Credit Suisse Securities is barreling ahead in wholesale market making.

The institutional brokerage only entered the retail end of the equities business in late 2011, but is racking up big gains. During the first four months of this year, Credit Suisse executed over 700 million shares on behalf of retail brokers, according to data from Thomson Transaction Analytics.

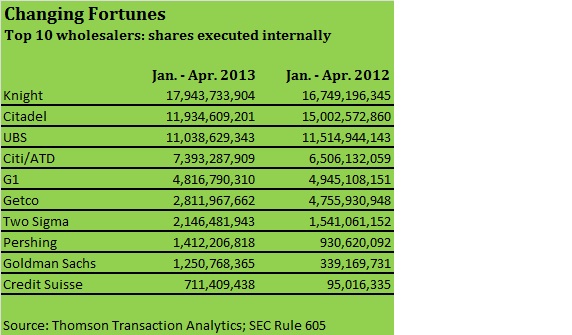

That compares with 95 million shares in the same period a year earlier, and places Credit Suisse among the 10 largest wholesalers. (See table below.) The data is derived from firms’ Rule 605 execution quality reports, which are mandated by the Securities and Exchange Commission.

Larry Birch, who spent two decades at wholesaler Bernard L. Madoff Investment Securities, is co-head of the new Credit Suisse operation. “I am calling on the relationships that I have built over the past 20 years,” Birch told Traders Magazine. “Our goal is to grow Credit Suisse’s retail presence and position ourselves as one of the top wholesale market making destinations.”

Birch joined Credit Suisse in 2010 after helping the trustee liquidating the Madoff business sell the defunct firm’s dealer business to Surge Trading. Accompanying him was Josh Stampfli, another ex-Madoff employee, who built the automated market making system now used by Credit Suisse.

Stampfli left the firm in January, and was replaced by Evan Pfeuffer as head trader, with responsibility for risk management, regulatory matters, and strategic development. Pfeuffer, co-head of the retail market making operation, joined Credit Suisse last October after spending eight years at UBS Securities.

Credit Suisse is one of three newcomers to the wholesaling business challenging the incumbents for market share in the most widely traded securities. Both Goldman Sachs and Two Sigma Securities, the broker-dealer division of asset manager Two Sigma Investments, also entered the business in 2011.

All three are growing rapidly, while larger firms such as Citadel Securities are losing ground.

According to Birch, the wholesale market making business—which uses firm capital—is a good strategic fit for Credit Suisse, which is best known for its agency executions for asset managers. “Credit Suisse has a very mature and reliable technology platform and a long history of customer service,” Birch said, “so retail is a natural fit.”

Credit Suisse is winning flow from some well-known names. In this year’s first quarter, Wedbush Securities sent the wholesaler 4.4 percent of its retail-sized New York Stock Exchange orders, according to its Rule 606 report. In the same period, Hilliard Lyons sent Credit Suisse 28.3 percent of its NYSE flow and 25.67 percent of its Nasdaq flow, according to its report. Also, in the first quarter, Raymond James sent Credit Suisse 7.7 percent of its Nasdaq flow.

All told, the broker has over 100 clients, according to Credit Suisse. Including Birch and Pfeuffer, Credit Suisse’s Retail Execution Services unit employs seven people.

The foray into wholesale market making is not Credit Suisse’s first stab at aggregating retail flow. In 2008, Credit Suisse’s Advanced Execution Services department established the Crossfinder Retail Network. That operation gathered up flow from retail brokers and ran it through Credit Suisse’s Crossfinder dark pool. At one point in 2009, the service was pumping 500 million shares per day through Crossfinder, according to a Credit Suisse press release.

The firm would not divulge current statistics, but did say Crossfinder executed a “significant amount of retail flow.” Crossfinder and the RES desk are two separate services, and cater to different segments of retail flow, according to a spokesperson.

Credit Suisse’s asset management customers have the option of matching up against RES orders, the spokesperson said.