The three pillars of digital transformation – big data and AI, new asset classes, and new digital information channels and platforms – create a challenging future for the investment industry according to the CFA Institute.

The global association of investment professionals announced the launch of its new Research and Policy Center which included the release of a report, Future State of the Investment Industry, discussing the most significant developments that will impact the fund management industry in the next 5 to 10 years. The report is based on a survey of 3,000 investment professionals globally in late 2022, as well as qualitative insight from discussion forums.

The study presents four potential development pathways – Diverging Worlds, Sustainable Finance, Digital Transformation, and The End of Cheap Money.

Digital transformation

Respondents to the survey believe that human intelligence and AI are mostly complementary. More than half, 56%, of respondents in the surveys said their firms are using AI and big data solutions in data analysis, but only 26% say the same for decision making.

“Those firms that best integrate these developments into their talent acquisition processes and investment teams, and best meet client demand for personalized and technology-driven products and securities, come to outperform,” added the report.

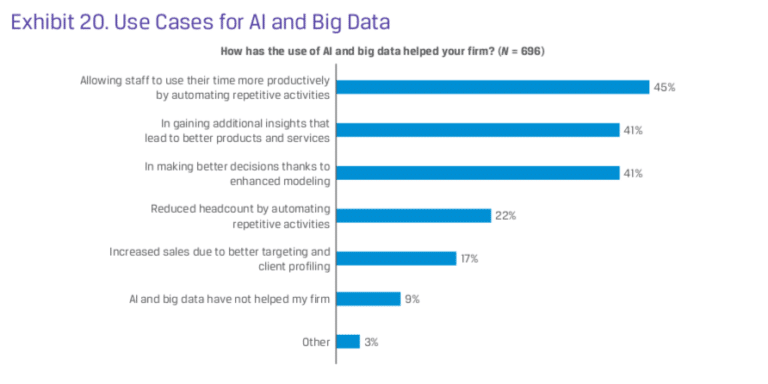

Their most commonly cited benefit was allowing staff to use their time more productively by automating repetitive activities according to the survey, while only 22% reported that adoption leads to reduced headcount.

However, 41% of respondents said a shortage of talent was a major obstacle to the integration of AI and big data into the investment process.

The CFA said: “This shortage inhibits firms from expanding their analytical capabilities and raises the premium that practitioners with both finance and data science experience can demand.”

As a result, professionals who understand both finance and the application of data science will carry a premium.

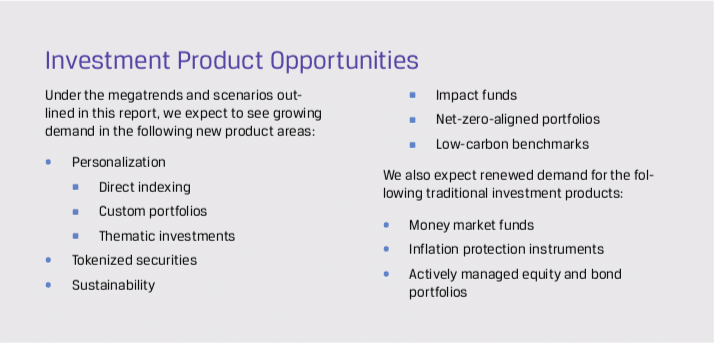

The CFA highlighted that generative AI could be a significant disruptor by reducing the cost, time, and skill set needed to perform complicated tasks, such as pattern identification, algorithm creation, data cleaning and analysis. This lowers barriers to entry and allows the creation of more customized solutions for investors in products and demand for such personalized products and access to alternatives will be central themes of new product development.

“Rather than seeking to be “one product for all” in their product offerings, firms may gravitate toward the maxim of “one product for each,” with each customer expecting personalization,” added the CFA. “In the broader industry, larger firms will apply advanced technologies at scale, and smaller firms will operate in more niche and focused product areas.”

This article first published as Beyond Liquidity on Markets Media. Beyond Liquidity is produced in collaboration with Liquidnet.