BMO Capital Markets has developed an algorithm which the bank said can achieve a nearly 500% improvement in hit rates for midpoint orders by increasing the probability of finding liquidity for a specific order type at different venues.

Ray Ross, co-head of electronic trading at Bank of Montreal (BMO Capital Markets), told Markets Media that the firm developed the Liquidity Awareness Signal because of the fragmentation of liquidity in the US equity market. Three new US equity exchanges launched last month taking the total to 16. In addition, there are more than 30 dark pools, as well as single-dealer venues.

Ross explained that the signal uses machine learning to analyse patterns amongst millions of trades.

“Different orders behave differently on different venues,” he added. “They also have different decay rates – the length of time for which the signal is useful for future trading.”

The bank said that using the dynamic signal means it is possible to achieve a nearly 500% improvement in hit rates for midpoint orders.

“We knew hit rates would go up but it was a question of working out how to leverage the data,” said Ross. “The more trading is done, the more powerful the signal becomes.”

Routing and execution data

In June this year the US Securities and Exchange Commission’s Rule 606(b)(3) went into effect requiring a broker-dealer to disclose routing and execution data for not held orders over the the previous six months if a customer asks for the information. The rule aims to help the buy side achieve better execution by getting more data and information about their trades.

Joe Wald, co-head of electronic trading at BMO Capital Markets, spoke about Rule 606(b)(3) on a panel at the STA Virtual Market Structure Conference last week.

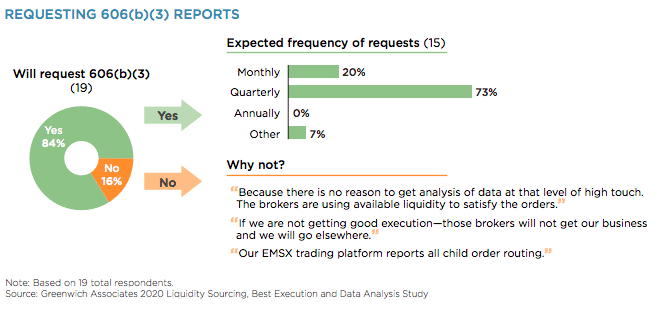

He said 80% of investors will request the 606 report and 70% will request the report quarterly according to a a survey from consultancy Greenwich Associates that was commissioned by BMO.

Wald said: “It is a catalyst for competition and execution quality. Rule 606 was a huge win and is a game changer in taking best execution to the next level.”

Shane Swanson, an equities and financial technology expert in Greenwich’s market structure and technology practice, said in the report that if a broker cannot provide the requested data, they will be penalised by both the SEC and institutions who are likely to trade in reduced volume.

He continued that the brokers that succeed will be those that have good technology for both trading and data management.

“Further, the winners will be able to offer the broadest access to the most desirable liquidity (as defined by the client) with the most robust service,” Swanson added.

The Greenwich survey also found that buy-side firms expect Rule 606(b)(3) data to have a fairly significant overall impact on execution protocols.

“Across all AUM breakouts, 37% expect the data will be important or very important to how they analyze their downstream trading,” added the report.

The consultancy said larger asset managers already have integrated programs to analyze execution outcomes at a fine level of detail. Under the new rule brokers have to provide access to this data to all buy-side firms, giving smaller firms the ability to analyze executions and improve execution.

Wald continued that there is a lot of innovation focussed on execution quality. He said: “We have a new toolset to measure results and have never been in a better position to take things to the next level for execution quality.”