Transparent active presents the biggest opportunity in the US exchange-traded fund market with 70% of issuers either developing or planning to develop the product according to research provider Cerulli Associates.

A report from Cerulli, U.S. Exchange-Traded Fund Markets 2021: Reaching a Growing Investor Base, found that ETF issuers said the transparent active opportunity is more attractive than semi-transparent, strategic beta, and passive offerings.

Cerulli said: “70% of polled ETF issuers are either currently developing or planning to develop transparent active ETFs. With $266bn in assets encompassing multiple asset classes and a consistent growth trajectory, transparent active ETFs are already a well-built category and development has more recently been spurred by the ETF rule.”

US active ETFs/ETPs gathered net inflows of $102bn in 2021, nearly double the $59.8bn gathered in 2020 according to ETFGI, an independent research and consultancy firm.

Rich Lee, managing director, global program and ETF trading, Institutional Services at Robert W. Baird & Co., told Markets Media that his desk is already seeing increased interest in active and thematic ETFs this year.

“We expect a rise in active ETFs, as well as thematic and dividend-based products,” he added. “Investors can express themes in an ETF wrapper which will only be limited by their imagination.”

Cerulli highlighted that out of $104bn in active equity exposures, only a sliver is in true active equity products given that a significant portion is allocated to thematic and strategic-beta-like offerings. Half of the ETF issuers in the survey are also currently developing or planning to develop semi-transparent active ETFs.

Daniil Shapiro, associate director at Cerulli, said in the report: “Managers considering launching active ETFs should also keep an eye on the dual-share-class structure used by Vanguard, which comes off patent in 2023.”

Gargi Pal Chaudhuri, head of iShares investment strategy Americas at BlackRock, also said in her review of 2021 that she expects an increase in active ETFs.

She wrote: “Actively managed ETFs accounted for more than 10% of all ETF inflows in 2021. and offer unique opportunities for investors to gain exposure to ETFs that seek outperformance in comparison to a benchmark or a specific investment objective.”

Flows

ETFGI said that at the end of 2021 US ETFs had record assets under management of $7.21 trillion, an increase of nearly one third, 31.9%, from 2020. In addition, US ETFs had record net inflows of $919.8bn , 87% higher than the prior high of $490.2bn gathered in 2020.

Lee believes there are no signs that ETF flows will abate this year. He said: “The landscape will be dominated by investors responding to the reopening trade from Covid 19, the Federal Reserve raising rates and inflationary pressures.”

The top three issuers for net inflows in the US in 2021 were Vanguard at $327.9bn, BlackRock’s iShares at $212.7bn and State Street’s SPDR with $97.6bn.

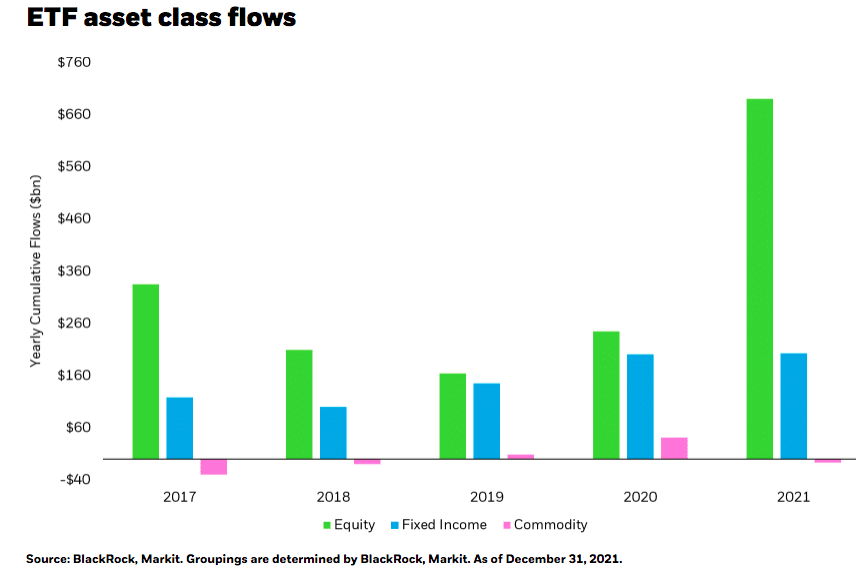

In 2021 US equity ETFs had record net inflows of $641.5bn according to ETFGI. Pal Chaudhuri noted that US investors favored U.S. equity strategies as the three largest S&P 500-tracking ETFs reached more than $1 trillion in assets under management last year, compared to just $375bn five years ago.

Pal Chaudhuri continued that inflation was also a key theme of 2021.

“Within fixed income, the inflation category saw $41.3bn in inflows, about 1.5 times the cumulative flow seen over the last four years combined,” she added. “Other “reflation” narrative ETF flow-gatherers such as the energy sector stocks, “value” factor, and real assets pulled in $14.1bn, $17.5bn and $30bn, respectively.”

Flows into sustainable ETFs were meaningful in 2021 according to Pal Chaudhuri as $37.9bn moved into sustainable ETFs across all asset classes and across all styles and themes.

Larry Fink, chairman and chief executive of BlackRock, said on the asset manager’s fourth quarter results call that momentum in sustainable investments continued in 2021 and the firm’s sustainable ETFs nearly doubled to $150bn in assets under management.