There is strength in numbers.

As a whole, the equity brokers that qualify to be labelled bulge bracket, lead the U.S. equity market in terms of market share and quality leaders, according to a recent report from market consultancy Greenwich Associates. And this comes as the overall market and commission spend remain stagnant or in some cases, shrinking but one bank stood out among the rest – JP Morgan.

The consultancy wrote:

In a shrinking and increasingly competitive market, J.P. Morgan, Morgan Stanley, Goldman Sachs, and Bank of America Merrill Lynch secured the title of 2018 Greenwich Leaders in U.S. Equity Trading Share, with the group besting all rivals in market share across four U.S. equity categories.

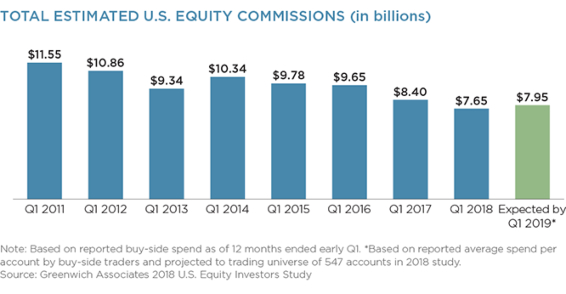

Amassing market share in U.S. equity trading commissions and in the institutional research/advisory vote is becoming more difficult and more important for brokers due to the long-term decline in the size of the equity trading business, Jay Bennett, author of the study wrote. The pool of commissions earned by brokers on trades of U.S. equities within the Greenwich Associates universe contracted 9% last year to an estimated $7.65 billion.

That drop marked the fourth consecutive year of decline. The total amount of commissions collected by brokers on trades of U.S. equities has dropped by more than a third since 2011.

As the combination of limited volatility and growth in passive investing and lower-cost electronic trading constrains trading volumes and commissions, U.S. cash equities have become a zero-sum business in which taking share is pivotal, wrote Jay Bennett.

2018 Greenwich Share Leaders

In trading, J.P. Morgan has established itself at the head of the pack in part by building a commanding lead in U.S. Equity Algo Trading. The other Greenwich Share Leaders in this increasingly important category are Morgan Stanley and Bank of America Merrill Lynch.

In the list of Greenwich Leaders in U.S. Equity Research/Advisory Vote Share, J.P. Morgan, Goldman Sachs and Morgan Stanley are tightly grouped, with each firm maintaining relationships with the largest investors through a combination of strong corporate access and macro/industry research.

Baird maintains its position as the top broker for U.S. small/mid-cap equities, closely followed by Jefferies. In a statistical tie for third place are Raymond James and J.P. Morgan, while Stifel Nicolaus and KeyBanc Capital Markets round out the top five.

2018 Greenwich Quality Leaders

The 2018 Greenwich Quality Leaders in U.S. Equity Research Product & Analyst Service are J.P. Morgan and Sanford Bernstein. In U.S. Equity Sales Trading & Execution Service, Goldman Sachs, J.P. Morgan and Morgan Stanley rate as standouts. In U.S Equity Electronic Trading, the Greenwich Quality Leaders for the second year in a row are J.P. Morgan, Jefferies and Sanford Bernstein.

The 2018 Greenwich Quality Leaders in U.S. Small/Mid-Cap Research Product & Analyst Service are Baird, KeyBanc Capital Markets, Raymond James, and William Blair. In the new category of U.S. Equity Commission Management Service & Execution, the 2018 Greenwich Quality Leaders are ITG, Nomura/Instinet and Westminster Research.

Click here for the full Greenwich Report and list of 2018 Greenwich Leaders in U.S. Equities.