Christiana Riley, chief executive of Deutsche Bank in the Americas, said she expects the US investment bank to have a return on tangible equity of 11% in 2022, a turnaround from 2018 when it could not provide an adequate return to shareholders.

Riley gave a presentation at Deutsche Bank’s strategy day this week. She said that since the global financial crisis there have been many questions around Deutsche Bank in the Americas: “What is the Americas business and its competitive platform, how accretive is it to the group’s results, and what level of risk is being taken for that return?”

She was chief financial officer of the global investment bank in 2018 and said it was abundantly clear that the US investment bank could not provide an adequate return to shareholders at that time.

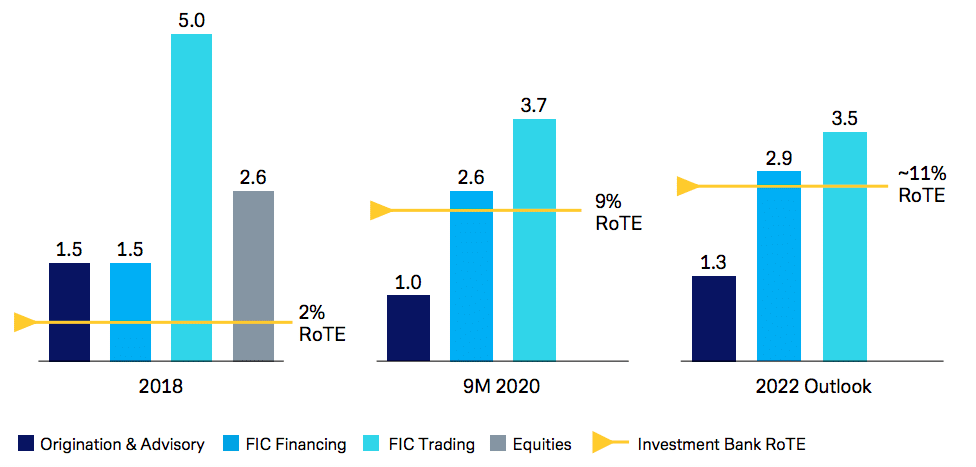

“The investment bank’s regional return on tangible equity was only 2%,

due to the significant drag of the underperforming leverage-intensive equities platform,” Riley added.

However, Riley said the ability to provide access to the US market is essential to the bank’s global offering. The importance can be seen in the fact that more than 70% of corporate revenue in the region comes from outside the US, two thirds from clients in European and one third from clients in Asia.

Riley continued that adjusted costs and the workforce have been cut by

more than one third since 2007 and by 13% since the second quarter of last year, with the majority of the reductions coming from the front office.

“We have exited unprofitable businesses, reduced our client perimeter to be focused on client relationships rather than league tables, and no longer take outsized risk,” said Riley. “This has resulted in exactly what we intended – increased stability and predictability of returns.”

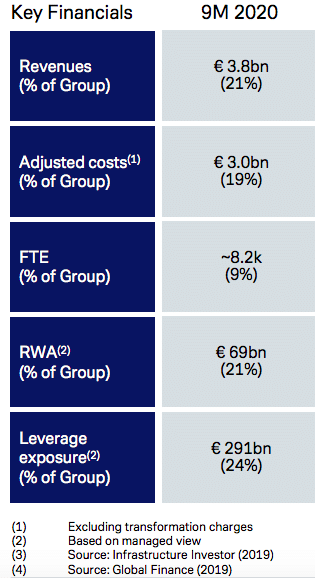

The region’s revenues for the first nine months of this year are €3.8bn ($4.6bn), or 21% of the group. Costs are a lower 19% of the group while the region uses 21% the group’s risk weighted assets.

The investment bank makes up the majority, about 60% of regional revenue, with the remainder coming from the corporate bank, private bank and asset management.

Riley said: “The evolution in the investment banking platform over the past 18 months has been remarkable. “

The US investment bank has had four consecutive quarters of revenue growth since the end of 2019 according to the presentation.

“The strengthening of origination & advisory is evident in our outperformance of the global fee pool in each of the last three quarters, to which the Americas business was a key contributor,” she added.

In fixed income financing Riley said Deutsche has particular regional strengths in commercial real estate, asset-backed and leveraged finance. In FIC trading the business in the region is focussed on foreign exchange, rates, credit trading and emerging markets.

She highlighted the inaugural investment grade bond issuance from T- Mobile to finance its merger with rival telecoms company Sprint in April this year during the lockdown, which was the thirteenth largest bond offering on record.

“We coordinated all aspects of the transaction, attracting an order book peaking at over $75bn,” she added. “The strength and quality of the order book allowed our client to upsize the transaction from $10bn to $19bn.”

Deutsche Bank also acted as strategic M&A advisor to T-Mobile on the merger.

Riley said the investment bank in the Americas is exceeding the group return on tangible equity target two years ahead of schedule.

“We expect the 2022 return to increase to approximately 11%, with the improvement coming from lower infrastructure costs and increased client activity,” she added.

Growth opportunities

One of the growth opportunities is increased demand for sustainable finance.

“Leveraging our European Union experience, I expect this to be particularly strong in the US given how the next US administration is expected to focus upon this,” Riley added.

The bank also expects revenue growth from controlled expansion in credit to new clients in focused sectors such as health care, industrials, consumer and telecoms, media and technology.

“With the growing confidence in the market that sales and trading has stabilized, and with improvements in our credit outlook, we are seeing the normalization of our wallet share with core client relationships,” Riley added.

As well as increasing revenues Deutsche aims to reduce costs, improve controls and invest in greater automation.

Riley said: “My team is working on securing an additional half a billion of savings through automation which will significantly improve the region’s utilization of resources.”