The variety of available investment strategies and vehicles can prove overwhelming to investors, encouraging them to rely on financial advisors to sift through the myriad options. Asset managers wanting to remain competitive must therefore cater to the preferences and key objectives of these advisors.

As part of our ongoing Advisor Pulse sentiment research series, ISS Market Intelligence explored vehicle preferences among advisors, alongside trends in portfolio construction and direct indexing. In this latest edition of its ISS MI Advisor Pulse Series, 806 advisors were surveyed in July 2024 to understand where sentiment lies across the industry and understand how this differs by Advisor type.

ETFs are the top vehicle choice for intermediaries

ETFs have increasingly become the most preferred vehicle for investment advisors. ISS MI asked advisors if the same strategy were available from one of their top asset managers as an open-end mutual fund, separately managed account (SMA), and an ETF, which would they choose. 60% of advisors stated they would prefer the ETF chassis, up from 53% in 2022. That movement appears to have come primarily at the expense of open-end mutual funds. The percentage of advisors choosing mutual funds first fell from 20% to 15%. Preferences for SMAs have remained consistent over surveyed periods at 27% in August 2022 and 26% in August 2024.

Increasing interest in Active ETFs

While passive ETFs have been the largest driver of the activity, and account for more than 90% of ETF assets, interest in active ETFs has also grown steadily. 58% of advisors stated that they intend to increase their use of active ETFs over the next 12 months, the highest for any vehicle surveyed in the study. Cost advantages have been an overwhelming reason for advisors to select ETFs. When asked for the top three reasons they selected passive ETFs, 85% of advisors selected their low fees and 60% of advisors mentioned their tax efficiency. Advisors referenced similar reasons for choosing active ETFs, with 57% mentioning low fees and 54% referencing tax efficiency.

ETF interest strongest among RIAs

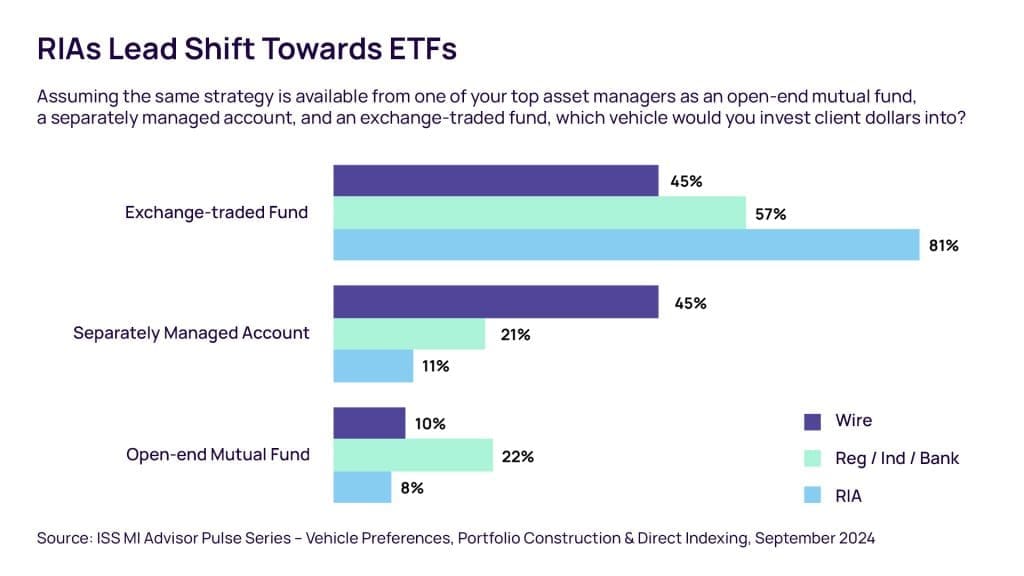

While the increased preference for ETFs has grown consistently in recent years, it is by no means uniform across channels. The chart below breaks out the preferences by advisor type. ETFs are still effectively the top choice across each group, but registered investment advisors (RIAs) displayed an overwhelming preference for them compared to wirehouse and broker-dealer advisors. An astonishing 81% of RIAs stated that ETFs were their top vehicle, whereas only 8% mentioned open-end mutual funds. Wirehouses advisors had the most balanced preferences of any advisors surveyed and were effectively tied between ETFs and SMAs at 45% each. The shift towards ETFs highlights cost pressure across investment strategies but the divide between channels raises the importance of asset managers meeting clients where they are.

Six times each year, ISS Market Intelligence (ISS MI) surveys Advisors across the country to understand the advisor decision making process and their perceptions of firms across the asset management industry. Download a Summary of the latest issue of the Advisor Pulse research series.

By: Alan Hess, Vice President, ISS Market Intelligence

Source: ISS