By Abhishek Kundu, Managing Director and Head of Quantitative Analytics, Clearpool

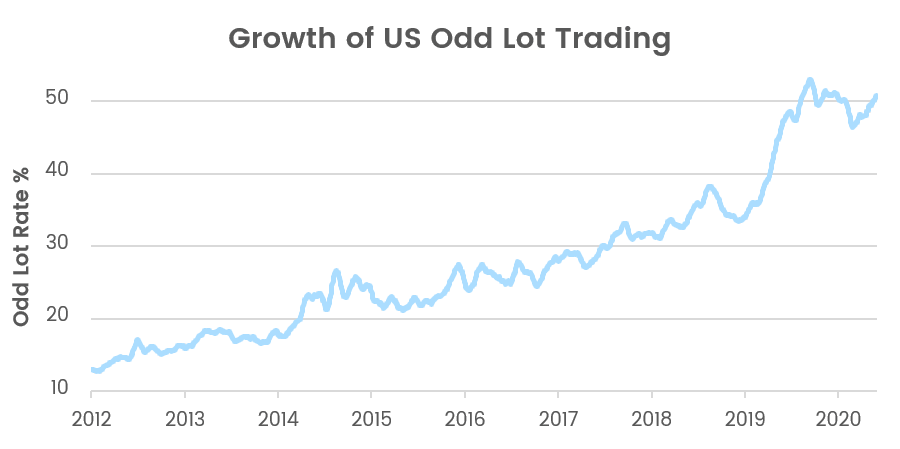

Since 2012, the market has seen a steady, prolonged and, at times, pronounced increase in the rate of odd lot trades as a percentage of overall trades (Odd Lot Rate %). What’s driving the increase in odd lot trading, and can we quantify the impact?

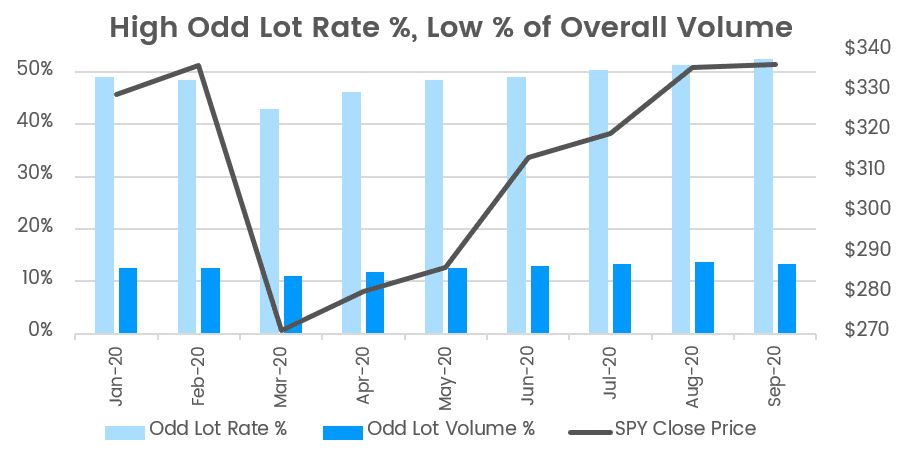

Although the rate of odd-lot trading is growing, it remains a small component of overall trading volume (Odd Lot Volume %). Throughout 2020, odd lots consistently represented around 12% of the overall market volume. While it’s not a huge number, it’s relevant enough that the SEC ruled to add odd lots to the SIP as part of core data.

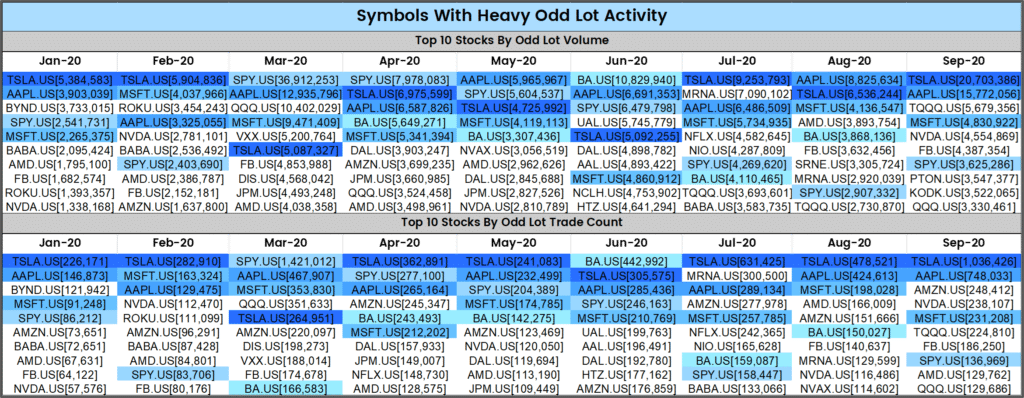

Retail and Odd Lots

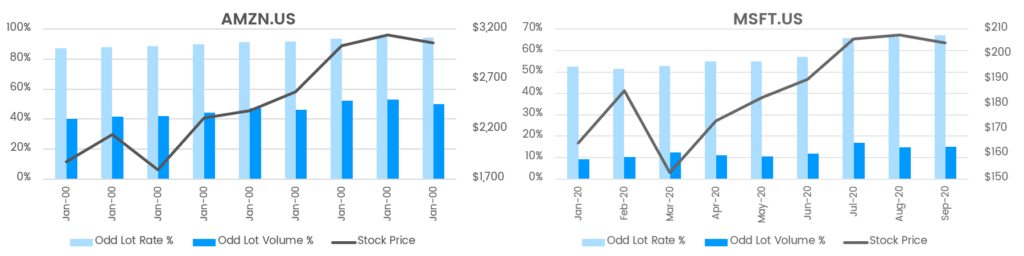

The growth in odd lots is often attributed to the boom in retail trading. Much of the increase seen in 2019 coincided with retail brokers’ move to zero commission. Looking at names with some of the highest rates of odd lots, many are household names (AAPL, AMZN, MSFT, TSLA). AMZN, in particular, trades in odd lots 91% of the time, with nearly half of its daily volume stemming from odd lots. Before its stock split, TSLA had a similar pattern where odd lots accounted for over 90% of trades and 45% of volume in July and August 2020. These names are heavily weighted in retail brokerage accounts but also popular on the institutional side—perhaps most notably in ETFs—so the sustained growth in odd lot trading suggests retail isn’t the sole driving factor.

Stock Price and Odd Lots

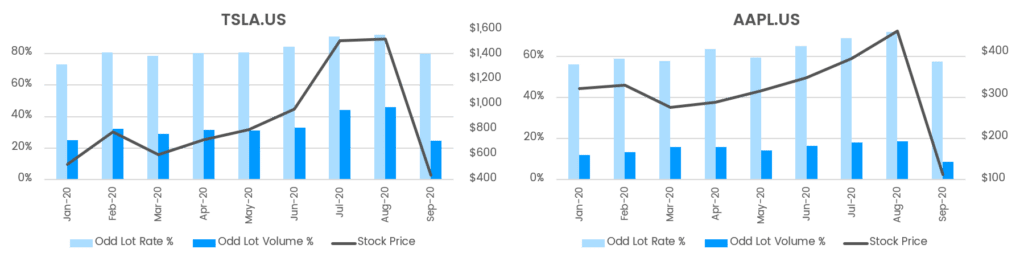

When looking at symbol-specific odd lot trends, stock price has the strongest correlation. As stock price increases, the frequency it trades in odd lots also increases.

Odd lots not only increase with stock price, but they increase quickly. At $75, odd lots start to pick up and represent roughly 60% of trades.

While the correlation between high-priced stocks and odd lots isn’t surprising, it’s worth noting just how rapidly it occurs. There has been a noticeable shift toward higher-priced names over the last few years, which could certainly be one component of the growth in odd lots.

To look at a microcosm of the share price effect, we examined two notable companies that split their stock last summer. While many companies have opposed splitting their stock, both TSLA and AAPL (which appeared several times in the Symbols With Heavy Odd Lot Activity table above) did just that. The 4-1 AAPL split on August 28th and the 5-1 TSLA split on August 31st brought their respective prices down substantially. Given the correlation demonstrated between stock price and odd lots, you would expect odd lot rates to drop post-split—and that’s precisely what we see. Compared to similar stocks (AMZN and MSFT), which did not have splits, we can conclude that the drop in Odd Lot Rate % and Odd Lot Volume % is directly tied to stock price.

Impact of Stock Split on Odd Lots:

Retail activity has been a popular theory on odd lot growth, but algorithmic and schedule-based trading has been another common rationale. This does make some sense as average trade sizes have been shrinking over time. The growth and popularity of ETFs have also been attributed to increased odd lot trading volume since create/redeem baskets can require trading in odd lots.

While the cause of increased odd lots isn’t clear, this trend appears unlikely to change. Conventional wisdom used by many institutional traders has generally been to put a 100-share minimum quantity on most trades to guard against predatory trading and information leakage. But is that the best approach given that around 12% of overall market volume and almost half of all trades are odd lots (even more in some popular names)? Shouldn’t traders attempt to find a way to interact with odd lots in their trading strategies safely?

Tactics for Managing Odd Lots in Your Algorithmic Trading

Here are a few suggestions on ways to manage how your electronic orders interact with odd lots:

- Smart MEQ

Instead of relying on a static Minimum Execution Quantity, use a “Smart MEQ,” which is dynamically calculated based on stock-specific trade-sized percentiles. - Odd Lot Volume Tracking

For each of your trading strategies, choose whether to include or exclude odd lots in the algo’s volume tracking calculations. - Odd Lot Slicing

Adjust odd lot slicing size to dictate what size orders are eligible to send odd lots. - Benchmarks

Understand whether the metrics you track include odd-lot sales in its calculation. - A/B Testing

Test two versions of the same strategy—where one interacts with odd lots, and the other does not—to methodically measure how odd lots impact your trading.