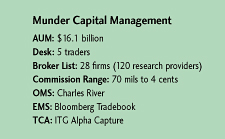

Dennis Fox, head trader at Munder Capital Management of Birmingham, Mich., is in the midst of integrating his firm’s trading system with its recent acquisition: Integrity Asset Management of Rocky River, Ohio. The transaction, which closed Dec. 31, introduced $3 billion in assets to Munder Capital. And it’s not over. "Munder continues looking for other firms to acquire like Integrity," Fox said.

Integrity’s five stock pickers and trading desk will remain in Ohio. Trader Brian Cavalier will continue to trade the same portfolios, plus the Munder Micro-Cap Fund. Once Integrity migrates to Munder’s order management system and accounting system, the two desks can back each other up.

Trade-cost analysis is a priority, and Munder plans to get Integrity set up with its provider, ITG’s Alpha Capture. "They had not used TCA in the past," Fox said. "Once their files are brought into our system, we will be able to run a historical analysis on their portfolios, in addition to running all of their future trades through our vendor."

Munder, primarily a mid-cap manager, has four domestic equity traders and one international trader. About 40 percent of its desk’s trades are high-touch. "I don’t view sales traders as commodities," Fox said. "These are relationships I’ve built over time."

Another 20 percent of its flow is done in electronic crossing venues such as Liquidnet, ITG’s Posit, Pulse Trading’s BlockCross, Pipeline and Aqua. And the remaining 40 percent is executed via algorithms. As for the toughest orders, "we want to work those ourselves" via the Bloomberg Tradebook EMS, Fox said. "I am looking to leave as small a trading footprint as I can."

Still, he sees a negative to the commission downturn the industry has seen in the last year. "There are too many good brokers, and they are not getting the same amount of business they used to get," he said.

Relationships have served Fox well in his career. He joined General Re Insurance as a computer programmer 21 years ago. Then fortune intervened. After working out in the company’s fitness center, Fox happened upon a colleague who needed dress shoes. He helped this unknown coworker–who turned out to be the firm’s chief investment officer. Two years later, the CIO recruited Fox to trade and manage the insurer’s money market portfolios.

"When the opening came, he remembered me two years later," recalled Fox. "We really only chatted from time to time, but it only affirms the adage ‘Be nice to everyone–you never know.’"

Fox moved in 1998 to quant shop Vantage Global Advisors, a subsidiary of Lincoln National Bank. There he traded fixed-income securities and equities. In 1999 a relationship again blessed Fox. Enrique Chang, his boss at Vantage, left the firm and joined Munder Capital. And in August, Chang brought Fox over to Munder as director of equity trading.