Currency markets worldwide currently settle two days after a trade but Gary Gensler, chair of the US Securities and Exchange Commission, said it is appropriate for regulators and market participants around the globe to start to consider the possibility of shortening this cycle.

Gensler spoke via video to the conference on Accelerated Settlement in the UK in London on 20 June.

On 28 May 2024 the US, Canada, Mexico, Argentina, and Jamaica shortened their settlement cycle for equities, corporate bonds, and municipal securities to one day after the transaction date (T+1) from T+2. Gensler said the move happened “smoothly.” He highlighted that fail rates did not spike following the transition to T+1, but stayed relatively flat.

“For instance, on the first day of T+1 settlement the fail rates went down modestly from May’s average,” he added.

In the US the move unified the US market structure, as Treasuries, options, and mutual funds already largely settled in one day. also joined the US in the move in May.

“If Europe and the U.K. were to join the major markets of North America and Asia in moving to T+1, we should start to engage now in conversations, along with central banks, about the possibility of shortening the currency trading settlement cycle,” Gensler added.

Before the T+1 transition, there were concerns that asset managers outside the US, particularly in Asia Pacific, would find it difficult to meet the shorter settlement cycle for buying and selling US stocks and executing the necessary foreign exchange trade was their biggest concern.

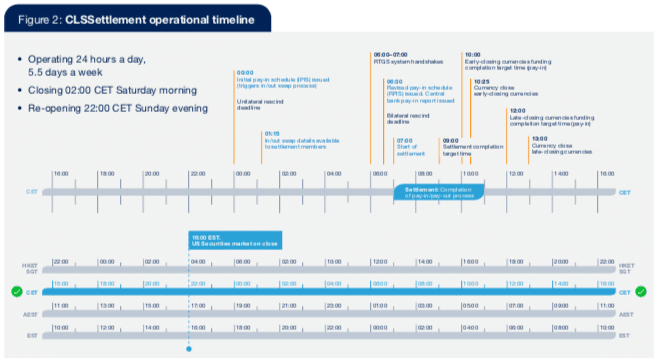

Concerns were expressed about the cut-off times for using CLS [Continuous Linked Settlement], the FX settlement infrastructure that was set up to reduce settlement and counterparty risk, which currently has 18 eligible currencies. CLSSettlement offers FX settlement risk mitigation through payment-versus-payment settlement and liquidity optimization through multilateral netting.

An EFAMA survey of European fund managers in March this year estimated that 40% of daily FX flows will no longer be able to settle through the CLS platform, which could be between $50bn and $70bn, but could rise to hundreds of billions of dollars in volatile markets.

EFAMA said in a statement: “We urge central banks and regulators to take a more proactive role in requiring mitigating measures such as an extension of the CLS cut-off time, and improved cut-offs and alignment among the custodial community.”

Gensler said the SEC had very good discussions with CLS, which is made up of around 70 or 80 member banks. The CLS cut-off time is midnight in central Europe or 6pm EST, and the next six hours are used to net trades and reduce the net notional volume that needs to be transacted. At midnight EST, there is a settlement process between central banks around the globe which takes about 90 minutes. CLS polled its members about extending the cut off times to allow asset managers to submit FX trades, but they said they would have to change their infrastructure.

“Remember the financial markets are only one part of why currency moves, and the bigger part is trade flows,” added Gensler. “With all respect, I would not condition going to T+1 on a change in CLS.”

CLS said in a white paper on 28 May 2024 that in a T+1 world, CLSSettlement may not be usable for a small fraction of securities-related cross-border currency trades.

For example, in the US the equity market closes at 16:00 EST. In order to align to the T+1 securities schedule, FX instructions should be submitted to CLS by the beginning of the day of settlement – 00:00 CET on day T+1 to enable securities settlement on day T+1, especially as custodians may have earlier deadlines in order to meet the CLS schedule.

“In extremis, there is a reduced window of only two hours to arrange the submission to CLS,” said the paper. “Time constraints may prevent market participants from using CLSSettlement for these trades, which could in turn lead to increased FX settlement risk (if they settle without PvP) and higher liquidity needs (due to less multilateral netting).”

Through analyzing its own transaction data, CLS found that approximately 1% of CLSSettlement’s average daily volume, $6.6 trillion, is executed on a T+1 basis.

“Therefore, the value that may need to move to T+0 is likely to be approximately 1% of CLSSettlement’s ADV, assuming no changes to participants’ trading and operational processes,” said the report.

CLS estimated that only around half of the $6.6 trillion could eventually be impacted by the move to T+1 and need to be settled outside CLSSettlement on either a gross or net bilateral basis.

A CLS survey assessed the feasibility of extending the 00:00 CET deadline. The survey found that over 40% of settlement members, representing approximately 50% of CLSSettlement’s average daily volume, may need to undertake system development to accommodate this change and would need considerable implementation time.

In addition, any material changes affecting the risk posed by CLS could require regulatory engagement and a comprehensive risk assessment supported by detailed modelling and analysis.

The paper said: “CLS will continue to monitor the T+1 transition’s impact and will address any emerging issues in collaboration with its settlement members and the wider FX market. As the industry moves forward, prioritizing execution and operational efficiency across the asset manager and fund community will remain a focal point, and CLS offers several additional products to support market participants.”

Takeaways from US migration.

For institutional investors, cutting the clearance and settlement cycle in half reduces the amount of margin that must be placed with the clearinghouse.

“The way the math works, it is likely to average 29% savings over time,” said Gensler. “First indications reported by the clearinghouse show a savings of 25%, or more than $3bn, resulting from the move to T+1.”

Gensler continued that some key takeaways from the US experience include that the transition is a team sport and a global sport, as the SEC staff engaged with market participants and regulatory counterparts around the world.

Another takeaway was the importance of mandating that allocations, confirmations, and affirmations are completed as soon as technologically practicable, but at least on T+0. When the SEC proposed this rule in February 2022, 68% of transactions were being affirmed on trade date. This increased to 73% by January 2024, and by May 29 had increased to approximately 95% at 9 p.m. ET, which is the Depository Trust & Clearing Corporation’s new deadline.

Gensler said this mandate requiring broker-dealers to have policies and procedures on same day affirmations and confirmations as soon as technologically practicable was key, as was the rule requiring clearinghouses to facilitate straight through processing (STP).

“The plumbing from the home market into the clearing house to facilitate STP was really critical,” he added.

Timing

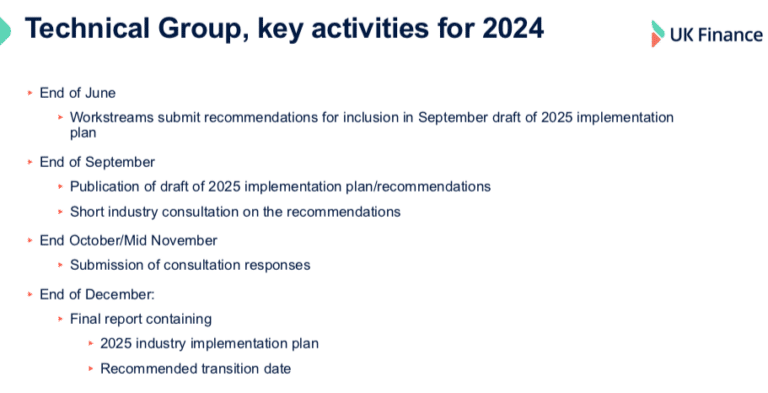

Gensler also highlighted the importance of setting a date for the transition, which does not change, as well as a well-thought-out timeline and schedule. In the US the process from proposing the rule in February 2022 to implementation was 27 months, and 15 months from final rule adoption to implementation. He said there is a public good in regulators setting a mandate as it allows market participants to coalesce and organise.

“If one looks at the 27 months it took the U.S. from proposal to implementation, your implementation might be June 2026,” Gensler added. “That’s 27 months from when you finalized your March 2024 Accelerated Settlement Taskforce Report.”

In December 2022, the UK government appointed Charlie Geffen to chair the Accelerated Settlement Taskforce to explore the potential for faster settlement of securities trades in the UK.

In March this year taskforce published its report which recommended moving to T+1 settlement for all securities trading on UK trading venues. The UK government accepted all the recommendations and endorsed the timeline of “no later than the end of 2027”.

James Pike, interim chief executive at Taskize and former EMEA client operations chief at Morgan Stanley, said in an email that Gensler’s call for the UK to set a firm T+1 deadline is well-intentioned. However, any date needs to allow ample time for market participants to adequately prepare as equities typically settle on the exchange in Europe which has the most liquidity.

“Unlike the relative uniformity of the U.S. market, Europe comprises multiple exchanges and clearing houses, each with its own set of regulations and practices,” added Pike. This cross-border trading further complicates the settlement process.”