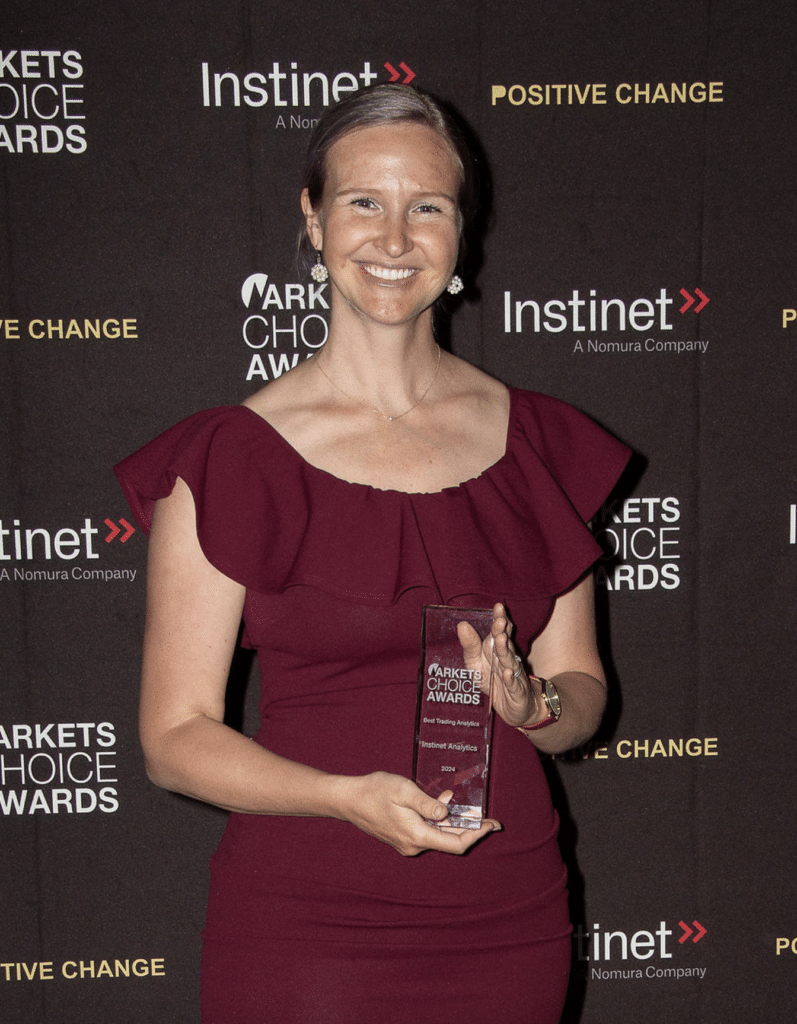

Traders Magazine spoke with Shannon Koenig, Executive Director, Head of ITS Analytics at Instinet, who won Best Trading Analytics at the 2024 Markets Choice Awards.

Please tell us about Instinet Analytics and its capabilities.

Instinet’s Analytics suite provides broker neutral data and decision tools for portfolio and single-name trading strategies, from idea generation through post-trade analysis in more than 60 markets with coverage for equities, options, and futures. Clients can access the full analytics suite, or individual modules, from most EMS/OMS platforms, including Instinet’s Newport® EMS, or as a stand-alone web interface, raw data exports, or widgets in third-party applications. Our Analytics suite helps traders distill, consolidate, and compare critical data, as well as, provide tools to measure, analyze, and calibrate strategies and tactics across every part of their trading workflow.

Our analytics collection includes:

· TradeSpex Strategy – Portfolio construction and pre-trade analytics

· Indigo Live – Customized pre-trade and real-time monitoring dashboards

· Execution Insight – Comprehensive post-trade reporting and analysis

How do you meet the needs of market participants?

The Instinet analytics suite helps provide insightful analysis for various different roles across the investment and trade cycle with all of our analytics platforms highly customizable to help the user create bespoke solutions tailored to their every need. For example, Portfolio managers can use our market impact cost estimates in the optimization process, capitalizing on our hedging tool kit, fundamental and macroeconomic risk models, liquidity prediction models and a wide range of implicit costs measurements. Traders can utilize our pre-trade execution scenarios, optimization tools and real-time algo strategy suggestions in addition to multi-broker post trade reporting and data on all industry-standard costs (e.g., spread, impact, timing, adverse selection, etc.). Compliance can use our tools for monitoring market abuse or generating industry standard reports such as Liquidity risk, Fund exposure and Best execution as well as utilize our market abuse surveillance tools. We also service both Buy and Sell side firms with all of our products offered broker neutral.

What is Trading Analytics and how can traders’ benefit?

Trading analytics are tools that process data to help provide traders with a clear and concise summary of current market conditions and indicative signals, in context to historical data and to the overall market activity. The Instinet analytics tools employ a combination of state-of-the-art and high-performance, proven and reliable technologies, using a mixture of pure statistical analysis, outlier analysis, peer analysis, regression, and in-house custom risk and cost models. These metrics empower traders to plan, monitor, and assess trading to produce actionable insights giving them the ability to make dynamic decisions based on real-time data inputs and signals.

What analytics tools are available and trending?

We believe there are currently three main trends in the market right now:

Accessibility: Everyone is demanding more control and visibility over the analytics process. Quarterly TCA pdfs from a consultant just aren’t cutting it anymore. Clients also want hands-on access to dive into the details and add new metrics, verify benchmarks, and evaluate outliers. So, we are providing more users with interactive tools and APIs so that they can engage more closely with their data.

Real-time metrics: Instinet have lots of client conversations on the real-time metrics available to traders in our Newport EMS. We’ve also recently rolled out a new TradeSpex API with access to real-time signals, volume predictions, cost estimates and more.

Automation: Everyone is trying to do more with less these days, and that means automation tools continue to grow. Clients want to streamline daily processes so we offer faster workflow solutions such as automating daily TCA reports and broker wheel reviews. Today’s wheels tend to be more tactical than they were in the early years with clear, explicit goals; whether measuring broker selection, algorithm parameter changes, or workflow changes. Users are more comfortable with the experimentation framework and in the conclusions to be gleaned.

Do traders prefer to buy or build their own analytics tools? / What are the latest trends?

Although some choose to build their own tools, it is often resource and time intensive building software and running statistical tests with requirements often escalating and changing quickly. The Instinet analytics suite offers many out of the box tools which can be highly customized and tailored to the users every need without the need to code. Our data and analytics libraries are also some of the vastest in the industry which continue to expand incorporating not only historical market data going back to 2006, but also impact modelling and real time analytics including liquidity, depth, volumes, spread profiles and proprietary risk models. We therefore see an increasing number of traders turning to vendors such as ourselves to explore the various analytics options already available.

What are your long-term objectives and ambitions for your firm?

At Instinet we continuously strive to enhance the user experience whilst staying competitive in the analytics space therefore one of our main longer-term objectives is to expand our distribution channels, making our vast data library’s and analytics tools as widely available as possible. We also want to enhance the research-driven user experience by modernizing the web GUIs across all of our analytics platforms. For this we have partnered with a leading University team to bring state-of-the-art UX research into this process from the very beginning. This has been a true discovery journey, with challenging aspects that were only resolved by breaking with some deeply entrenched practices, yet making the whole experience immensely rewarding.

What are your current initiatives at Instinet?

One of our current strategic initiatives puts more focus on the automation of our event-driven Analytics workflows such as Index research which we recognize as an area with a lot of potential. It has several interesting angles to it including data normalization, event modelling tools and capabilities, and automated client-facing content generation. Another area we continue to develop is our capacity and performance capabilities with a focus on post-trade processing on-demand (T+0) and access to live models, such as MAS our real time trading optimization tool, offered via our API products. In addition, we are also pushing for more EMS integrations, having launched an updated data and analytics API earlier this year, which opens up opportunities to scale up and expand integrations with 3rd party EMS platforms. We have had discussions with a few platforms, and the feedback so far has been immensely positive. Watch this space.

What can we expect from Instinet in the nearest future?

We have recently enhanced the analytic offering within Newport through our Indigo real-time analytics platform, to cover true live pre-trade analysis by deploying two new widgets. The first provides a straight-forward and focused live predicted impact and risk for an order, updated in real-time and powered by our Micro Adaptive Sequencer (MAS). The second widget, also powered by MAS, provides live strategy comparison, to inform algo and parameter selection before and during order execution. This also relies on live data and signals so results might change as market conditions improve or deteriorate intraday. We truly believe that, from an Analytics perspective, Newport offers one of the most, if not the most, comprehensive solutions out there.

We are also exposing some of our live models via our JSON Rest API with the newest addition to the family being, again, MAS. This is particularly attractive from a 3rd party EMS integration perspective, as it allows this cutting-edge model to be seamlessly weaved into the execution workflows of various platforms.