By Phil Mackintosh, Chief Economist, Nasdaq

It’s that time of year. Many of you, like us, have interns and new hires joining the desk and needing to learn all about markets for the first time. So we decided to put together an “Intern’s Guide to the Galaxy” to help explain some of the core concepts about how markets work (virtually).

For those who have worked in the market for years, relax and enjoy the recap. You never know when an intern will ask a question on this stuff.

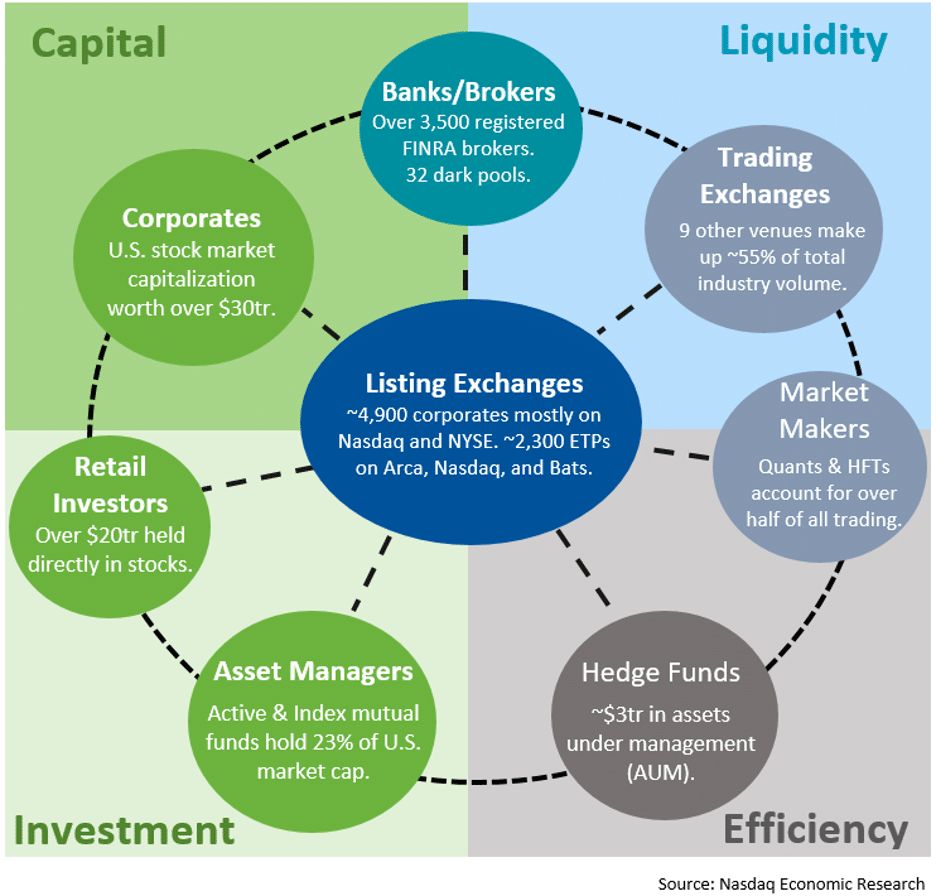

The markets are an ecosystem

Stock (and bond) markets have a pretty simple underlying purpose. They help join those who need capital with those who are looking to invest.

Modern markets have evolved into an ecosystem of specialized participants. Each playing a different but important role in primary (IPO) and secondary (trading) markets.

Chart 1: The market ecosystem

Issuers are critical to public markets. Without issuers joining public markets, there would be fewer companies to invest in and fewer dividends for investors and less securities to hedge and trade. To learn more about the trends in public listings see We Need a Constant Focus on Bringing IPOs to Market.

U.S. Equity markets aren’t alone though. Public markets have to compete with private markets, and U.S. markets also compete with international stock markets for listings. Having said that, the U.S. stock market is the largest source of equity capital in the world with $35 trillion of market cap.

Exchanges play a central role in stock markets, literally. They are (by law) open to everyone. Creating a “single market” for issuers, investors and liquidity providers allows companies, investors and traders to all interact at the same prices despite their different time horizons and trading signals. Exchanges, by making prices public, also create competition to be the best buyer or seller. That creates tighter spreads that not only reduce transaction costsbut also forms prices that everyone can use for portfolio valuation and to find new assets to buy or sell.

In contrast, bond markets don’t have exchanges. In those markets, banks provide different quotes to different customers and traded prices and volumes are often never disclosed. That makes it harder for any participant to know if their bond trade was at a good price (or not).

Investors come in two main flavors: mutual funds (also called “institutional investors”) and retail investors. Data suggests they both have around the same amount of capital to invest (approximately $15 trillion each). Other smaller owners of stocks include hedge funds, banks, market makers, arbitrageurs and foreign investors who hold U.S. stocks for investment, risk management or trading purposes. Although each of these participants have different objectives, they all play a critical role in keeping markets efficient and liquidity cheap.

Banks have many direct relationships with issuers and mutual funds. They research and often lend to companies. They also execute trades for mutual funds. Many also sell structured products that then need to be hedged in the market too. So they contribute to both capital formation and liquidity. Many of them also run their own ATS’s (Alternative Trading Systems, such as dark pools) which allow them to match trades off-exchange.

Market makers don’t hold stocks for long as their specialty is being both a buyer and seller at the same time. Creating a “two sided market” in each stock ensures investors can trade regardless of whether they are looking to buy or sell.

Hedge funds and arbitrageurs, in contrast, tend to hold long and short positions at the same time. Their strategies often also keep stock pairs or ETFs and futures efficiently priced. That helps reduce costs when investors try to buy a single ticker, helping make relative valuations more efficient.

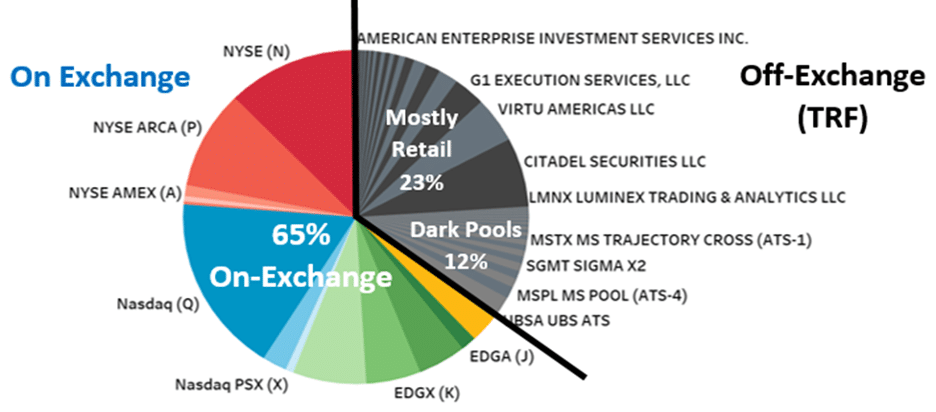

Where do stocks trade?

Decades ago UTP (Unlisted Trading Privileges) allowed trading exchanges to compete with listing exchanges for trading revenues. Brokers are also able match trades off-exchange, using an ATS (e.g. dark pools) or facilitating (trading directly with) clients trades, usually for profit.

This results in a very fragmented market. Over one-third of trading occurs off-exchange, and on-exchange trading is spread across more than a dozen venues (Chart 2). For more on how different markets attract liquidity, see Slicing the Liquidity Pie.

Chart 2: Where and how do stocks trade

Source: Nasdaq Economic Research

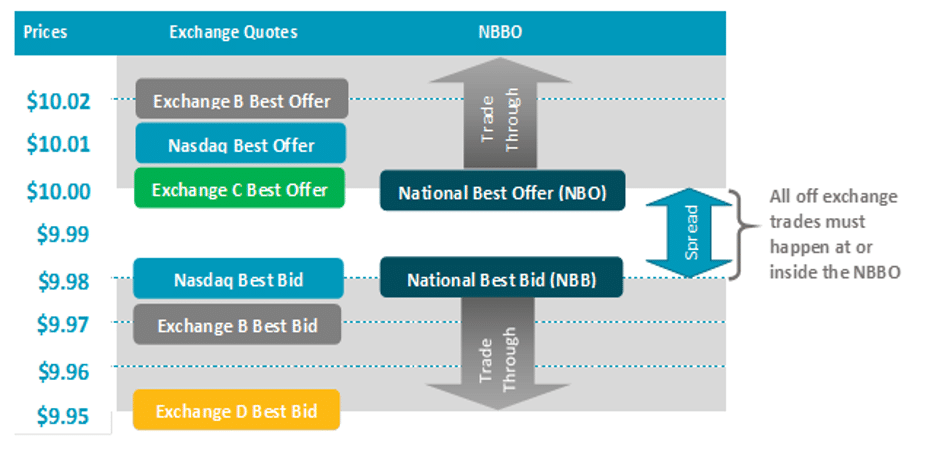

Where do prices come from?

Despite this complexity and fragmentation, regulators in 2005 created a consolidated national best bid and offer (NBBO). Think of it like Priceline (Nasdaq: BKNG) for stocks. Even if the best bid and best offer were on different markets, the NBBO shows investors the combined best prices (Chart 3). To learn more see Reg NMS for Dummies.

Chart 3: Where do prices come from?

Source: Nasdaq Economic Research

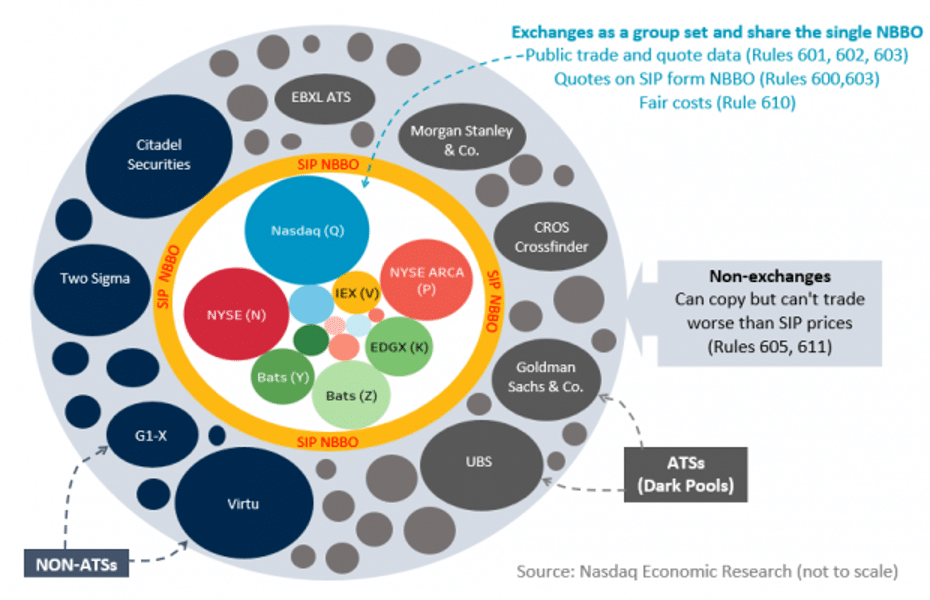

Those best prices are shared with investors and the public through a consolidated data feed called the SIP (Securities Information Processor). Not all investors need the instantaneous market-wide best quote – some need more data some need less. So exchanges also issue their own BBOs, some of which compete with SIP data (e.g. Nasdaq Basic has saved users more than $270 million over the SIP feed since its launch in 2009).

But the SIP, and exchanges quotes, are very important as those prices also protect investors trading off exchanges. That’s because off-exchange trades (Charts 3 and 4) must occur at prices no worse than those available on exchanges. For more on the SIP and NBBO and ATS’s read ABCs of U.S. Stock Market Acronyms.

Chart 4: Reg NMS creates a single NBBO out of a network of competitors

What is the trade desk talking about?

Sometimes things on a trade desk happen really fast. Quotes change, prices disappear, and opportunities are missed and misunderstandings can cost a lot of money. So traders have developed jargon to pass on a lot of information in a consistent and unambiguous way.

For example, you bid to buy and offer to sell.

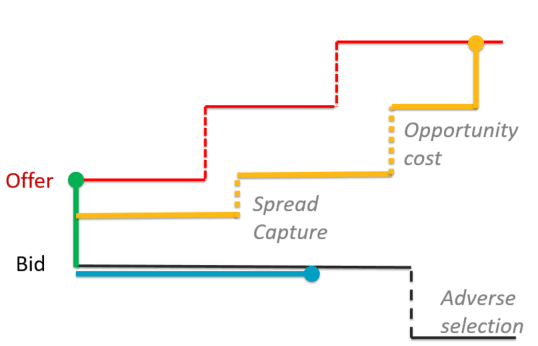

The difference between the bid and offer is called the spread (Chart 3 and Chart 5).

That also means every trader has a choice to make and consequences to deal with (Chart 5):

- If you want to buy “right now,” you’ll have to pay the higher offer price (lift the offer). Sometimes this is called a “market order” as it will trade at whatever the market price is.

- But if you prefer to save some money, you’ll need to use a “limit order,” probably at the bid (which is a “marketable limit”) as lower prices will not attract sellers. Then you need to wait for sellers to cross the spread (and “hit the bid”) to get to the top of the queue and eventually a fill (trade).

- The problem with being patient is sometimes the price goes up before you get to trade (red line). That can mean you’ll end up paying (even) more than the offer, something known as “opportunity cost.”

- Of course the opposite can happen too, and prices can fall. Although that means you get your fill (trade) and save the spread, it also would have been cheaper to wait for prices to fall. That’s called “adverse selection.”

- There are also midpoint orders. Paying half the spread can seem like a good compromise between the costs of market (price taker) and delay of limit (price maker) orders. However midpoint orders are also “hidden,” meaning they are not publicly displayed on the SIP. That means sellers won’t know you’re there, which signals less, but hiding also means you might wait even longer for a fill.

For more on routing decisions and trade-offs see Routing 101: Identifying the Cost of Routing Decisions and Routing 201: Some of the Choices an Algo Makes in the Life of an Order.

Chart 5: Traders choices and consequences

Source: Nasdaq Economic Research

How fast should you trade?

Although this all sounds complicated, the reality is that computers (trading algorithms) are able to handle much of this for human traders. The key input from the trader is to tell the algorithm how fast you need to trade.

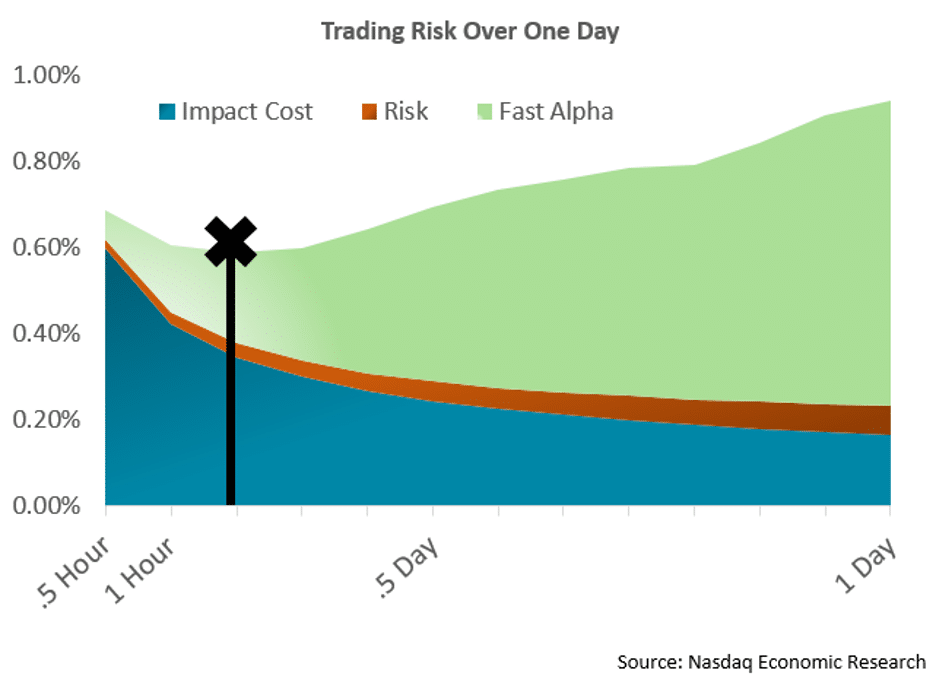

The problem for the trader is that:

- The faster you trade, the more you will cause market impact (a buyer will add to demand, which makes prices go up).

- The slower you trade, the more others will take all the good prices (opportunity cost when other traders make prices go up anyway).

As we discuss in How Fast Should You Trade?, the right speed depends on assessing how many other traders are likely competing for your order, as well as how large your order is compared to typical daily supply.

Chart 6: Optimal speed to trade-off impact and opportunity cost can be mathematically determined

Do all stocks trade the same way?

No. In fact experienced traders (and algos) will modify their strategies to suit different stocks characteristics.

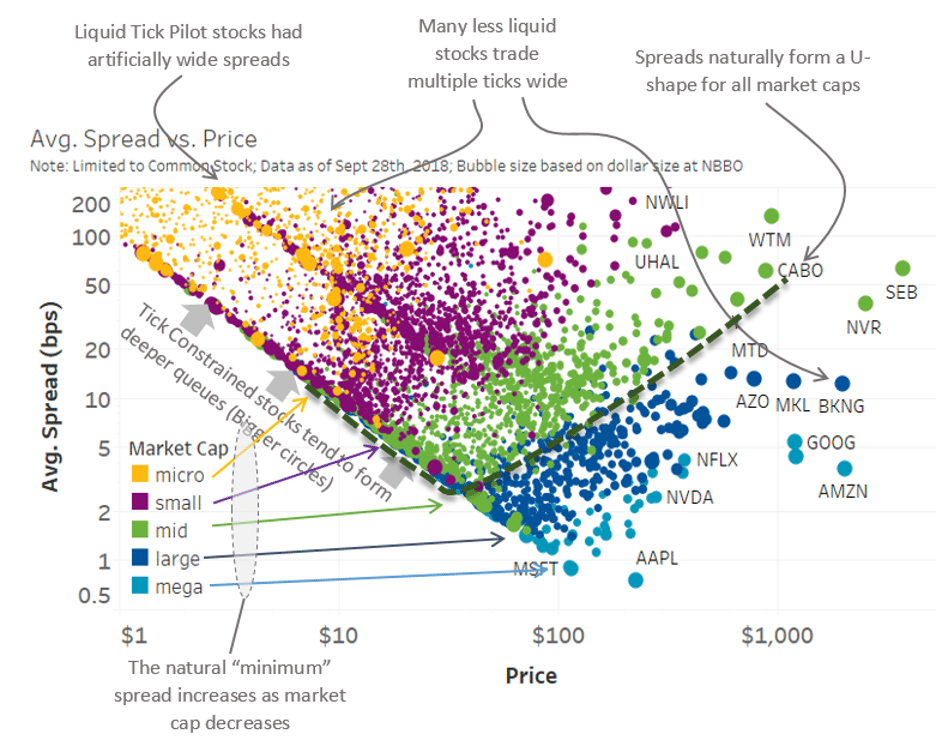

A combination of liquidity, spread and volatility affect the returns market makers earn for providing liquidity. Because each stock can quote no better than a one-cent spread, that spread is worth more on a $1 stock than on a $1,000 stock. That changes the attraction of limit vs market orders, which in turn affects the length of queues which in turn leads to other ways to buy queue priority.

At the extreme we also find that odd lots increase as prices rise. Odd lots are not protected nor do they contribute to the NBBO, even if they are at better prices. It’s a problem regulators and the industry are currently trying to solve.

There are some other important trends we’ve found too:

- Asset managers seem to focus on larger cap and more liquid stocks, which makes them trade more competitively, which gives them tighter spreads.

- That leaves retail investors dominating microcap stock trading, which leaves them with wider spreads and contributes to more off exchange trading.

- We’ve also found that spreads get consistently better as liquidity (measured as value traded) increases. So more liquidity reduces trading costs and spreads.

- But liquidity itself is mostly driven by the size (market cap) of a company (with a little boost from periods of volatility).

Chart 7: Liquidity (in $) is a key driver of spreads, but so is the one-cent tick

Source: Nasdaq Economic Research

How fast do stocks trade?

Almost all large investors will “work” their large orders, in many smaller pieces, over a long timeframe; sometimes days.

However, almost all orders that enter the market these days are worked by computers. That means orders will be entered, or trades will be filled, and prices will be updated in less than one-thousandth of a second (a millisecond). In fact, the actual matching of trades happens in microseconds (millionths of a second), most of the rest of the delay is due to the speed of light. Learn more about that in Time is Relativity: What Physics Has to Say About Market Infrastructure.

Where to next?

U.S. equity markets are fragmented and complex. That’s for sure.

But they are also the largest and most efficient markets in the world. That’s thanks to all of the participants in the ecosystem competing and playing their part in capital formation, liquidity provision, risk transfer and price efficiency.

When done right, all participants benefit from lower trade costs, higher valuations and deeper liquidity.

There is data to prove it. If you’re interested, you can see more of what we’ve learned from the data here.