The Pyth network has introduced a staking system to reward contributors for the quality of their data as the decentralized blockchain-based distribution platform aims to make financial market data across asset classes cheaper, and more accessible.

Timely and accurate market data has historically only been available to institutions who can afford to pay for direct connectivity to exchanges, vendors or other providers.

Pyth was launched to find a better ways to make financial market data available on blockchain to projects and protocols using smart contracts, as well as to the general public. Mike Cahill, chief executive of digital asset infrastructure provider Douro Labs and a core contributor to Pyth, told Markets Media tha the network was designed to solve the oracle problem in blockchains.

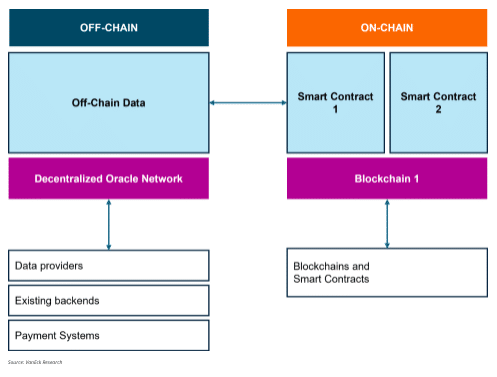

On a blockchain, trust or verification from the user is not needed because data is stored on a decentralised ledger with global consensus. However blockchains need a way to securely access some off-chain data, such as asset prices which are constantly changing. Oracles were designed to provide secure access from blockchains to off-chain data using smart contracts to connect to external data providers.

Menno Martens, crypto specialist and product manager at fund manager VanEcK , described the Pyth network in a report on 5 November 2024 as a high-frequency oracle using Solana blockchain technology. This offers a robust solution for off-chain data sharing for primarily decentralized finance applications (DeFi), and provides services such as real-time price feeds and benchmarks. VanEck has a Pyth exchange-traded note.

“Pyth’s data pull model provides data directly from the source, such as exchanges, market makers or DeFi protocols,” added Martens. “Because data is pulled only on demand and not pushed at a given interval, it scales efficiently, and costs are offloaded to users where updates are demand-based.”

Cahill said Pyth was designed to allow DeFi to compete with the traditional financial world by having the lowest possible latency and cost, and run as efficiently as possible. The initial pitch for the network was to approach high-frequency traders and highlight that they had valuable data which could be contributed to this blockchain project to solve the oracle problem.

“We are able to generate a very high quality but zero-cost data stream,“ Cahill added. “This revolutionizes how people think about data and is completely orthogonal to the existing data economy, because we are relying on this found resource from so many different trading firms.”

Pyth began by approaching the biggest trading firms and some of the largest exchanges, but now has a comprehensive set of about 110 contributors across 550 symbols, according to Cahill. For example, in 2021 market maker Virtu Financial began to contribute financial market data across equities, foreign exchange, futures, and cryptocurrencies to Pyth. Douglas Cifu, chief executive of Virtu Financial, said at the time that with growing support from the trading community, the Pyth Network would become an integral piece of infrastructure in the evolving DeFi ecosystem,

In 2022 Cboe Global Markets became the first major global exchange operator to join the Pyth Network and contribute real-time, derived market data, starting with 10 symbols from one of its four US equities markets. This year Laser Digital, the digital asset subsidiary of Japanese bank Nomura, became an institutional data provider across crypto, equities, commodities, and FX.

“From the very beginning, the idea around who should publish on this network was the only trust it had,” added Cahill. “So they are institutions who have got too much reputation to lose than they have to gain by manipulating data.”

In order ensure the quality of the data there are mechanisms in place such as never having just one publisher in a symbol and needing a minimum of 10 publishers in order to generate an aggregate. Cahill said: “We have made some refinements, and think we will be able to scale those numbers up tremendously over the next several months.”

Pyth has just rolled out oracle integrity staking which Cahill described as adding economic trust to the network. Providers are incentivized to help maintain data quality by receiving rewards from an open-ended pool. However, they also face the risk of having their stake slashed as a penalty for failing to maintain data accuracy.

“Imagine this sci-fi world where you have everything that is traded reports its price to Pyth because we have incentivized all the traders to earn rewards,” said Cahill.

Users can see on-chain how much each publisher has been rewarded for providing the highest quality data, and validators can also receive a portion of the rewards.

“Using these game theory mechanisms can reinforce the outcome for higher quality,” Cahill. “Pyth is designed to optimise trust at speed, which is vitally important for financial services.”

Pyth price feeds currently update every 400 milliseconds according to Cahill, which is very fast for blockchains but relatively slow for institutional finance who operate in microseconds, or sometimes nanoseconds.

“The end goal is to get all symbols on Pyth as close to T0 as possible,” he added. “The roadmap is to make things faster, make more data available and keep it very cheap.”

Cahill has ambitions that as Pyth starts to scale up into the many thousands, hundreds of thousands or millions of symbols, it will become an alternative to visual data for traders, which has historically been prohibitively expensive.

“Projects like OpenBB are already plugged into Pyth data and they are making it available to retail traders who have relied on 15-minute delayed data,” he added. “This is a global project and we think that giving equal access to everyone is a huge endeavor, which will be a game changer.”

Pyth data has also been integrated with TradingView, which allows users to view Pyth prices on their own website. Cahill said: “We are very aligned to being able to make data available everywhere.”

Data is currently available on 80 different blockchains in 425 applications, and has been used by 65% on-chain derivatives markets, according to Cahill. He said close to $1 trillion of volume in derivatives have been executed at the Pyth price over the network’s lifetime.

Market data pricing

In traditional finance, market participants have raised concerns about the cost of market data. Trade bodies including The Association for Financial Markets in Europe (AFME) and EFAMA, the European Fund and Asset Management Association, issued a joint statement on significant issues with the supervision of market data costs in October this year.

They told regulators that proposed new regulation does not ensure that the pricing of market data must be based on the actual cost of production and dissemination with a reasonable margin, bearing in mind that market data is a by-product of the trading activity.

“The present proposal will, if not changed significantly in line with the associations proposals, imply that the trend of considerably increasing costs of market data and complexity of terms & conditions will continue to exist to the detriment of the key-stakeholders in the capital markets meaning investors and pension savers will face less investment choices, less transparency, higher costs, lower savings, and companies may face reduced access to capital and higher cost of capital,” they said.