Fredric Tomczyk, chief executive of Cboe Global Markets, said the group will be less focussed on acquisitions and capital will be allocated to organic growth initiatives, investing in the global technology platform and returning cash to shareholders.

On the second quarter results call on 2 August, Tomczyk said he is sharpening the strategic focus of the group to areas that have the most valuable growth opportunities. He took over chief executive in September 2023 and has been carrying out a strategic review.

As a result, he said Cboe is dialling back on M&A; reallocating resources to align with core strengths, including winding down the digital asset spot market; lowering expenses and stabilizing margins. Capital will be allocated away from M&A to increase investments in organic growth initiatives, such as investing in the global technology platform, and increasing returns to shareholders through dividends and share repurchases.

“To that end, we are refocusing our view that the company has both import and export businesses that enable us to unlock even more of our global growth potential,” he added.

The export business involved expanding into new geographies and deploying technology and data to create better trading experiences for customers across the globe and exporting the US derivatives market model to Europe. However, there are now opportunities to grow the import business.

“From my travelling and talking to our global client base over the last nine months, I have learnt there is a huge appetite to invest in the US market and our analysis confirms this trend,” said Tomczyk.

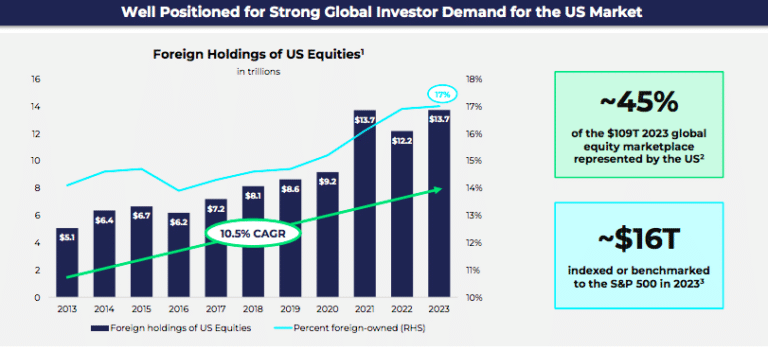

Holdings of US equities reached nearly $14 trillion last year, growing at a compound annual growth rate of 10.5% CAGR over the last decade. Cboe expects this trend to continue due to the growth of the retail investor globally, and different markets implementing legislative changes that are expected to create opportunities for Cboe.

“The S&P 500 is the dominant global equity benchmark, with an estimated $16 trillion benchmarked to the index, and importing foreign investment back into the US is a significant and growing opportunity,” added Tomczyk.

Cboe also continues to see significant opportunity in Asia Pacific, where there is growing demand for index options to access the US market. Three global brokers in the region joined in the first half of this year and added CBOE products to their platforms, including S&P 500 index (SPX) options. Tomczyk continued that this is a long-term secular trend and international participants are highly valuable to the US market as they improve the trading ecosystem.

“We believe the secular trends that are reshaping trading and capital markets, including the globalization of markets, the rise of the retail investor, increased use of options by market participants, and the technology and data revolution, create excellent opportunities for Cboe,” said Tomczyk. “The strategic review should be viewed as a journey, and not an event, and you will see us continue to refine our strategy over time.”

SPX and volatility suites

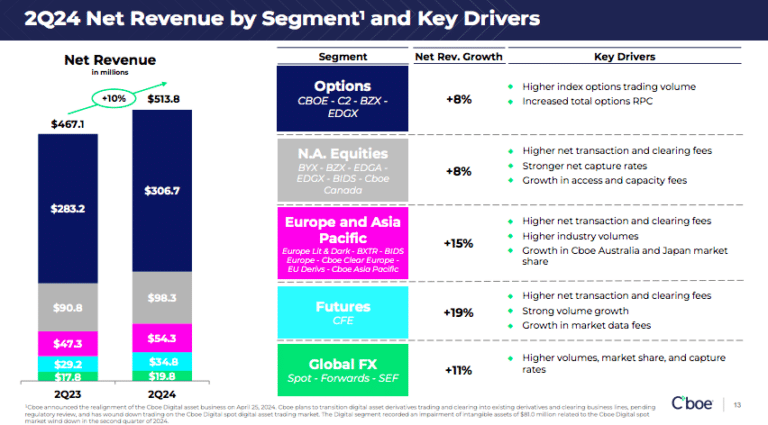

Tomczyk said the derivatives business delivered another “solid”quarter as organic net revenue increased 11% year over year, with volumes increasing across the board. Options net revenue of $306.7m rose 8% from the second quarter of 2023 and futures net revenue of $34.8m increased $5.6m over the same period.

Dave Howson, global president of Cboe, said on the call that SPX options hit their highest monthly volume in April when there was a spike in volatility. In the second quarter, volumes in SPX options rose 9% year-over-year to 3 million contracts.

“VIX [volatility] options volumes surged 18% quarter-over-quarter making it the third largest quarter on record, ahead of even the Covid-driven spike in the first quarter of 2020,” Howson added. “On the back of this unprecedented interest in VIX options trading we are excited to expand access and utility with our planned October launch of options on VIX futures, subject to regulatory review.”

The new options will trade on Cboe Futures Exchange, CFE. Howson said this is important as it allows access to participants who may not be able to use Cboe’s options exchanges, and Cboe will also be able to offer shorter tenors to meet customer demand.

“We are especially excited about expanding our volatility toolkit ahead of this year’s US election, which has historically been a meaningful catalyst for markets,” said Howson. “The VIX index jumped over 10 points in the months leading up to both of the last two elections.”

Growth plans

Tomczyk said the second quarter results illustrate the durability of the Cboe business model with year-to-date net revenues increasing by a strong 8%.

“These results were driven by a contribution from each part of our ecosystem with improved volumes in our cash and spot markets, solid volume across our derivatives franchise, specifically our proprietary index options and futures products, continued expansion of the data and access solutions business and disciplined expense management,” Tomczyk added.

Jill Griebenow, chief financial officer at Cboe, said on the call that Cboe reported strong 10% year-over-year net revenue growth in the second quarter as each business segment posted solid year-over-year trends.

Cboe anticipates that organic total net revenue growth for the group will finish in the 6% to 8% range this year, up from prior guidance of the higher end between 5% and 7%. However, Cboe expects data and access solutions to meet the lower end of organic net revenue growth of between 7% to 10% this year. Howson said timing plays a big factor in data and access solutions’ revenues.

“We are optimistic on our outlook for this business as we look to further leverage our global network and ecosystem to drive growth,” added Tomczyk.

In access solutions, Howson said Cboe is “excited” about the momentum behind the new dedicated cores offering which provides reduced latency and enhanced throughput. Dedicated cores went live on all four Cboe’s US options markets on 1 July 2024 and the firm plans to roll out the technology in Europe in the fall.

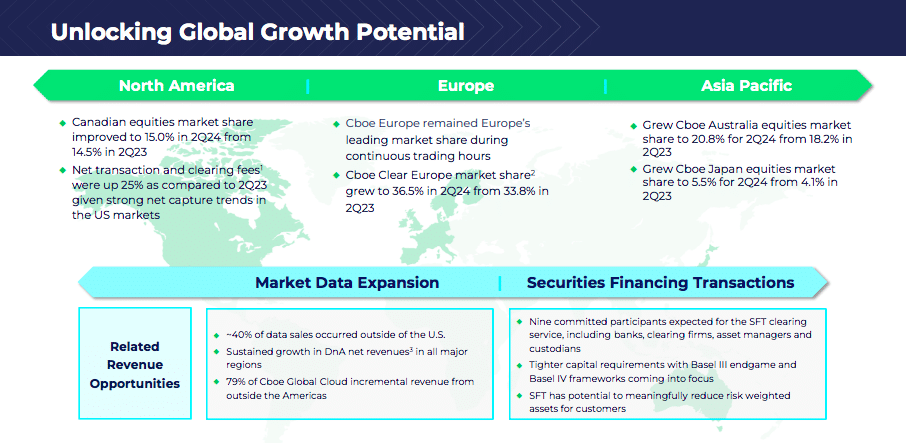

Europe and Asia Pacific’s net revenue of $54.3m increased by 15% compared to the second quarter of 2023. Japanese equities average daily notional value was 71% higher and Australian equities average daily notional value rose 12% over the same time period. In Canada, the migration to CBOE technology is on track for early 2025, subject to regulatory review, according to Howson.

“The Asia Pacific region remains one that we are incredibly excited about,” said Howson. “We see the opportunity to more effectively monetize our ecosystem of transaction and non-transaction businesses in local markets like Australia and Japan. As we grow, we look forward to fuelling the import of derivatives activity into the US.”

Griebenow said: “We expect to see continued strength from demand for access across our global markets, particularly as we increase our presence in new geographies, leverage the distribution capabilities of CBOE global cloud, expand dedicated cores to greatly enhance our exchange access layer and increase capabilities around our US options data as we reallocate technology resources from integration efforts to organic revenue-generating enhancements.”

On April 25 2024 Cboe announced plans to transition digital asset derivatives trading and clearing into existing derivatives and clearing business lines, pending regulatory review, and the group has wound down trading on the Cboe Digital spot digital asset trading market. As a result, the digital segment recorded an impairment of intangible assets of $81m in the second quarter.

Cboe is seeking additional regulatory approval for crypto ETFs and crypto index options.

Howson said: “There are a number of regulatory and infrastructure obstacles that we need to knock down, but we are really looking forward to working on those with our customers and the regulators.”