Avantis Investors, owned by global asset manager American Century Investments, and PT Asset Management, a Chicago-based boutique fixed income asset manager, have both entered the European exchange-traded fund market due to its “huge” growth potential.

On 1 October 2024 Avantis Investors said in a statement that it was entering the European ETF market shortly after its five-year anniversary. Phil McInnis, chief investment strategist at Avantis Investors, said in an email that it is a very exciting time to be entering Europe.

McInnis added that Avantis has been getting asked when it will bring something to market in Europe for some time. He said: “When we hear of demand from existing clients and potential new clients, we want to meet it.”

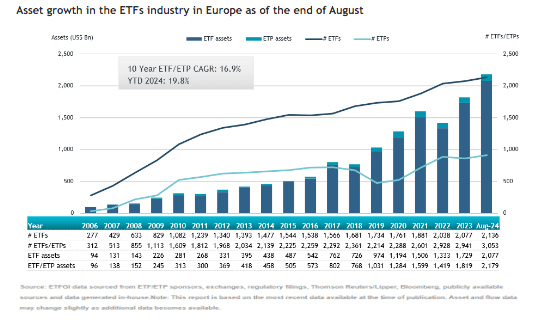

In Europe, assets invested in ETFs reached a record $2.18 trillion at the end of August according to ETFGI, an independent research firm on trends in the global ETF industry. At the end of August there were 3,053 ETFs in Europe, with 12,522 listings from 100 providers on 29 exchanges in 24 countries.

McInnis acknowledged that the European market is highly competitive but argued that the wide adoption of Avantis’ capabilities in the US is evidence of its ability to differentiate itself. Avantis launched its first strategy in September 2019, and now has $54bn in 28 strategies across, allowing American Century to become the fourth largest active ETF issuer according to the firm.

“Our investment process combines concepts from traditional active and index-based approaches as we seek to offer investors the best of both worlds,” added McInnis. “Namely, low fees, broad diversification, and transparency along with the potential for outperformance.”

At the start of October, Avantis listed a global equities ETF and a global small-cap value ETF on Deutsche Börse’s Xetra, which both draw on the same investment approach that has powered equity strategies in the US. McInnis said conversations with investors indicated that these were highly relevant strategies for the European market.

“We will continue to work with European investors to design the solutions that best fit their needs,” he said.

In October PT Asset Management partnered with HANetf, a European white-label ETF platform, to launch its first ETF in Europe. The actively managed Performance Trust Total Return Bond UCITS ETF provides exposure to the $59.9 trillion US bond market. PT Asset Management has developed a ‘shape management’ methodology which is a maths-based investment process that analyses the risk-return profile of a bond’s future cashflow.

HANetf said in a statement that PT Asset Management was founded in 2008 and has accrued over $8bn in assets under management across three mutual funds and one ETF. Hector McNeil, co-founder and co-chief executive of HANetf, said in a statement: “It is always exciting to partner with US asset managers such as PT Asset Management to bring new and innovative strategies to European investors. It’s also great to add our first active fixed income ETF.”

HANetf said PTAM was the fifth active ETF on its platform.

Growth potential of European ETFs

McInnis described the growth potential of the European ETF market as “huge.” He gave the example of Germany, which is already a $0.5 trillion ETF market because it has an efficient ETF platform infrastructure. Investors from many other countries have been reaching out to Avantis and communicating their preference for the ETF vehicle. He added that while there will always be a need to educate investors on the ETF structure, the manager is confident of success in European markets.

The current state of the European ETF market is similar to when Avantis entered the US market five years ago, according to McInnis.

“There was already quite broad adoption of passive ETFs, but we found many investors interested in learning more about the vehicle and since then have seen a proliferation of active strategies being offered,” added McInnis.

As active ETFs develop in Europe, he expects there will be some winners and some losers as in any highly competitive market, He said the response to the Xetra listings has been “wonderful.”

“And if we point to our experience with the introduction of more active strategies in a marketplace, in the US we are the fourth largest active ETF issuer coming from a base of zero assets under management five years ago,” McInnis added. “So our expectations for the European market are high.”

Active ETFs accounted for a record 25% of global ETF flows in the first half of this year, with Europe seeing $5.9bn inflows according to HANetf. ETFGI said year-to-date net ETF inflows in Europe were a record $151.9bn at the end of August. “We expect the ETF industry in Europe to end 2024 with record assets and record level of net inflows,” added ETGI’s report.

Detlef Glow, head of EMEA research at research provider LSEG Lipper, said in his September review that the European ETF industry had a lot of net flows into innovative products and new market entrants during the month, including American Century.

“This market entry means another US asset manager made its way over the pond to offer its asset management expertise to European investors,” said Glow. “In addition, Fair Oaks Capital launched an ETF share class of its Fair Oaks AAA CLO fund, which is the first ETF specializing in collateralized loan obligations in Europe.”

In addition to US managers, the ETF market in Europe is also becoming increasingly attractive to European asset managers according to Glow. He highlighted that Italian Intesa Sanpaolo’s private banking arm, Fideuram, entered the European ETF industry with the launch of six ETFs on its new D-X ETF platform. In September, Dutch asset manager Robeco also announced the launch of six active ETFs as a first step to leverage its existing asset management capabilities and expertise.

“All these new market entrants demonstrate that the European ETF industry is a fast-growing industry which will further increase its market share within the European asset management industry,” said Glow. “From my point of view, the launch of actively managed ETFs from well-known asset managers will be one of the growth drivers.”