US/China Multifaceted Wars

If you thought the tariff war between China & the US would cause some meltdown in tech stocks you would be correct but only in the eastern hemisphere. China has resorted to sacrificing its stock market for as long as possible by deleveraging debt and devaluing its currency as an offset to Trump’s tariffs. All the Chinese have to do is devalue the yuan to the percentage that offsets the latest round of tariffs imposed by President Trump, therefore, having no effect on the cost of exporting goods to the US.

The current mood towards the stock market in China is completely indifferent to that of the US. China will happily tank their stock market if required to maintain their political status quo. Under a communist rule by the Communist Party of China social mobility and cohesion ranks higher than profits and gains driven in the Shanghai Composite.

As investors start to see that China is on the brink of stock market meltdown and the EM debt crisis causing flatlining stock prices, the US tech sector has gained an artificial safe haven status alongside defensive sectors and the US dollar. Investors are flocking into the dollar as a safe-haven trade and US equities have outperformed other world stock markets in 2018 dramatically.

Tech Earnings Growth Has Peaked Dramatically

What the EPS estimates show is something to behold. Analysts are currently estimating that stocks such as NVDA and INTC have negative next year EPS YoY growth estimates of around 80%~ compared to the previous year yet stocks have continued to rise even after Q2 earnings releases. The hilarity ensues as analysts are still maintaining strong buys on the stock even though the growth potential for next year’s earnings has dwindled to single-digit figures. Current earnings estimates tend to only matter until the second-quarter earnings releases and after that next year’s earnings start to matter a lot more on Wall Street.

We have seen this kind of false optimism occur many times before. Every analyst had a Buy or Strong Buy rating on Apple stock in 2011 however 12 months later it was trading at a 50% discount to the sector and retail investors who had made money on the way up in the previous year ended up breaking even. This shows that tech stocks are in classic bubble territory where investors are loaded up on fake optimism and no one is really looking at the actual numbers.

FIRRMA Effects Are Being Underestimated

If you think the US tech sector has weathered the perfect storm you would be mistaken, this is just the beginning of the multifaceted war between China and the US. President Trump has another powerful weapon up his sleeve to create even more market uncertainty in the future; introducing The Foreign Investment Risk Review Modernization Act (FIRRMA).

The act is part of reform enacted by the The Committee on Foreign Investment in the United States and was signed into law recently on August 13th, 2018. The bill essentially grants Trump greater powers over Chinese business influence in the US such as prohibiting company takeovers and the transfer of new technologies. As China continues to steal technology from US through various channels Trump has a new trick in his playbook and can cause a cataclysmic effect on tech stocks by limiting Chinese investment not just in the technology sector but also in telecommunications and defensives.

“Shutting off the second biggest market in the world (China) to technology related investments will cause a major correction and revaluation of technology stocks in the US market.”

Once Trump starts to use this weapon it is likely to cause severe pain for the tech sector as a whole but the most pain will be seen in extremely high beta stocks such as chipmakers and testers that operate research and development facilities in both the US and Asia regions.

A Missile Pointed At Chip Stocks

FIRRMA has the potential to kill the rapid growth in any company that sells or licenses technology developed in America to non-U.S. customers. For AMD this is particularly worrying since they carry out research in facilities located in both the US and China.

We see the same risk factors in every chip stocks’ annual report:

Uncertain global economic conditions have in the past and may in the future adversely impact AMD’s business, including, without limitation, a slowdown in the Chinese economy, one of the largest global markets for desktop and notebook PCs.

We conduct product and system research and development activities for our products in the United States with additional design and development engineering teams located in Australia, China, Canada, India, Singapore and Taiwan.

AMD Annual Report 2017

So what happens when AMD’s Chinese facilities make a breakthrough? The Chinese can easily issue countermeasures to seize technological advances before it ever reaches the US mainland. Chip companies rely on providing technological breakthroughs hence it allows them to beat their competitors in gaining contracts with important clients further up the value chain. This could have disastrous effects on the bottom line of chip making companies like AMD as governments seize their means of production.

China’s Likely Response: Technological War

China retaliates in a copycat fashion and expects nothing but the same from The Communist Party. Anything the US has done to hurt China, China has replicated. So imagine how the market will react when both sides start to engage in technological armageddon. The result inevitably is a major correction in the tech sector which has the potential to push major US indexes down sharply due to the highly cyclical nature of tech stocks.

ISM Report on Business Is Flatlining

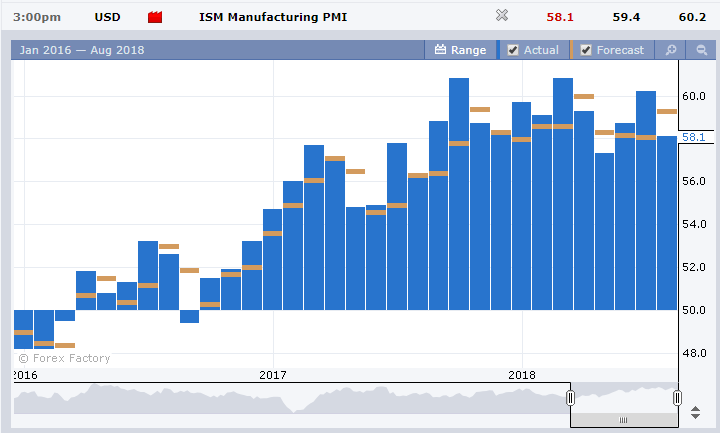

The main indicator for economic health indicator the ISM Report on Business has rebounded from it’s yearly lows in February 2018 where world markets plunged 10% the month earlier however its beginning to look like a downtrend in growth is occurring. What we could be seeing is the topping out in the US which would only add to the decline in stock markets worldwide. So what does this mean for tech stocks?

The Warning Signs Are There

Taxes kill growth and the victims are the technology, telecommunications and defense companies. An exit strategy to get out of tech stocks at the right time is hard but looking at the headwinds in the future and understanding what the effects of FIRRMA could be on the global tech industry is a no brainer. Reducing tech allocations in stock portfolios will likely to be a big theme in the near future as the reality strikes home.

What matters is how the media reacts to FIRRMA in the coming months and Trump’s weaponization of the new legislation in order to give the US a temporary edge in the multifaceted war which in turn will have the Chinese respond with similar countermeasures. I will be keeping an eye out on the ISM reading for August if it continues trending downwards we could be seeing a massive downward move in technology stocks that is long overdue.

The trick is to get out before it’s too late.