Northern Trust Asset Management is aiming to double revenues outside the US over five years and is currently expanding its fixed income team in Europe.

John McCareins, head of Northern Trust Asset Management International, is responsible for Europe, the Middle East, and Africa (EMEA) and Asia Pacific (APAC) He said at a media briefing on 25 January: “We are aiming to double international revenues over the next five years due to changes in markets and investor demands.”

Investors have moved away from purely focusing on returns to optimising risk, returns, sustainability and fees. As a result Northern Trust Asset Management hired Guido Baltussen in a newly created role of head of quantitative strategies, international in November last year. Based in Amsterdam, Baltussen was previously head of equity factor investing and co-head of quantitative fixed income at Robeco. Northern Trust Asset Management had $31.7bn in assets under management in quantitative strategies as of 30 September 2023, out of a total $1.09 trillion.

Northern Trust Asset Management also serves about 500 family offices, with an average $1m in assets under management, according to McCareins. The business will become more intentional in serving this client base outside the US by bringing together an advisory model, wealth management and asset servicing.

Fixed income

McCareins described 2024 as the “year of credit” and said Northern Trust Asset Management is building its fixed income team in London and hiring portfolio managers and traders.

Dan Farrell, head of international short duration in fixed income at Northern Trust Asset Management, agreed at the media briefing that the business is in growth mode after years of sub-zero rates in Europe.

For example, demand for new bond issues this year has reached record levels, especially for sovereigns. An Italian government bond issue attracted more than €100bn of demand and a recent UK gilt issue reached demand of more than £30bn according to Farrell.

He added: “Investors want to lock in yields for longer.”

Farrell said the firm’s base case is that there will be an economic “spot landing” in the US with inflation and unemployment falling, and real GDP growth in the range of 1% to 1.5%. Under this scenario, the Federal Reserve starts cutting interest rates in the middle of this year.

Northern Trust said in its 2024 Global Investment Outlook: “We note that 2024 is a presidential election year, but we see no reason to believe that this will dictate monetary policy decisions.”

Eric Williams, senior portfolio manager and head of credit at Northern Trust Asset Management, said at the media briefing that he expects 2024 to be a “terrific year.”

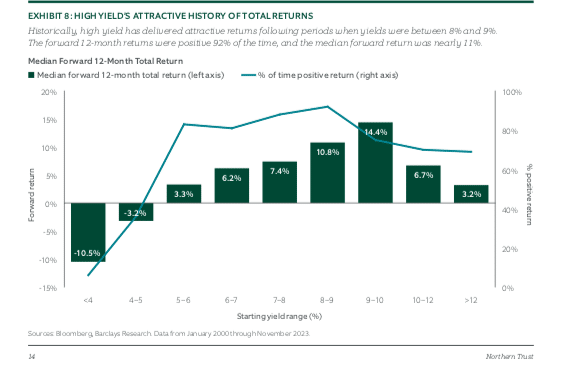

The Global Investment Outlook said investors should find value in the diversification benefits of fixed income, specifically in high yield.

“The high yield market has matured and is effectively of its highest quality in history,” added the report. “Today, with BB- and B-rated issuers composing close to 90% of the asset class, default exposure is low.”

Northern Trust also expects an increase in capital market activity amid lower rates and issuers continuing to focus on the maturity wall.

“We find the high quality composition of near-term refinancing needs to be supportive of valuations,” said the report. “While refinancing upcoming maturities involves a step up in coupon relative to existing debt, most issuers are in a position to absorb higher interest costs given their scale as well as an ability to deliver through productivity gains and earnings growth.”