By George Rosenberger, Broadridge Trading and Connectivity Solutions, and Linda Giordano & Jeff Alexander, Babelfish Analytics

A recent rise in proprietary trading has created a fresh challenge for traders: more inaccessible liquidity. Initially driven by retail trading surges, traders continue to grapple with managing this liquidity gap. Now it seems that more firms are now turning to riskless principal trading, and while this may offer a refuge from uncertainty, it can further exacerbate liquidity challenges on exchanges and in dark pools, continuing the trend towards market fragmentation and decentralization.

The New Liquidity Paradox

Retail trading surged during the COVID-19 pandemic, with platforms like Robinhood and Fidelity seeing high activity. Beyond the pop culture frenzy over meme stocks like GameStop, AMC, and Tesla, retail trading volumes skyrocketed across many widely held names, including Amazon, Boeing, and Apple. Based on FINRA, CBOE and other data sources, retail trading totals 25 to 30% of activity, but in some stocks, individual investors are driving 40 to over 50% of volume. A large portion of these trades not only transpire off-exchange, but occur via direct trading arrangements that are the result of payment for order flow (PFOF.) These mutually beneficial trading arrangements allow retail brokers like Robinhood and Fidelity to offer free commissions and price improvement and market makers like Citadel Securities and Virtu benefit by capturing the spread and controlling large quantities of shares.

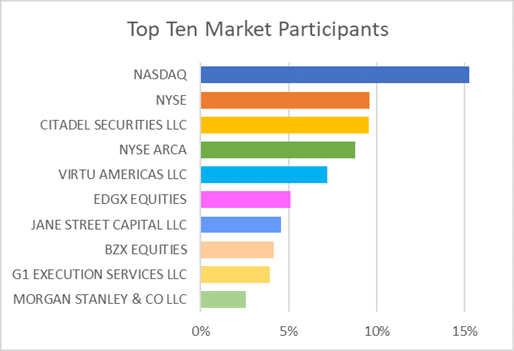

Since late 2023, proprietary trading has surged as buy-side traders work to navigate liquidity-constrained stocks, intensifying off-exchange activity and further limiting accessible liquidity. Surprisingly, Morgan Stanley and Goldman Sachs’ specialty desks sometimes rank among the top ten liquidity providers, surpassing exchanges like IEXG and MEMX. With retail PFOF arrangements accounting for 25-30% of inaccessible liquidity and riskless principal trades adding another 10-15%, over 40% of shares can sometimes be locked away in direct trading arrangements. While this activity usually represents only handfuls of trades, the quantities are significant enough to disrupt broader trading strategies, especially as it is reported via “de minimis.”

Navigating a Liquidity Crunch

Reduced liquidity can lead to price discovery issues, with wider effective spreads on lit exchanges due to the significant gap in on-exchange liquidity. This distorts price signals and impacts transparency, as critical information about true supply and demand remains hidden. Volatility risks increase in stocks with higher retail participation, where prices are often driven by crowdsourced sentiment rather than fundamentals. This volatility undermines stability and raises risk premiums for institutional trades.

Market share compression becomes evident as alternative liquidity venues like dark pools and smaller exchanges see reduced volumes, requiring institutions to transact on primary lit markets. This shift raises operational costs and exacerbates challenges in sourcing liquidity efficiently. Collectively, these factors highlight the systemic complexities introduced by fragmented and inaccessible liquidity.

Impact on Algorithmic Trading

Without specifically adapting algorithms for situations with inaccessible liquidity, traders may find that they cannot achieve expectations. VWAP strategies can be disrupted as intraday volume patterns are distorted by the unaccounted-for off-exchange activity, making volume profiles not indicative of the trading reality. Traders using percent-of-volume algorithms will miss their desired participation rates because total reported volume is more than accessible volume. Liquidity seeking, dark, and arrival algos, which are typically biased towards minimizing costs by preferencing alternative destinations, may struggle to execute in low liquidity destinations. This can be calamitously inappropriate in situations when adverse momentum is present and result in extremely costly results.

These disconnects result in missed stock, information leakage, higher market impact, and worse execution prices. These challenges underscore the need for trading strategies that account for the complexities introduced by large retail participation and prop trading.

Implications for Institutional Traders

Institutional traders are increasingly faced with higher trading costs in stocks with substantial inaccessible activity. These stocks exhibit wider spreads and higher impact costs, making execution both expensive and unpredictable. Algorithms that rely on historical volume profiles are particularly vulnerable, as they are more likely to signal large orders to the market, exacerbating price slippage.

The challenges extend beyond individual trades to affect portfolio-level strategies. Fund managers encounter heightened risks when constructing portfolios, especially when managing large positions in retail-heavy names. Liquidity miscalculations can result in prolonged unwinds and additional costs. The dynamic and volatile nature of retail trading means that institutional traders must adapt to a rapidly shifting landscape, where traditional strategies may no longer be effective.

Adapting to the New Reality

In an increasingly fragmented market environment, it is crucial to understand where liquidity naturally resides, particularly during adverse price trends. Selecting appropriate strategies and destinations that account for participation is vital. This involves leveraging advanced analytics, enhancing pre-trade analysis, and adjusting order slicing strategies to address the complexities introduced by reduced liquidity conditions. Paramount to reducing negative outliers and aggregate costs, traders must match the market situation with the proper trading algorithm, using dynamic and systematic advanced analytics.

By making these adjustments, institutional traders can navigate the challenges posed by inaccessible liquidity, ultimately maintaining competitive execution and efficiency in a market increasingly influenced by retail players.

George Rosenberger is Head of NYFIX at Broadridge Trading and Connectivity Solutions

Linda Giordano is Founder & CEO at Babelfish Analytics, Inc.

Jeff Alexander is Founder & President at Babelfish Analytics, Inc.