By Kelvin To, Founder and President of Data Boiler Technologies

The 2022 digital asset crash wiped out more value than the $1.7 trillion during the burst of dot-com bubble in 2000. The aftermath of the historic $3+ billion cryptocurrency seizure that connected with Silk Road Dark Web Fraud, the bankruptcy of FTX, and the countless cases of Crypto and Stable-coins’ downfall are starting to be unveiled. Investigations or “accusations” to grill mania involved in the chaos is the hindsight of politicians, regulators, and many others, but not us. We play the devil’s advocate to critically think about the paradox of Digital Assets, to see whether its future may evolve like the Quantum Cat – i.e. simultaneously both alive and dead.

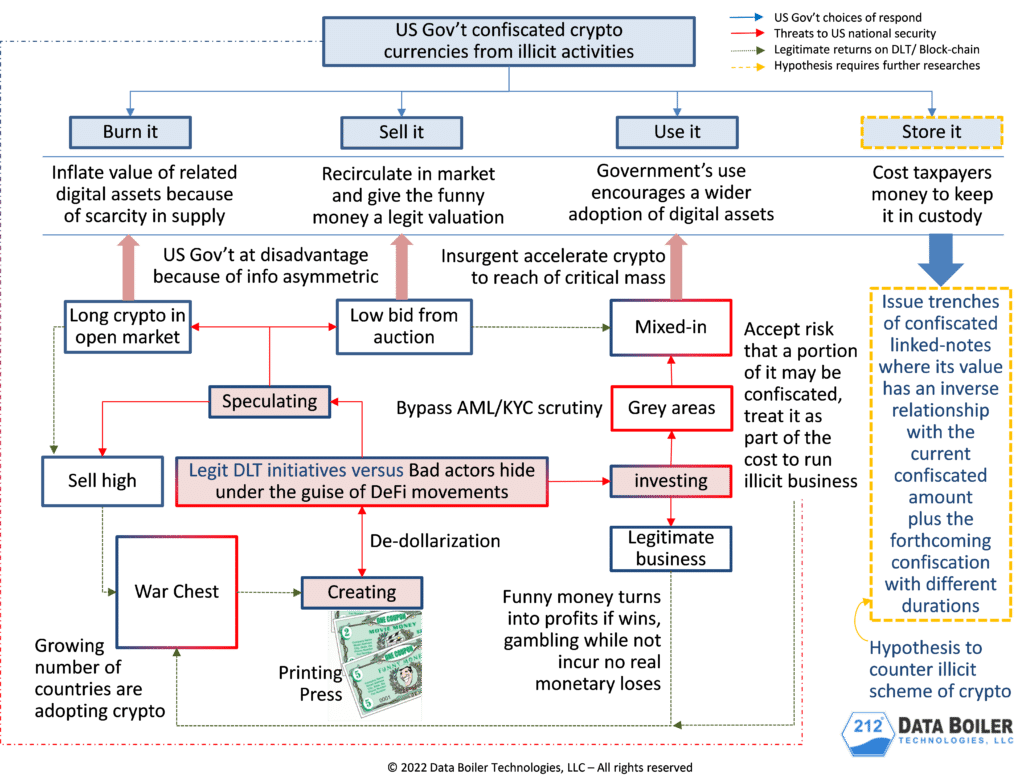

This study by IE University in Spain have pointed out that “existing cryptocurrencies have failed to achieve the objectives envisioned by their pioneers and would generally not be considered as money” and “modern discussions and debates about cryptocurrencies tend to confuse ‘money’ with ‘systems of payments’ or, the mechanism by which transactions are processed and settled.” The IE authors seem to indicate “trust” being a crucial factor for digital assets, while those who view cryptocurrencies negatively may compare such “trust” aspects to alleged Ponzi scheme. So, as an example, we used the US Government confiscated cryptocurrencies from illicit activities to showcase the “trust” issues regulators are facing:

As illustrated above, there is no good way in dealing with confiscated digital assets or crypto meltdown. Burn it, sell it, or use it, all lead to undesirable outcomes. The entire flow mixes-in legitimate DLT (distributed ledger technology) initiatives with potential bad actors / foreign adversaries that hide under the guise of DeFi / De-dollarization movements.

Funny money gets legitimized in growing the War Chest and create insurgent or disadvantages for any Government to curb illicit activities. While we feel thankful that the Financial Stability Board (FSB), the Bank of England (BOE), and others have compiled several comprehensive assessments of risks to financial stability from digital assets, we think there are gaps to truly gauging the risks of digital assets. For example, the “reuse” backdoor and keylogging issues as mentioned in our 2017 press interview seem to be not getting scrutinized. The crypto sector seems unprepared for the arrival of Quantum computing. The “51 percent attack” could be cracked open within seconds by Quantum computing, making most if not all of today’s DLT-Blockchain and other cryptography security vulnerable. Questionable hard fork, insufficient attention on various pre- and post-trade transparency issues, reliability of digital assets’ market data, the maturity and liquidity mismatches underpin stable-coins’ structure for potential redemption run, … the list can go on and on. Yet, none of these get as high a priority as debating among regulatory agencies on who should have oversight over the crypto markets. How sad! For the cited risks (e.g., capital requirements, counterparty due diligence, financial resources for managing participant defaults, use appropriate stress scenarios for sizing financial resources) by CME concerning the FTX’s settlement and custody proposal, it seems addressable while it never gets a chance to be enforced or implemented. Prior to the collapse of FTX, it claimed to be working with NASDAQ’s RTFY retail order router to source order book liquidity at the best possible prices without relying on PFOF. We wonder why no one questioned that. Especially that its former President leaves FTX soon after. It is usually a red flag when senior executives abruptly part ways with their company. The bigger questions that puzzles us are: had funds be deliberately transferred somewhere else before the announced bankruptcy; who are the front-facing ‘puppets’ and real forces behind FTX that gave them the War Chest; what is their next move if they are to use the residual digital assets to resurrect in another domain(s)?

How was the Bahamas government able to tap into the substantial assets that were left behind by FTX/ Alameda Research before their more powerful counterparts in the US even started to identify and confiscate any money? There lacks orchestrated actions to address borderless issues of digital assets amid Global regulators and prominent industry leaders around jurisdiction issues. Is it due to the competitive dynamic globally or other conspiracies that this irrational exuberance in digital assets may be an intentional act to funnel billions if not trillions into the hands of some elites who have significant stakes in legitimate digital asset infrastructure? Conspicuously, whoever is facilitating the alleged movement of billions into profit opportunity for the elites to legitimize these funny monies must be powerful enough to guarantee such transaction as well as be well-connected. We refrain from guessing possible foreign adversaries or geopolitical figures. Our point of concern is indeed about the irony of TradFi or CeFi elites dominant of DLT-Blockchain that is supposed to be a revolutionary way to disrupt or ‘disintermediate’ the centralized bureaus. These elite legacy players are pouring billions into building related infrastructure. Digital asset infrastructure presents an even larger investment opportunity than digital assets themselves. We attribute this phenomenon to these encumbrances’ preference for “rent seeking” over subjecting themselves to the regulatory uncertainty and market volatility of digital assets. Hence, there is the issue about ‘skin in the game’. It solidifies the dominant powers of the elites, discourages DeFi to have healthy competition against the legacy TradFi or CeFi, and exacerbates the gap between the ‘haves’ and ‘have-nots’. Without DeFi keeping CeFi intact, bureaucracy and barriers would be built and accumulated. This combined with the mentality of policy makers to use existing regulatory frameworks to guard against digital assets risks is counter-productive.

Many do not seem to realize the emerging threats against capitalism or dare to admit it. DeFi and De-dollarization movements are on the rise and reap benefits out of chaos. Foreign adversaries would like to see the US engage in

“unhealthy” competition to erode the US’s prominent market position. So, despite the Quantum Cat of Digital Assets appearing to be resurrected in a more tightly regulated form, its purpose may no longer serve the best interest of society. In our opinion, there are a few things regulators should do in view of this dilemma:

1. Warn the public to “Bear your own risks” and do not look to the Government for a bailout.

2. Curb chaotic / manipulative activities of users, consumers, and/or investors by the ‘nature’ of transactions.

3. Be vigilant in knowing who are consumers, investors, and businesses that the Government should step in to protect and develop capabilities to discern and deal with insurgent/ foreign adversaries in the Cyberpunk era.

Last but not least, the stage of digital assets development is like the warring states period before Qin dynasty unified currencies with Ban Liang. For the mass adoption of digital assets to be beneficial to the “equitable economic growth”, we must figure out a way to use digital assets to better delineate rights and obligations around the World to eliminate injustice. Please see our comment letter to the US Treasury for additional thoughts.