Nomura’s digital assets subsidiary has invested in ClearToken, a startup that is launching a clearinghouse for spot digital assets, as institutional investors believe confidence in the infrastructure that underpins the trading process is a key enabler for growth.

In March this year Laser Digital, Nomura’s digital assets subsidiary, announced a strategic investment in ClearToken, a startup that will introduce a central counterparty to the digital asset marketplace that intends to operate with traditional market structure best practices. Introducing a CCP removes bilateral counterparty risk for settlement, financing and derivative transactions by centralising clearing, settlement, collateral and risk management arrangements.

Benjamin Stephens, chief executive of ClearToken, told Markets Media that the firm was founded because institutions have a number of difficulties entering the digital asset market, particularly around obtaining credit and the need to pre-fund transactions.

“If investors don’t want to pre-fund, they need to risk manage the time between trading and settlement through a clearinghouse, which is a traditional financial market infrastructure,” Stephens said. “We allow institutions to use a digital assets clearinghouse.”

He stressed that the CCP will be run in the same way as a clearinghouse in traditional finance (TradFi), with general clearing members and futures commission merchants, a default fund and a similar risk model. Stephens argued that although digital assets are volatile, they are less volatile than traditional assets such as small, growth companies or energy markets.

“Existing clearinghouses have quite a few margin calls a day and our intention is to not just use the existing mechanisms, but also the 24/7 commercial or central bank payment mechanisms,” said Stephens. “However, we are not going to cut anybody off or use auto-liquidation.”

Stephens expects intra-day repo, and intra-day borrowing and lending, to grow aggressively in digital assets in the future. It will become much more efficient for market participants to move collateral, which ClearToken can facilitate as a clearinghouse.

ClearToken would take the same types of collateral as a TradFi clearinghouse, such as fiat currency and bonds, but also take 24/7 versions of these securities as they develop. Stephens stressed that ClearToken would only take stablecoins as collateral if they are regulated.

“In addition, the acid test is whether another member would accept that collateral to make them whole when we are transferring a portfolio,” he explained. “If the answer is no, you cannot use that asset as collateral.”

The new CCP is not native to any individual exchange or platform and can also clear bilaterally agreed over-the-counter transactions. ClearToken is also discussing the membership rules and the assets that it will clear in accordance with guidelines from IOSCO, the International Organization of Securities Commissions, and Emir, the EU central clearing regulations.

The firm is running a proof of concept with a number of industry participants with the technology that it has developed to take in trades from a number of venues as it waits for regulatory approval from the UK authorities.

In derivatives LCH SA, London Stock Exchange Group’s European clearer, will provide a new segregated clearing service for digital asset derivatives venue, GFO-X, as more trading in the asset class is expected to move to regulated venues. In April this year LCH DigitalAssetClear said it will provide clearing services for cash-settled Bitcoin index futures and options contracts traded on GFO-X, a venue approved as a multilateral trading facility by the UK Financial Conduct Authority. The service is expected to go live in the fourth quarter of 2023.

Stephens argued that incumbent CCPs are systemically important but there may also be a regulatory desire to spread risk. ClearToken feels there is an opportunity to create a new version of a CCP that operates on modern technology on a horizontal basis and incentivises participants.

“If members are risk sharing, then it is very important that they are able to own part of the clearinghouse,” said Stephens. “Our structure allows the CCP to be member-owned and have their incentives aligned with risks.”

ClearToken would like to be operational in 2024, once regulatory approval has been received.

“There is no reason in practical terms why most securities won’t become digital and movable 24/7, but we have to solve the regulatory definition of settlement finality,” added Stephens. “Existing legislation covers the vast majority of what we want to do, but there are gaps, which we can help to fill.”

Institutional infrastructure

Dr. Jez Mohideen, chief executive of Laser Digital, said in a statement that the venture invests in projects which aim to address the challenges institutional investors currently face in the digital asset marketplace. Laser Digital is headquartered in Switzerland and chaired by Steven Ashley, who formerly led the Japanese bank’s wholesale division.

Mohideen said: “ClearToken’s initiative has the capacity to remodel a marketplace fraught with bilateral risk, transforming this market as we know it.”

ClearToken is engaging the leading market participants including digital asset exchanges, liquidity providers, prime brokerages, custodians and asset managers as contributors and members to accelerate the next phase of the project.

The need for institutional infrastructure in digital assets was highlighted by a study, Cornerstones for Growth, published in June 2023. The majority, more than 60%, of respondents pointed to a safer trading environment as the key driver for increasing confidence in trading of digital assets which will lead to greater adoption.

Censuswide on behalf of SIX, the Swiss exchange and infrastructure group, surveyed 300 portfolio managers, asset allocators, and hedge fund managers, across Europe, Asia, and the US in April 2023.

David Newns, head of SIX Digital Exchange (SDX), said in the report that there is a clear desire among the buy side to trade digital tokens on institutional platforms with regulatory oversight and to increase the options for consumers when it comes to institutionally attractive, safely tradeable digital tokens.

“It is important to reiterate that it is not a lack of confidence in the assets themselves that has decelerated or even prevented engagement with this market,” added Newns. “It is the need for institutional platforms that have robust governance as well as sound risk and regulatory oversight.”

SDX believes that, alongside experienced market infrastructure providers, regulated and traditional trading and custody venues have a key role to play in the development of the digital assets space based on blockchain technology.

The study said It appears that digital tokens are at an inflection point in adoption by international buy-side firms. Currently, just 11% of respondents hold digital tokens in their portfolio but nearly three quarters, 69%, plan to include digital tokens in their portfolios over the next 12 months. This rises to 83% of buy-side companies in Asia.

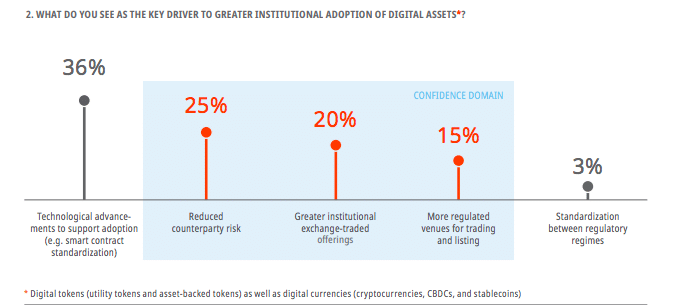

Confidence in the way that digital assets are traded was consistently cited as a key driver to greater adoption, with more than 60% of respondents pointing to a desire for a safer trading environment. One quarter of respondents said that reduced counterparty risk would be a key driver in their adoption plans; while a fifth mentioned greater availability of institutional exchange-traded offerings; and another 15% said regulated venues for trading and listing would help.

“There is space here for experienced exchange and market infrastructure operators to make the trading, settlement, and custody of these exciting assets both more accessible, and more secure, underpinned with the appropriate application of blockchain technology,” added the report.

In addition technological advancements, including smart contract standardization, regulatory oversight and sound risk management are the main accelerators of adoption.