A race for analytics and data has begun as nearly all banks, investors and capital markets service providers plan to increase spending on data management.

Paul Humphrey, chief executive at data engineering and analytics firm BMLL Technologies, told Markets Media: “The race for speed has been replaced by the race for analytics and data.”

BMLL Technologies and Plato Partnership, the not-for-profit company working to improve the European equities marketplace, launched Platometrics in December last year.

Platometrics was developed to provide market participants with a complete picture of trading data and trends from European venues. It can be expensive for participants to gather data from all the venues in the region and Platometrics is free of charge on a transaction date plus one day basis (i.e. up to the end of the prior trading day) with up to six months of historical data.

Humphrey said: “There is a large amount of information in historic data which can be used for predictive insight.”

Plato Partnership said in its latest newsletter that Platometrics has been a resounding success with hundreds of active users and positive feedback.

The latest Plato newsletter is in inboxes now! Featuring updates on @Tradeweb, Platometrics, new members and AIR Summit London 2.0. Read it here ? https://t.co/MNJpuwPnrB

— Plato Partnership (@PlatoMarkets) February 11, 2020

Mike Bellaro, chief executive of Plato Partnership, said in the newsletter: “The metrics provided by Platometrics offer an easily accessible and coherent view of a large complex data set. This was previously only possible with a large data warehouse and understanding of complex data analysis tools.”

Ben Collins, head of sales & CRM at BMLL Technologies, told Markets Media that in the last five years the firm has developed the platform to combine data, computing power and analytics and can now provide access to a central data lake to a wide community of users in a scalable environment.

“Plato Partnership does a really good job of representing the whole market and Platometrics provides a visual showcase of how advanced analytics can add value to the financial community,” Collins added.

Humphrey continued that BMLL Technologies has a unique dataset in terms of depth and breadth.

“The BMLL platform provides access to granular Level 3 data and solves a huge problem by creating analytics at speed and scale, which investors find useful and can be embedded in their workflows,” Humphrey added. “For example, we have provided 20 metrics on four and a half years of trades on the NYSE in one hour and seven minutes.”

Humphrey became chief executive in January this year. His previous roles include global head of FICC at Euronext, interim chief executive at Euronext London and chief executive for electronic broking & information at Tullett Prebon. His appointment came as BMLL closed its latest funding round raising $25m(€23.1m) from investors including Oceanwood, venture capital firm IQ Capital and investment fund Angel CoFund.

“We have more than 20 customers today, including Tier 1 institutions, and can spread to many other client types and uses not just within our clients’ firms, but beyond,” he added.

Value of data

The value of data in financial markets is increasing as shown by a recent survey by data provider Refinitiv and consultancy Greenwich Associates. The Future of Trading report found that 85% of banks, investors and capital markets service providers plan to increase spending on data management.

The #TradingDesk of 2024: Our series on the future of trading examines the rising value of data. https://t.co/2cxr092YYT @Refinitiv #SmarterTrading pic.twitter.com/sG3hkSqa8E

— Refinitiv (@Refinitiv) February 4, 2020

Michael Chin, managing director and global head of trading proposition at Refinitiv, said in a blog that the quantity and velocity of market data will continue to grow alongside trading volumes and the number of tradable instruments.

“At the same time, tolerance for errors and acceptable latency for delivering that data will drop,” Chin added. “Large investments in market data infrastructure by those up and down the value chain must continue for the foreseeable future.”

He continued that the evolution of analytics is just as critical as acquiring the data itself, particularly for investing and measuring execution quality,

“In other words, finding data is not enough,” he said.’ You have to put it to work — to interpret, analyze and utilize existing, new and unstructured data across trading workflows.”

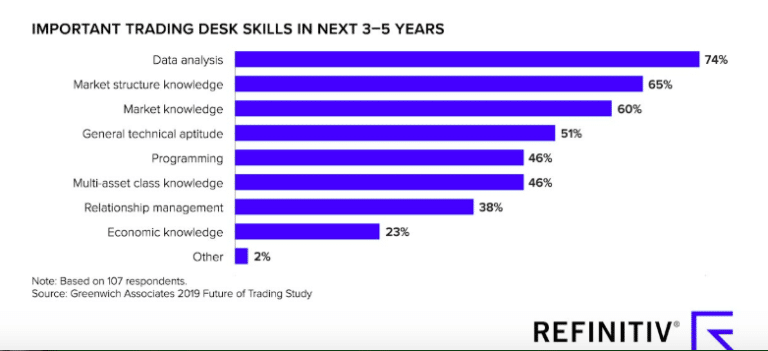

As a result the majority, 57% of capital markets professionals expect to spend more time analyzing data, and 74% believe data analysis is the most important skill required to work on the future trading desk.

In addition nearly all, 95%, of trading professionals believe alternative data will become more valuable to the trading process in the coming years.

Chin said: “Data is not simply a buzzword. If gathered correctly and interpreted accurately, it’s the path forward for trading.”