How can a pension fund maximize its commission flow and best serve its shareholders?

That’s the question John Lane, the newly appointed chief investment officer of the Ohio Public Employees Retirement Systems faced back in January 2010. The 25-year veteran’s answer was a familiar one, said Joan Stack, trading manager at OPERS: to lighten the trading load of some of its external managers and to have the OPERS desk trade their stock picks. The structural change was a novel approach.

"It was the single biggest change to the equity trading desk’s operations in years," Stack said. "He introduced this new concept of the OPERS trading desk executing orders for the external managers. The belief is that commissions are an asset of the system and we’d like to control them."

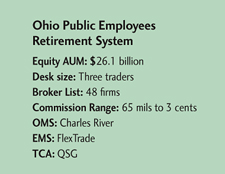

OPERS is the 12th-largest public pension fund in the U.S., with $45.6 billion in equity assets under management. As such, how it uses its assets and generates cost savings is extremely important when serving 936,000 members-or roughly one in every 12 people in the Buckeye State. Every penny saved in trading costs flows right to the retirees.

In February, the OPERS trading desk started receiving order flow from six of its external managers. The desk now trades with any broker or in any venue for best execution. The financial benefit is that OPERS has better control over its commission budget. A handful of other public pension funds also receive order flow from their managers, such as the Public School Employees’ Retirement System in Pennsylvania, which Lane previously ran as chief investment officer.

Stack explained, "We are like a broker destination." More external managers are expected to join the program. The additional flow excites Stack. It’s that thrill of being on the trading desk and getting the best execution that drives the 30-year trading veteran. She began as a portfolio assistant on the personal trust desk at Manufacturers Hanover, and immediately caught the "trading bug." "My desk was right next to the trading room," she reminisced. "I’d have my face pressed right up to the glass to see what was going on."

After stints at Bankers Trust and ING, where she was head trader, Stack joined OPERS in 2003. The desk trades U.S. equities, U.S. equities options and futures, as well as currencies. OPERS trades across asset classes. The desk plans to hire a fourth trader, who will eventually trade global equities later this year.

"Some people have an image of state pension funds as sleepy, but that’s not the case here in Ohio," she said.