Trading Reimagined is a biweekly content series that examines how the transformative power of technology is prompting a reimagining of the markets. Trading Reimagined is sponsored by Exegy.

Large buy-side investment managers are typically risk-averse and conservative, happy to allow others to be first to adopt new processes and technologies and enter new markets. So the high-profile cryptocurrency exchange FTX collapse in late 2022 could have been the death knell for institutional interest in digital assets.

But digital assets have endured, as the price of Bitcoin – the quickest one-number gauge of the health of the market – has soared more than 80% this year, to more than $30,000.

More importantly for institutional adoption of crypto and other digital assets, the CEO of the world’s largest, and arguably the most influential, investment manager was decidedly constructive on the asset class in a recent television interview.

The role of crypto is “digitizing gold,” BlackRock’s Larry Fink told Fox Business on July 5. “Bitcoin is an international asset…It can represent an asset that people can play as an alternative” to individual currencies, he said.

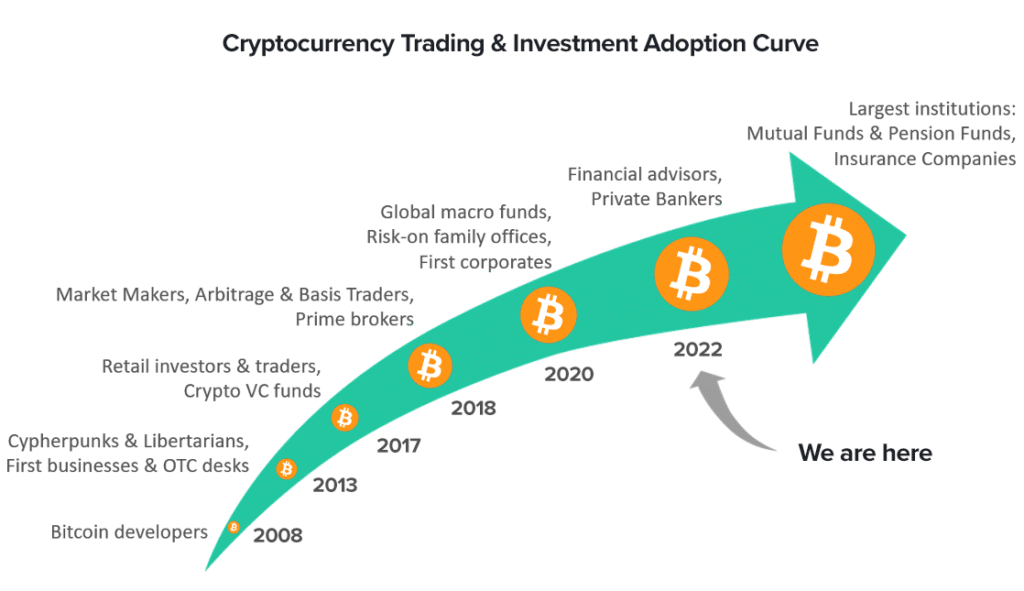

Finoa, a Europe-based crypto custodian, published a December 2022 report with a “crypto adoption curve” that showed retail investors and traders, and some VC funds got involved with crypto around 2017. Market makers and prime brokers signed on around 2018; financial advisors and private bankers adopted crypto in 2022. The final frontier – with an unknown date – will be the largest institutions such as mutual funds, pension funds, and insurance companies.

Increased crypto activity by existing players is helping boost liquidity, improving market conditions at least incrementally for larger institutions.

“We’ve seen strengthening interest from professional traders in the crypto options space,” said Robert Kallay, Director of Automated Trading Solutions for Exegy, whose Metro trading platform recently added Deribit options. “There have been bumps in the road over the past year, but when someone as influential as Larry Fink of BlackRock speaks constructively about Bitcoin, it reinforces confidence in the asset class.”

BlackRock, which manages $8.6 trillion, filed an application with the U.S. Securities and Exchange Commission for a spot Bitcoin ETF in June. Fidelity Investments followed two weeks later with its own application, and WisdomTree, VanEck and Invesco have also signaled interest.

A few of the larger crypto exchange-traded products and funds increased assets under management by about 40% between May and June, according to Digital Asset Research. The firm said it “believes exchange-traded crypto products and funds (ETPs and ETFs) are the next area of interest for traditional financial institutions.”

For the past few years at industry conferences, buy-side executives have said they need crypto regulation, and especially crypto regulatory clarity, in order to participate in the nascent market. The SEC greenlighting a name-brand asset manager’s application for a Bitcoin ETF would be a meaningful step in that direction.

Cboe Clear Digital, the digital assets unit of Cboe Global Markets, said on June 6 it had received approval from the Commodity Futures Trading Commission to margined futures contracts. The initial product launch will include physically and financially settled Bitcoin and Ether contracts in the second half of this year.

On a May 5 conference call to discuss first-quarter earnings, Cboe executives said there were a number of futures commission merchants ready to onboard once there was regulatory clearance. “Spot trading is hampered by the regulatory environment,” Cboe Chief Strategy Officer John Deters said on the call. “We think…the derivatives products that we’re preparing really change that, because there’s full regulatory clarity around that product set. So that’s an enabler in our point of view.”