By Paul Daley, Managing Director, BondWave

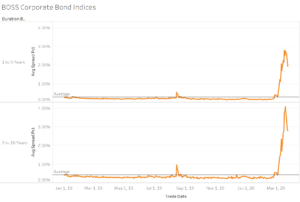

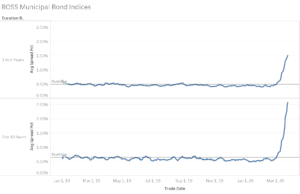

With concern about the impact to economic activity of the COVID-19 virus being blamed for the recent steep selloff in equities, we are also seeing an impact on the cost of trading liquid, investment grade corporate bonds. The BondWave Benchmark Data and Trading Indices includes two corporate bond bid-offer spread indices. The BondWave Bid-Offer Spread Service (BOSS) measures the width of the bid-offer spread in the dealer-to-dealer market for A and BBB rated corporate bonds as well as the bid-offer spread in the dealer-to-dealer market for AA and A municipal bonds.

Corporate Bond Liquidity Cost Pulls Back From Highs

Corporate bond bid-offer spreads saw their first significant tightening since the beginning of the pandemic. With work progressing on the economic stimulus package (which was ultimately passed overnight) the corporate bond market began to respond with improved trading conditions, though bid-offer spread levels remain high. The BOSS 1 to 5 Year Corporate Index fell to 1.93% on 3/25/2020 after hitting a high of 2.76% on 3/20/2020, while the BOSS 5 to 10 Year Corporate Index fell to 2.79% after recording its high of 4.07% also on 3/20/2020. Corporate bond bid-offer spreads continue to outpace municipal bond bid-offer spreads.

It is important to note there is measurement bias at work in the data too. The BOSS Index is created from reported trades. A bond that fails to trade would not be reflected in this data. So, it is possible that the index can understate the “true” spread faced by a trader. It is also possible to overstate the true spread on the corporate index if bonds that are more effected by events trade more often (airlines, energy, etc.).

Source: BondWave BDTI

Municipal Bond Bid-Offer Spreads Do Not Respond to Rally

Municipal bond bid-offer spreads continue to move higher in spite of a record rally in municipal bond prices that saw the BondWave AA Muni QCurve drop by double digits across the entire curve (and more than 50 basis points at many spots on the curve). The BOSS 1 to 5 Year Muni Index rose to 1.51% on Wednesday. Meanwhile, the BOSS 5 to 10 Year Muni Index rose to 2.58%.

Source: BondWave BDTI