Rayne Steinberg, chief executive and co-founder of Arca, expects the institutional digital asset manager’s blockchain transferred fund (BTF) structure to be used by other buy-side firms this year.

Steinberg told Markets Media: “This year is going to be a transformative year as there are some interesting things that we are doing with the BTF structure.”

Arca launched the first BTF that is registered with the US Securities and Exchange Commission in 2020. The Arca U.S. Treasury Fund is regulated under the Investment Company Act of 1940 as a closed-end fund investing in US Treasuries.

Blockchain technology has been used to create ArCoin, a digital security which represents a share in the Arca U.S. Treasury Fund and accrued interest is paid directly to ArCoin holders each quarter. Arcoins can be transferred peer-to-peer or from wallet-to-wallet and the Ethereum blockchain technology provides greater transparency, traceability, speed and a reduction in costs as it requires fewer financial intermediaries.

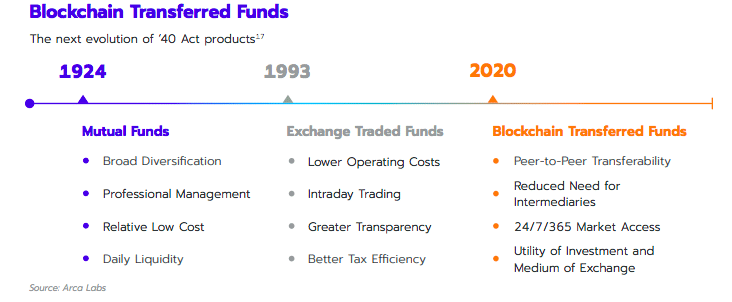

Steinberg said Arca conceived BTFs in May 2018, filed a draft prospectus in November of that year and received SEC approval in 2020. He said: “We really see this as a continuation of the evolution of regulated co-mingled funds.”

Before launching Arca Steinberg co-founded ETF issuer WisdomTree where he was responsible for raising capital, creating intellectual property and building and overseeing the sales team responsible for raising $50bn in assets under management.

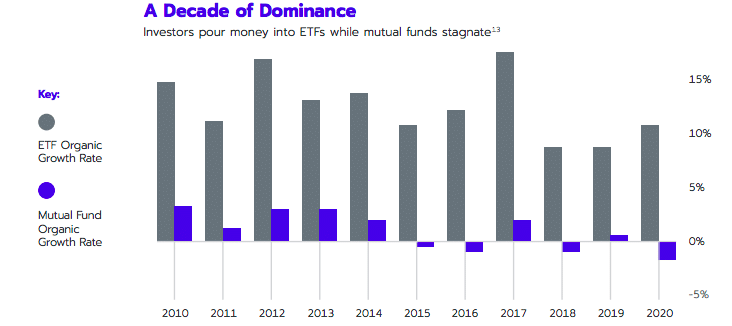

He argued that BTFs could potentially have a faster growth trajectory than ETFs which improved on the daily 4 pm market close and liquidity limitations of mutual funds. BTFs offer greater advantages including peer-to-peer transferability, 24/7 trading and immutable record keeping.

“When I co-founded WisdomTree the whole ETF industry had $40bn in assets and fund managers were not sure that this was going to be the killer structure,” Steinberg added. “That is what they have become 29 years after their invention.”

Global ETF assets reached a record $10.3 trillion at the end of 2021 according to ETFGI, an independent research and consultancy firm.

Steinberg continued that the BTF structure’s ability to increase capital efficiency due to real-time settlement and the use of smart contracts to integrate with settlement workflows also has large potential.

“I think there will definitely be some use cases coming out this year,” he said. “We are also in discussions to partner with some large asset managers.”

Barriers

Steinberg said a market ecosystem needs to develop to allow large traditional asset managers to use BTFs. For example, in addition to issuers, the ecosystem requires authorised participants.

Another barrier is the lack of regulatory clarity around digital assets and issues such as custody.

“The regulators are trying to get this correct and this is not an easy project,” Steinberg added. “We are going from a very centralized world with walled gardens and jurisdictions to a world where you can buy any security around the world so there are a lot of difficult issues.”

David Easthope , head of fintech, market structure, and technology at consultancy Coalition Greenwich, said in a blog that greater regulatory certainty is needed before traditional investors can further embrace the digital asset ecosystem.

Engagement

However, Steinberg also said that 2021 was a watershed year for institutional engagement in digital assets and that has not changed despite prices dropping.

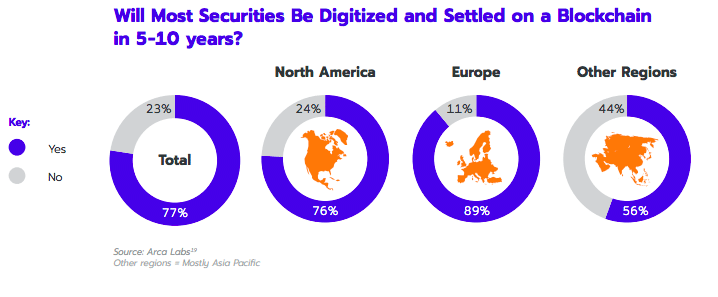

The Arca Labs white paper, Blockchain Transferred Funds (BTFs) To Transform the Financial System, found that three quarters, 77%, of respondents believe all securities will be settled on blockchain in five to 10 years.

“A year ago 77% of respondents would not have believed that,” Steinberg added. “There is institutional recognition that this is a very important and transformative business.”

The Arca Labs report said that just as the smartphone transcended the telephone’s original intended uses and transformed photography, navigation, and software creation and distribution, financial institutions look for additional applications for their current financial products

For example, financial institutions are investigating how they can utilize ETFs for other workflows in collateral and treasury management applications.

Easthope wrote that as an ecosystem around BTF participants emerges, other second-order networking benefits are also present in areas such as collateral management, compliance and stablecoin alternatives.

“ETFs were originally designed to address some of the flaws of mutual funds and offer low-cost investment opportunities to retail and institutional investors alike,” Easthope added. “But the rise of blockchain, 24/7/365 markets and broader digitization efforts offers a new approach.”