NYSE Technologies said it is launching a market data feed that will compete with the securities industries’ consolidated tape of bids and asking prices for trades in National Market System stocks.

The feed will consolidate trade, volume and status information on on all stocks and exchange-traded products traded on the New York Stock Exchange, NYSE Arca and NYSE MKT. The product, titled the NYSE Best Quote and Trade (BQT) feed, is launching this week.

The feed will be an alternative to the Consolidated Tape Association’s distribution of market data from the same markets, said Todd Watkins, Vice President, Global Market Data at NYSE Technologies.

That industry body, with voting members from non-NYSE markets such as the Chicago Stock Exchange, the National Stock Exchange and the Chicago Board Options Exchange, supplies a feed known as Tape A contains market data for New York Stock Exchange-listed securities from trading on all market centers. The CTA also supplies a Tape B, which contains data from NYSE MKT, NYSE Arca and regional stock exchanges.

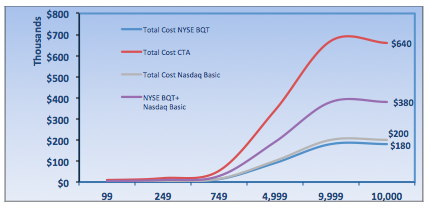

In a blog posting, NYSE Technologies promotes its feed as saving three-fourths of the cost of a Consolidated Tape Association feed:

For a retail brokerage firm with 10,000 employees designated as professional wealth managers and back office personnel, taking the NYSE BQT feed, means access to very high quality top of book data at a fraction of the cost of other products. NYSE Technologies will charge the firm $18 per user looking at the data from CTA who charges $64 per user. That’s a quick monthly savings of $460,000.

The feed will also include data on Nasdaq Stock Market-listed securities and BATS Global Markets-listed exchange-traded products, as long as they trade on one of the three NYSE Euronext exchanges.

In effect, that will mean the BQT feed includes trade details on all National Market System symbols, though, Watkins said.

The BQT feed will include the best bid and offer on each symbol at any given moment, as well as the associated size. Trade details will include last sale information, including price and volume.

Every minute, the feed will include a stock summary, including opening price, high, low and closing price, for every NMS symbol, throughout the trading day. The message will be sent out each minute for each stock, even if there is no change.

All data will be in the exchange data protocol, or XDP, that NYSE Technologies is switching to as its standard format for all its market data feeds.

While NYSE Technologies will not be pitching its feed as an alternative to Tape C, which covers Nasdaq Stock Market-listed securities, the feed, Watkins said, can be seen as a source of Level 1 data for all NMS securities.

Separately, Nasdaq OMX last week enhanced its UltraFeed market data service to include U.S. equity market depth data from Nasdaq OMX, NYSE Euronext, Direct Edge and BATS exchanges.

Included now in UltraFeed is TotalView, a product that displays the Nasdaq Stock Market’s full order book.