In the second quarter Nasdaq completed rolling out the first artificial intelligence-powered order type approved by the US Securities and Exchange Commission and chair and chief executive Adena Friedman said there has been a 20% increase in volumes for Dynamic M-ELO and a 20% improvement in fill rates.

The SEC approved Dynamic Midpoint Extended Life Order (M-ELO) in September last year. Nasdaq offered a midpoint extended life order (M-ELO) order type for several years which introduced a fixed holding period to gather order interest before a transaction for clients seeking larger trade sizes at the midpoint. However, Nasdaq found trade execution could be improved under certain market conditions by applying adaptable holding periods. Dynamic M-ELO uses AI to adjust the length of holding periods throughout the trading day on a stock-by-stock basis to improve fill rates and reduce market friction.

Friedman said on the second quarter results call on 25 July that Dynamic M-ELO is a premium product in terms of pricing.

“Our clients get huge value out of it,” she added. “It’s a really nice way to get a higher fill rate in size at the midpoint.”

It took Nasdaq’s AI and data science teams several years to fine tune the order type as Friedman said it is quite complicated to achieve the right outcomes. The exchange also constantly fine tunes the data points and their weightings to ensure the holding period is effective.

“It is extremely hard to replicate,” said Friedman. “The formula is available, but how you manage that formula is very much part of the greatness of our technology division.”

In addition to Dynamic M-ELO, Nasdaq is using generative AI capabilities across all of its business segments.

For example eVestment, a platform that provides institutional investment data, analytics and market intelligence for public and private markets, deployed a new AI-powered feature called Pension Meeting Minutes Summarization. This provides asset managers with insights on current and future pension fund strategies to help inform their business development and engagement priorities with top pension fund decision-makers.

Nasdaq also introduced a generative AI tool within IR Insight in beta testing. The tool helps investor relations teams by synthesizing and deriving insights from earnings calls, conference presentations and shareholder meetings.

Verafin, the anti-financial crime segment, continued the rollout of its first integrated generative AI tool. The Entity Research Copilot is already available to more than 250 banks and the roll out is expected to be completed in the third quarter. By integrating the Entity Research Copilot feature directly into the workflow of its anti-money laundering solution, Verafin reduces the time investigators spend on manual research tasks to accelerate the alert review process.

Surveillance also scheduled a test launch of an AI copilot feature that provides an estimated 33% reduction in investigation time with improved overall outcomes.

Trading volumes

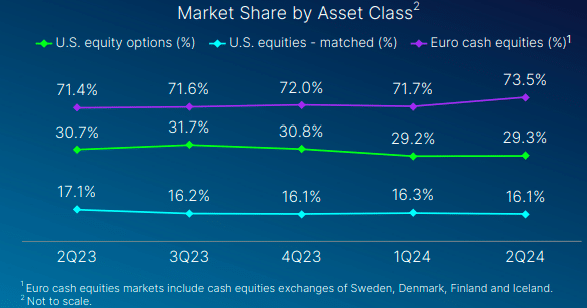

Friedman continued that Nasdaq is seeing sustained robust trading activity in markets across North America and Europe as investors navigate the dynamic market environment. Nasdaq reported a sequential increase in North American options market share, as well as growth in US equities in market share and capture.

US cash equities executed Russell, MSCI and S&P index rebalances during the second quarter. Record volume of shares and notional value were traded in the closing cross during the quarter, including the largest notional liquidity event on Nasdaq for the Russell reconstitution in June. During the annual Russell U.S. indexes reconstitution, 2.9 billion shares were traded on Nasdaq in 0.878 seconds across listed securities, representing a record $95.3bn in market value.

The number of initial public offerings improved in the second quarter as 31 U.S. operating company IPOs raised more than $3bn in proceeds. Friedman said stability in the US economy and the potential for a lower cost of capital going forward is resulting in modest improvements in the IPO landscape, and the most recent IPO Pulse index is near a three-year high.

“However, investors continue to contend with external uncertainties and the timing of monetary policy shifts, as well as that dynamic macro political environment,” she added. “Our current US IPO pipeline indicates that stronger momentum is likely to manifest starting in the first half of 2025.”

Index business

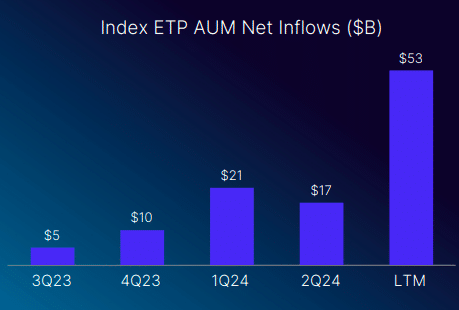

Friedman continued that the index business delivered another “exceptional” quarter with $17bn of net inflows during the second quarter, taking flows to $53bn over the last 12 months. Nasdaq had $569bn in assets linked to index-based exchange-traded products at the end of the second quarter, which was a second consecutive quarter of record ETP assets, which increased index revenues by 29% to $167m.

“Innovation is at the heart of our growth strategy in the index business, as we extend the franchise to new markets globally, drive institutional adoption and introduce new products beyond the Nasdaq 100,” said Friedman. “During the quarter 50% of index product launches were outside the US.”

Nasdaq partnered in the launch of 18 new products in the second quarter, including three insurance annuity vehicles targeting institutional clients. Index products go beyond the Nasdaq 100 and include thematic indexes covering technology trends such as cloud, security and AI, as well as thematics across different investment strategies such as momentum and dividend.

Index derivatives trading volumes also increased 25% year-over-year in the quarter, including record index options revenues.

“We’re really excited about how the Nasdaq 100 index options business is developing,” said Friedman. “We have done a lot of legwork with investors over the last several years to build up an understanding of options, how to use hedging and we have a data capability and a lot of analytics.”

Nasdaq is looking at additional indexes to bring into the index options franchise. The index team and options team have been working hand-in-hand which Friedman said brings benefits to the institutional community through better hedging tools.

Integration of acquisitions

On 1 November last year Nasdaq completed the $10.5bn acquisition of Adenza from software investment firm, Thoma Bravo. Adenza provided capital markets risk and regulatory technology through two software platforms – Calypso’s front-to-back suite of capital markets risk management, treasury, cash, collateral management, and post-trade solutions; and AxiomSL’s regulatory reporting, global shareholder disclosure, capital and liquidity management, transaction and ESG reporting solutions.

Friedman said Nasdaq has already completed over 70% of the $80m of net expense synergies that it targeted at the time of the acquisition and reduced its leverage ratio ahead of schedule. Both AxiomSL and Calypso are fully integrated into Nasdaq’s financial technology division.

AxiomSL and Calypso generated 58 combined upsells and added six new clients in the second quarter with 68% of new bookings cloud-based.

Financials

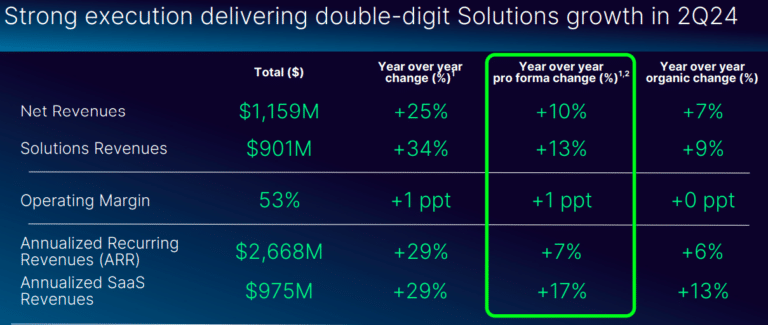

Second quarter 2024 net revenues were $1.2bn, reflecting 25% growth versus the prior year period, or 10% growth on a pro forma basis. Revenue growth includes a $168m benefit related to the acquisition of Adenza.

Sarah Youngwood, chief financial officer of Nasdaq, said on the call: “Nasdaq delivered a quarter of strong top-line growth and positive operating leverage. We successfully executed on our first deleveraging goal and achieved our year-end 2024 actioned synergy target six months in advance.”