By Phil Mackintosh, Chief Economist, Nasdaq

Lots of traders talk about markouts when they’re measuring execution performance and fill quality. That is one reason we recently highlighted that our Midpoint Extended Life Order (M-ELO), has very high quality fills.

Adverse selection has an upside and a downside. On the upside, you got a fill and your next route might be able to post at an even better price. That helps you complete a large order and beat arrival price.

On the downside, in hindsight you might have been able to save some money if you’d only waited for the price to improve. That is what the industry calls adverse selection.

Chart 1: Adverse selection happens when you get a fill, but the new price is better than before

Source: Nasdaq Economic Research

But often, adverse selection isn’t so bad. It’s better than chasing a stock as it gets more and more expensive.

When is adverse selection good?

The short answer is: It depends on how fast you need to trade.

A more detailed answer includes all the choices algos can make to work orders that transition from very passive to getting instant fills.

What we discover is that there is a trade-off between liquidity and execution quality that exists on a continuum: The more liquidity you need, the more impact you should expect (and vice versa).

In short, markets are good at pricing immediacy. That means traders should be pretty good at knowing how much immediacy they need; otherwise, they’ll be paying too much for their stocks.

Different order types help you trade faster

We looked at agency orders in our primary market for liquid stocks with stable one-cent spreads and Best Bid and Offer (BBO) quotes to see how “natural” investors might fare with different order types.

The data (Chart 2) shows that choosing different order types can significantly affect the liquidity and fulfillment of each order.

Chart 2: Trading is a trade-off between costs and liquidity

Source: Nasdaq Economic Research

Not surprisingly, crossing the spread will give an investor the highest probability of a fill. In fact, the data shows that an average spread-crossing order gets access to even more liquidity than is shown on the NBBO. That’s because of hidden orders that are also in the system. The trade-off is that a market order captures no spread (Chart 5).

Advertising is more important that price. Although a mid-point order is willing to pay half the spread the fulfillment on public (near touch) limit orders is more than double.

However, midpoint orders do buy some queue priority. Although data in Chart 2 shows lower fulfilment, data in Chart 6 shows a shorter wait time for a fill. That’s important if opportunity costs are positive. Hidden orders also benefit from not signaling the existence of a buyer or seller to the market, something we’re not measuring here.

Not surprisingly, because M-ELO orders are selective about liquidity that they interact with, they are likely to have lower fulfillment than other midpoint or advertised liquidity. That’s the trade-off for having a high quality fill, among other benefits.

Hidden orders fill faster when lit orders are at the NBBO

The fact that hidden orders don’t signal their existence to the market also makes them harder to find.

For hidden orders to be found, either another investor has to send an offsetting midpoint order to the same venue you chose, or a trader willing to cross the spread needs to send an order to the venue you chose.

That’s where, ironically, a high quality lit market actually helps hidden orders. The lit quotes at the NBBO attract liquidity takers, which improves the probability that interacts with hidden order they didn’t even know were there.

That’s why Nasdaq’s time at the inside is important, even for hidden orders.

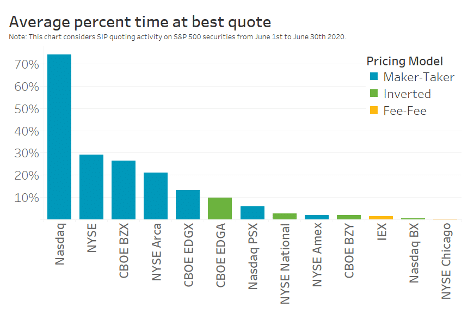

Chart 3: Nasdaq is at the NBBO more than any other venue

Source: Nasdaq Economic Research

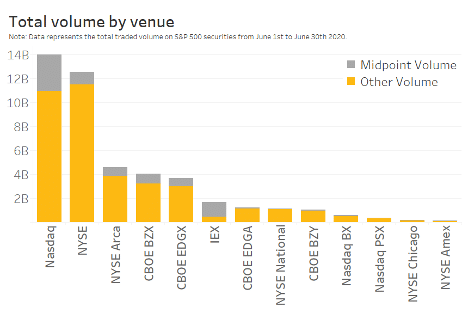

In fact, data shows Nasdaq has more midpoint volume than any other exchange. Our midpoint executions account for around 4% of all market-wide volume at the midpoint, or 28% of all midpoint trades executed.

Chart 4: Nasdaq executes more firm midpoint orders than any other venue

Source: Nasdaq Economic Research

In short, having the best quote gives all investors cheaper spreads, and it also improves the liquidity and fills on hidden orders which in turn adds overfills and price improvement to takers.

It is a win-win for buyers and sellers. It also highlights the benefits of more consolidated (less fragmented) market for investors.

Back to that trade-off

So now we know some orders have better liquidity than others, but we don’t know what that liquidity “costs.”

As all order types are trading off urgency for spread capture, we know:

- A market order expects to capture none of the spread

- Midpoint orders are willing to capture half the spread

- Limit orders are trying to capture the whole spread

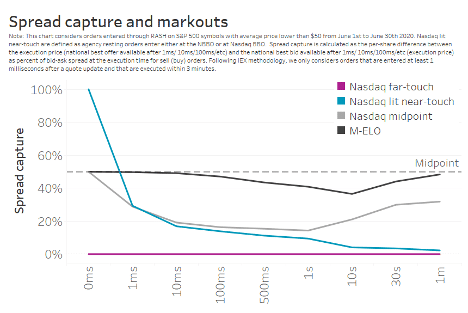

And at the instant of trade Chart 5 shows that’s true.

However, if we add markouts into this assessment, we see that the spread you capture (in hindsight) is actually less than the spread earned at the time of the trade. This is sometimes called the “realized spread” (Rule 605).

Chart 5 shows that although the quote rarely changes after a MELO fill (allowing for a realized half spread capture) some midpoint orders are filled by a larger order that also changes the future quote. The realized spread those orders capture also falls over time.

However, our average midpoint orders still capture more realized spread than lit (near touch) quotes. Over a longer time, the market more often reverts too (reducing markouts). That indicates they trade more with other “less informed” flow.

Chart 5: Markouts increase with liquidity reducing the realized spread captured over time

Source: Nasdaq Economic Research

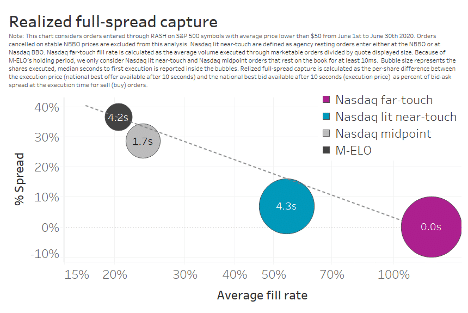

Markouts aren’t all bad, but good market quality is always good

When we put together all that we have looked at here, what we see is that costs and liquidity exist on a continuum. Each of the order types, when comparing realized spread vs. fulfillment, rest roughly on a diagonal. In short, add more urgency, you will, on average realize less spread capture.

It’s also important to remember that markouts, by definition, only include orders that filled.

What happens to the orders that are “unfilled?” It’s likely many didn’t fill because the prices moved away from them (got richer). That means the fills on those residual orders may actually cost the full spread, or even more. That’s something we don’t quantify here, but it’s another reason why a faster fill is worth paying for. Accounting for that might also improve the performance on a midpoint fill (thanks to its faster fill).

Chart 6: Markouts increase with liquidity

Source: Nasdaq Economic Research

In short, trading involves a lot more than spread capture or getting a fill.

But data shows that there is trade-off between liquidity and spread capture. The point is to know how fast you need to trade, so what you pay for your liquidity is just right.

Interestingly, this data also highlights a benefit of centralized markets. Increased fragmentation disperses hidden orders across more venues. That makes them less likely to fill, increasing opportunity costs for the patient investor. It also makes price improvement less likely for investors with urgency. Neither of which is good for investors.