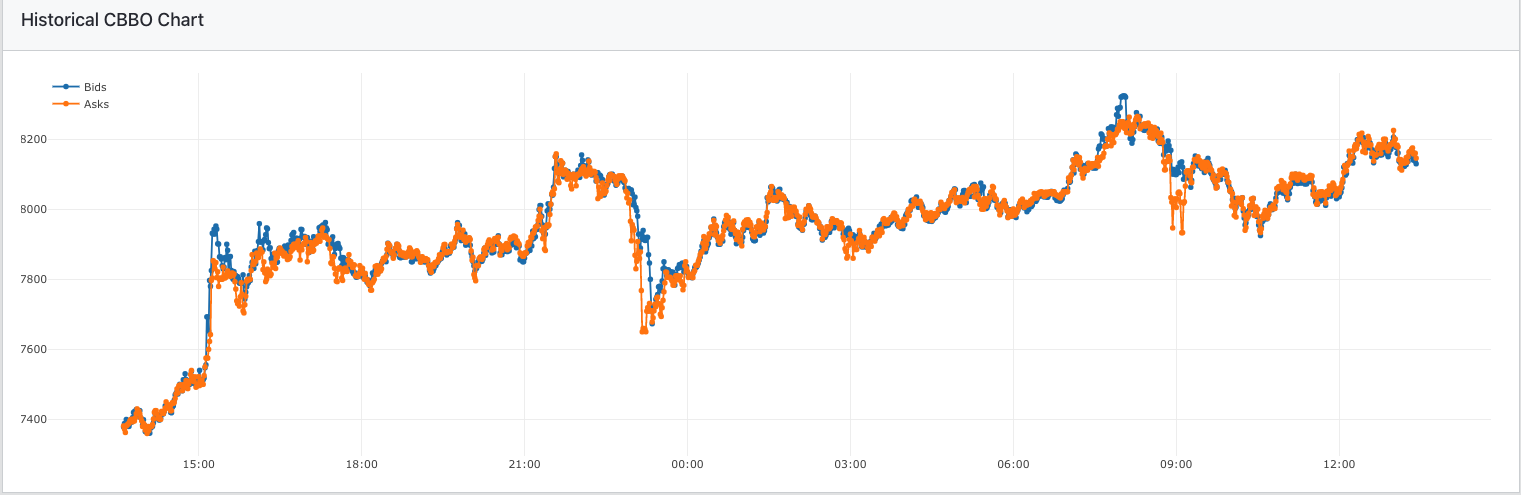

This is a quick note, written during Consensus to explain why investors and traders of Bitcoin should care about best execution. At CoinRoutes our algorithms enable our clients to be fully aware of the price discrepancies between exchanges. Yesterday, we saw incredible volatility that shows why this matters. First, lets look at the last day of trading overall through our depiction of the consolidated best bid and offer (CBBO):

As one can see, Bitcoin traded in an $800 range during the past day and, this chart shows that, several times, the best bid (in BLUE) was well above the best offer (in ORANGE). When this happens, buyers on blue exchanges are paying too much and sellers on orange exchanges are receiving too little. The magnitude of this can be significant as is shown by these three zoom views:

As one can readily observe, there were about a half dozen occasions over the past day where trading on the wrong venue could have cost investors over $100 dollars per Bitcoin, with several examples where the magnitude approached $300 per coin. While these examples are extreme, they point out quite conclusively why “best execution” matters.

Bluntly, those who trade on one exchange at a time, or use algorithms that are unaware of the market movements on a cross section of exchanges, are throwing money away. It is not an exaggeration to suggest that those who become clients of CoinRoutes will be able to catch some of that money when those others decide to trade in ignorance…

For more information on related topics, visit the following channels:

Group Co.

Group Co.

Comments (0)