The more things change, the more they stay the same.

U.S. equity commissions have been on the decline since shortly after the financial crisis – which ironically caused an initial spike in volatility, trading and commissions. Ask some traders around Wall Street and they can remember that commissions were upwards of $17 billion dollars in 2009 ( as reported by Tabb Group) back in the day – and all brokers flourished and got a taste of the good life.

Queue up the theme song Those Were the Days, as once played by the U.S. TV sitcom All in the Family.

But now queue up Bob Dylans The Times they are a Changing.

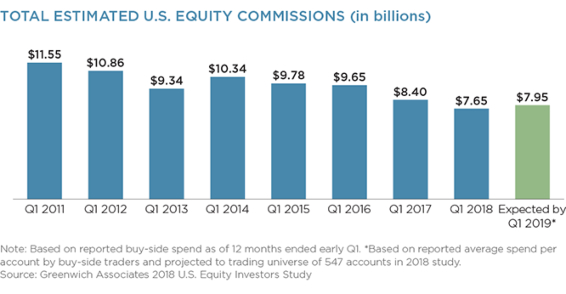

Just this week, market consultancy Greenwich Associates reported that U.S equity commission spend has dropped yet again. Amassing market share in U.S. equity trading commissions and in the institutional research/advisory vote is becoming more difficult and more important for brokers due to the long-term decline in the size of the equity trading business, Jay Bennett, author of the Greenwich study wrote. The pool of commissions earned by brokers on trades of U.S. equities within the Greenwich Associates universe contracted 9% last year to an estimated $7.65 billion.

That drop marked the fourth consecutive year of decline. The total amount of commissions collected by brokers on trades of U.S. equities has dropped by more than a third since 2011. In 2011 commissions were $11.55 billion.

As the combination of limited volatility and growth in passive investing and lower-cost electronic trading constrains trading volumes and commissions, U.S. cash equities have become a zero-sum business in which taking share is pivotal, Bennett told Traders Magazine.

Greenwich estimates that commissions should rise slightly for the 2019 commission survey to $7.95 billion.

So, whos getting a share of the smaller commission pie?

As a whole, the equity brokers that qualify to be labelled bulge bracket, lead the U.S. equity market in terms of market share and quality leaders, according to a recent report from market consultancy Greenwich Associates. And this comes as the overall market and commission spend remain stagnant or in some cases, shrinking but one bank stood out among the rest – JP Morgan.

The consultancy wrote:

In a shrinking and increasingly competitive market, J.P. Morgan, Morgan Stanley, Goldman Sachs, and Bank of America Merrill Lynch secured the title of 2018 Greenwich Leaders in U.S. Equity Trading Share, with the group besting all rivals in market share across four U.S. equity categories.

In trading, J.P. Morgan has established itself at the head of the pack in 2018 in part by building a commanding lead in U.S. Equity Algo Trading. The other Greenwich Share Leaders in this increasingly important category are Morgan Stanley and Bank of America Merrill Lynch.

In the list of Greenwich Leaders in U.S. Equity Research/Advisory Vote Share, J.P. Morgan, Goldman Sachs and Morgan Stanley are tightly grouped, with each firm maintaining relationships with the largest investors through a combination of strong corporate access and macro/industry research.

Baird maintains its position as the top broker for U.S. small/mid-cap equities, closely followed by Jefferies. In a statistical tie for third place are Raymond James and J.P. Morgan, while Stifel Nicolaus and KeyBanc Capital Markets round out the top five.

Click here for the full Greenwich Report and list of 2018 Greenwich Leaders in U.S. Equities.

This article originally appeared in the July 2012 edition of Traders Magazine

Commissions Continue Spiral

By John DAntona Jr.

Commissions paid by U.S. institutions dropped for the third straight year, down 6 percent for domestic equities, according to a recent Greenwich Associates study of the buyside.

Greenwich’s 2012 U.S. Equities Investors Study reports that brokerage commissions paid by U.S. institutions on domestic trades were $10.86 billion from Q1 2011 to Q1 2012. That comes after the Street saw a surprising drop last year to $11.55 billion for the same period. That’s way off the $13.18 billion reported in the previous survey done in 2010 and a huge 22 percent off the 2009 survey’s $13.95 billion.

According to the report, the drop in commissions was unexpected, as previous survey respondents were forecasting commissions would grow by about 8 percent into 2012.

“The bottom line is that the entire industry-investors, brokers and other equity research providers-should be preparing to operate in an environment in which there are fewer commission dollars to spend,” said Jay Bennett, one of the survey’s authors. “The sellside is already moving to adjust their business models to this new reality.”

Separately, according to a recent Abel Noser Solutions report, the top ten full service brokers traded nearly $1.7 trillion overall in 2011, which is 34 percent behind the trading volumes of 2010.

Jason Lenzo, head trader director, equity and fixed income trading at Russell Investments, told Traders Magazine that commission spend in large part is driven by portfolio turnover, and that due to large macroeconomic events, such as the European debt crisis and U.S. economic woes, portfolios managers aren’t making as many changes to their holdings. Fewer changes, he added, means lower trading volumes for the Street and fewer orders for him to execute.

“Many firms are unwilling to make changes in their new investment strategies decisions or already have their portfolios in a position that is set for the current economic environment,” Lenzo said. “It’s these factors, this static mind-set, that is contributing to lower trading volumes and the drop in commissions.”

Long-only institutions paid 56 percent of their equity brokerage commissions toward research/advisory services for the year ending Q1 2012, a slight rise from 55 percent in the prior 12 months. That left 44 percent to pay for executions, including high- and low-touch electronic trading using algorithms, capital commitments and analytics such as transaction-cost analysis.

John Feng, another author of the report, told Traders Magazine that several brokerages are cutting back on head count, consolidating trading desks and reducing resources dedicated to equities.

The average number of research providers employed by U.S. institutions fell to 38 from 40 during the survey period. Hedge funds trimmed their research lists the most, cutting back to an average 45 providers from 53.

“Smaller brokers and regional players are feeling the most heat here,” Feng said.

Greenwich Associates interviewed 227 equity fund managers and 316 U.S. equity traders between December 2011 and February 2012.

The report also shows that there are fewer commission dollars available to spend on research. U.S. institutions spent $6.2 billion in commissions on sellside research from Q1 2011 to Q2 2012. This is off 9 percent from the $6.8 billion spent in the prior 12 months. Greenwich said the main reason for the drop was due primarily to a 6 percent drop in overall commissions paid by institutions to brokers on U.S. equity trades.