OneChronos, an operator of smart markets that matches trading counterparties using mathematical optimization, has applied for regulatory approval to launch equities trading venues in the European Union and the UK, but also has plans to expand into fixed income and foreign exchange.

In the US, the OneChronos alternative trading system (ATS) runs periodic auctions that seek optimal matches across all orders, instead of matching orders one-by-one based on speed. Each auction looks for the configuration of “winning” orders and per-security clearing prices that will result in the most price improvement dollars cleared, taking into account all the orders’ constraints.

Richard Suth, co-founder at OneChronos, told Markets Media that the firm has submitted a regulatory application for the UK, and is about to submit for a multilateral trading facility (MTF) in the European Union, which it is aiming to launch in the middle of next year.

Suth said: ”In Europe we are going to compete directly in the periodic auction space, which is about 4-6% of the overall market. We are not just looking to take market share from the incumbents but looking to grow the overall periodic auction space.”

He argued that OneChronos is fixing some of the market structure problems that exist in Europe to allow more order flow to come into periodic auctions, which will result in better execution, less information leakage and less adverse selection. As a result, OneChronos’ design should help promote liquidity throughout the trading day in Europe, instead of everyone waiting for the closing auction.

Since launching in 2022 the OneChronos ATS has become the fastest-growing off-exchange US equities trading venue, according to the firm, and facilitated more than $500bn in institutional securities transactions. In November this year the ATS facilitated an average of more than $4.5bn in daily trading volume according to OneChronos, across roughly 5,000 different stocks per day that are diverse across large, mid and small caps and even sub-dollar stocks.

Suth said the OneChronos ATS now executes roughly 600 block trades a day, which is up from 100 at the end of last year. Volumes are up six to seven times from the end of last year and that growth trend is continuing , he added.

“We are really proud that our performance has not deteriorated even though volume has grown significantly, and that is a very good highlight for our broker partners and the buy side,” said Suth.

He continued that OneChronos ATS is participating in a broader range of algo strategies so fill rates continue to climb, which attracts more flow.

“Our sell-side and buy-side clients have said that when firms trade with us, the market stays relatively flat,” Suth added. “That shows that information is not leaking, so they can put in larger trades at more aggressive prices, which promotes liquidity.”

He continued that almost every major bank and broker is connected to the venue, and after accumulating data and measuring performance, they make OneChronos ATS part of the default routing.

Consultancy Coalition Greenwich identified the OneChronos ATS as one of the innovative ATSs in US equities, alongside IntelligentCross and PureStream in a report, The Innovators: How and Why Alternative Trading Systems Succeed.

Jesse Forster, who leads equity market structure research for the market structure and technology team at Coalition Greenwich, said in the report: “It’s not just a fleeting infatuation—they have won over the hearts of market-savvy buy- and sell-side firms that want to minimize market impact costs.”

The OneChronos ATS runs 10 to 15 randomized auctions a second and Suth said the goal is to level the playing field for all participants, whether they are fast or slow, sophisticated or not sophisticated.

“Execution quality is not a function of speed but of price and quantity as many different order types and strategies can come into the marketplace at the same time to match up in a benign way,” Suth added.

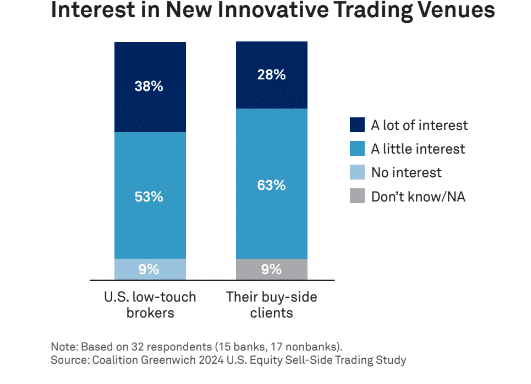

As a result, ATSs execute about 16% of U.S. equity volume according to the Coalition Greenwich study. Nearly half, 40%, of the study participants also expressed a lot of interest in having more innovative trading venues to choose from, as do their buy-side clients, due to the focus on execution quality.

Forster said the trading ecosystem is more open to non-traditional solutions than ever before.

“Whether buy or sell side, it’s crucial for traders to stay on top of the innovative and diverse solutions venues that emerge,” Forster added. “Those that do will capitalize on opportunities that others cannot see.”

The sell-side and buy-side have encouraged OneChronos to expand into equities in Asia, according to Such. After covering equities globally, Suth said the firm will have a footprint to look at other asset classes and products.

Fixed income

In November this year OneChronos said in a statement that it had raised $32m, led by venture capital firm Addition. Suth said the firm decided to take this extra cash so it has a pretty big war chest for some aggressive expansion goals, both within and outside capital markets.

Andrew Miskiewicz, partner at Addition, said in a statement that OneChronos has shown remarkable growth in traditional capital markets, and with this additional funding, the company will be able to expand into new markets where significant value can be generated.

“We tremendously value the partnership with Addition, who are great to work with,” added Suth. “They are long-term investors, which aligns with how we are looking to build this business for the next 15 to 20 years.”

Expansion plans include moving into other asset classes, including fixed income in the US, once the firm has regulatory approval.

“We think there are multiple entry points and that we can bring a real step change to improve how some fixed income is traded and give more control over transaction costs,” said Suth.

He claimed that US equities is probably the hardest asset class to get into because it operates at speed and scale, so OneChronos can do something even more powerful in fixed income by running its optimizations and offering tools for expressive bidding.

A lot of automation in fixed income has been in pre- trade and post-trade through automating the messaging between the buy side firm and trading desks, rather than coming up with smart matching mechanisms according to Suth. As a result, fixed income markets are 10 to 15 years behind in terms of electronification so OneChronos can provide a “ton of value.”

”The entrance of expressive bidding into fixed income will be a huge game changer,” added Suth. “It has been proven to work in other industries around the world, is much more efficient than traditional auctions and operates at a fraction of the cost.”

OneChronos aims to expand trading opportunities in fixed income for all participants through improved efficiency, and providing better control risk and the transaction costs going into a trade.

“They currently don’t know these things until the trade is done and that is the real game changer,” said Suth.

Foreign exchange

FX currently has either a continuous limit order book or bilateral streams. However, Suth said the market is increasingly becoming more algorithmic so it fits very well into OneChronos’ strategy.

“We think spot FX is going to launch at the end of the first quarter of next year,” said Suth. “We would like to get into FX derivatives as the next product launch within that space.”