By Adrian Griffiths, Head of Market Structure, MEMX

24-hour trading has become a hot topic in the U.S. equities market. To date, the U.S. Securities and Exchange Commission (“SEC”) has approved two applications for exchanges to trade during overnight hours, one from the 24X National Exchange LLC (“24X”)[1] and the other from NYSE Arca, Inc (“Arca”).[2] However, both of those approvals are contingent on the Securities Information Processors (“SIPs”) being available during those hours to disseminate real-time, consolidated quote and trade information. While much of the discussion surrounding the SIPs has focused on the hours that the SIPs will be open for business, there are important market microstructure questions to answer as well. One that has not gotten enough attention involves the processing of corporate actions.

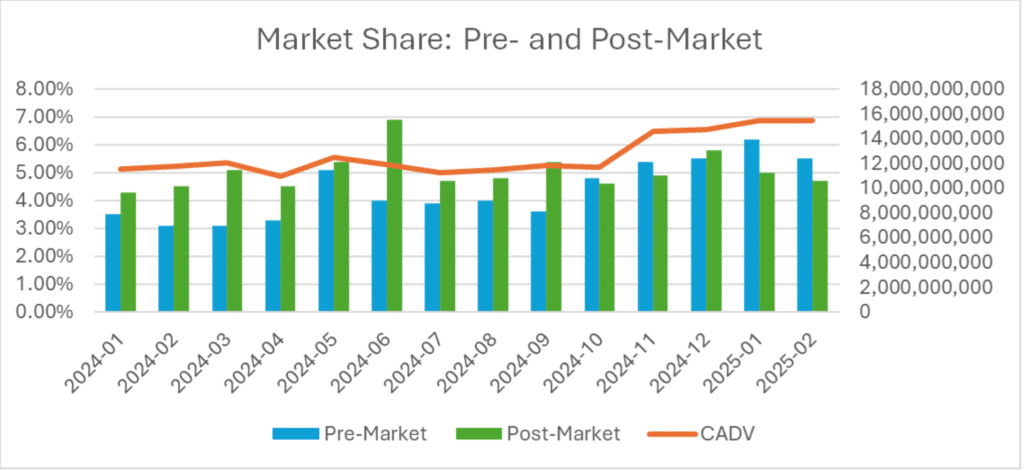

Hundreds of corporate actions have already been processed in just the first two months of 2025. On any given day, listing exchanges update the stocks that market participants can trade based on corporate actions, including initial public offerings (“IPOs”), stocks splits, reverse splits, and delistings. While often overlooked, the way corporate actions are processed today creates significant operational risk. And, unless we take necessary precautions now, extending trading hours will exacerbate those risks.

Decades into electronification of the stock market, corporate actions are still processed in a manner that more closely resembles the manual markets of the past than the highly automated and efficient markets that have evolved in their place. As an industry, we trade billions of shares a day at speeds measured in microseconds and nanoseconds. In January, the CTA and UTP SIPs handled peak traffic of about 2.5 billion messages per day across Tapes A, B and C.[3] However, in contrast to the generally robust mechanics of electronic trading, each trading day starts with a decidedly manual process. That process involves cobbling together out-of-band files, in differing formats, from each of the listing exchanges, and then attempting to validate the result against other non-authoritative sources such as third-party market data providers. This listing market information is often not made available in a timely manner and unexpected delivery issues, or subsequent corrections or modifications to previously posted information, frequently cause problems.

While symbology issues are typically resolved in the early morning during maintenance periods – and as such prior to the start of pre-market trading – shrinking this maintenance period in support of 24-hour trading significantly increases the risk of operational issues making their way into a production trading environment. And exchanges are not the only ones impacted by these issues. Two years ago, a major retail broker dealer reported a $57 million loss associated with an issue processing corporate action information. Reporting around that incident indicates that this single error, which was promptly resolved, caused the broker, a publicly traded company, to miss, instead of beating its earnings estimate. While we do not know the specific technical cause of that issue, it’s clear that market participants also have similar troubles handing corporate action information in the manner that it is currently provided. These kinds of issues will be ever more prevalent if we do not address this problem when moving to a 24-hour trading cycle.

Given the industry-wide operational risks associated with processing corporate action information within a shrinking maintenance period, MEMX recently submitted change requests to the SIPs that would require them to disseminate a “single source of truth” for U.S. equities symbol information at the start of each trading day.[4] If approved by the SIP operating committees, the SIPs would be required to disseminate symbol directory messages that include all necessary reference data to exchanges and other market participants in a consistent and reliable format. The data to be provided in these symbol directory messages includes information about any corporate actions as well as other regulatory information, such as trading halt or Regulation SHO status. The requests also ask the SIPs to implement new halt reason codes for stock splits, reverse splits, and symbol changes. This would allow the market to be halted, if necessary, when a corporate action is effectuated, with new symbol directory information disseminated by the SIPs once the halt has been lifted.

Ultimately, our requested changes are necessary to support any extension of SIP hours and should be prioritized to ensure that this project can be implemented safely. Failure to modernize these antiquated processes would introduce fragility into the nascent market for overnight trading. As an industry, we must strive to be the best that we can be. That’s particularly true when making major market structure changes. While market microstructure like corporate action processing may not make headlines, getting the details right is as important as the bigger picture. Our hope is that our change requests, and the conversations they generate, will put us all on a path to address these issues.

Appendix – MEMX SIP Change Request

Information to include in Symbol Directory Messages:

(Note: Some of this information is available today on the UTP SIP. However, information should be made available consistently on both CTA and UTP SIPs as described below.)

- Today’s Symbol

- Prior Day’s Symbol (if renamed)

- Initial Reg. SHO State

- Initial Trading State (new – explicitly is it trading or halted, i.e., do not simply assume that a symbol is trading today if no halt message has been received)

- Halt Reason (if Initial Trading State = halted)

- Prior Day’s Consolidated Closing Price (adjusted for corporate actions)

- Prior Day’s Market Center Official Closing Price from Listing Market (adjusted for corporate actions)

- Listing Market

- Round Lot Size

- Is this symbol an ETP

- Is this symbol an IPO

- [Optional] Tick Size Above One Dollar (initially send same value for everything, if tick size changes are implemented, different value per symbol)

Add new Halt Reason(s) to Trading Status updates and Directories for Corporate Action(s) that could impact the pricing or reporting of a symbol:

- Split (halt for the split, send a directory update to update the prior closing price, unhalt)

- Reverse Split (halt for the split, send a directory update to update the prior closing price, unhalt)

- Rename (halt the old symbol for a rename, then send a directory message with the new one, then resume the new one)

[1] MEMX Technologies LLC has been selected to provide 24X’s trading platform and also currently provides technology used by the Blue Ocean ATS (“BOATS”), an alternative trading system that executes trades during the overnight session.

[2] Cboe EDGX Exchange, Inc. (“EDGX”) also recently announced plans to launch 24×5 U.S. equities trading.

[3] See Q1 2025 Monthly Processor Metrics.

[4] A list of specific changes covered by our change requests are included in the Appendix.