The brokers have stepped up their game.

As COVID-19 plunged equity markets into turmoil in mid-March, volatility and trading volume exploded.

At the same time, the health crisis forced brokers abruptly away from their trading floors, threatening to disrupt their ability to maintain well-functioning operations and service their clients—who were also working remotely—when they were needed most for insights and execution.

It was here where the brokers rose to the collective challenge of meeting their clients’ respective needs or find themselves left out or even worse, out of business.

Looking back, Greenwich Associates noted the buy side and sell side both adapted well during this unprecedented stress test. Following a short period of adjustment, most brokers mobilized to deliver robust front-office coverage that met their clients’ needs.

By mid-April, when the consultancy reached out to North American buy-side traders regarding their experiences during those first weeks of the crisis, it found 80% were satisfied with brokers’ performances in providing liquidity, hedging solutions, market color, and insights, including nearly 50% who were highly satisfied, despite some issues raised about settlement processes.

Standout Brokers

As part of those conversations, the firm asked buy-side traders to name the brokers whose execution coverage had been most helpful to them in navigating the market turmoil caused by COVID-19. The following six firms garnered the most mentions and were closely grouped:

Outside of the bulge bracket firms, Instinet, JonesTrading, RBC Capital Markets, and Virtu also stood out for their execution support among clients.

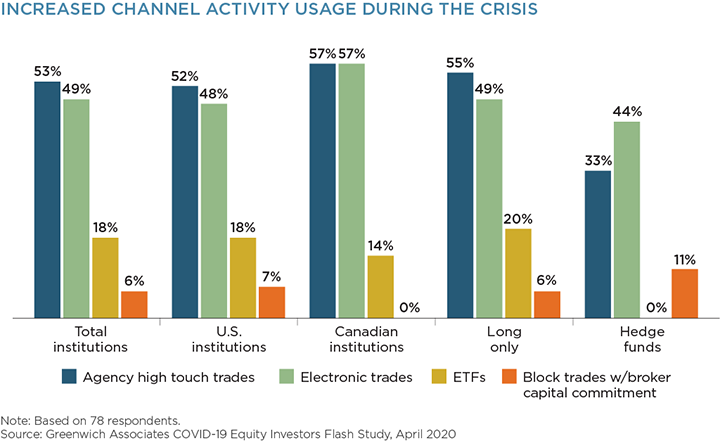

Since the outbreak, just over half of institutions shifted their equity volume mix toward more agency high-touch trades, while a nearly equal proportion significantly increased the use of electronic trading. Brokers that received the most citations in this flash study were well positioned to meet investors’ changing needs in this unusual environment, as evidenced by their strong capabilities and broad relationships in our equities studies in recent years.