By David Lichtblau, CEO, Sentieo

Remember when Artificial Intelligence seemed like something only fit for dramatic storylines in blockbuster movies? Machines that could independently think, anticipate, and act sounded more like science fiction than computer science just 15 short years ago. Today however this type of technology – AI and machine learning – is rather widely applicable in the real world. AI has become a part of the mainstream in so many industries, from self-driving cars to AI-driven travel chatbots, and it’s time for the investment world to hop on board.

We have what AI needs to succeed: Data

Investment firms, hedge funds and asset managers depend on research and analysis that is complete, accurate, and timely. That becomes a tall task given the vast amount of unstructured data available today – so many KPIs and vital pieces of information are simply not housed in a structured database or spreadsheet. The SEC alone generates 3,000 terabytes of information every year between 10-Ks, 10-Qs, 8-Ks, prospectuses, and other such documents.

The data problem is exacerbated by the mishmash of tools that analysts and researchers rely on to source, organize, and analyze data. From legacy terminals to Excel documents, emails to Evernote, each analyst and each firm has their own process and their own unique way to uncover and synthesize data, transform it into relevant information, and turn that into actionable investor insight. But are those strategies really working?

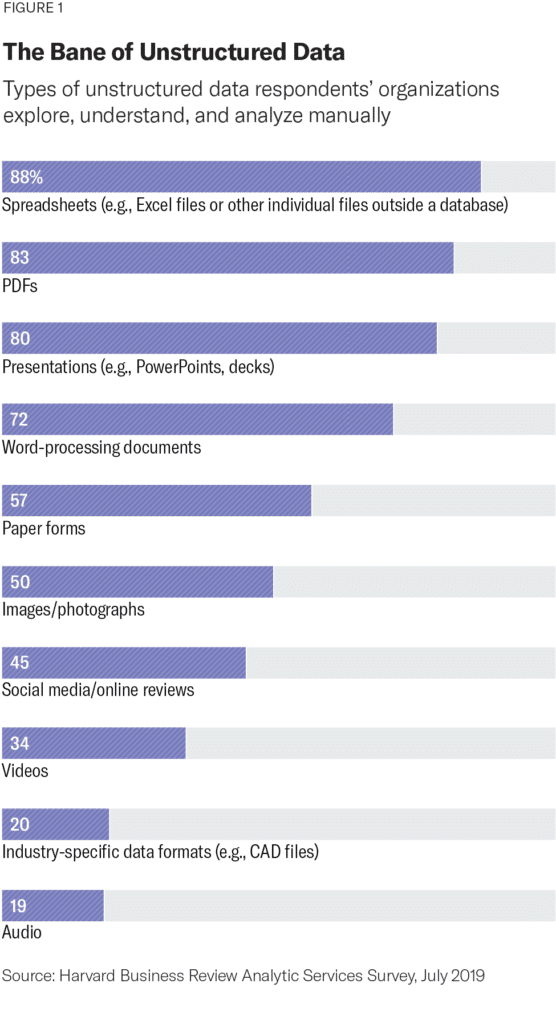

A survey by Harvard Business Review Analytic Services found that more than 80% of respondents cited the process to gather, understand, and use unstructured information is a significant challenge within their organization, and it’s no wonder why – 72% of them noted they sort and manage unstructured data manually. Information gaps abound preventing individual analysts and teams from working as efficiently as possible, and their research from consistently delivering alpha.

Innovations such as AI, machine learning, and cloud-based collaboration can help transform the research workflow and uncover insights no one else has …but the investment community has been slow to adopt. A 2019 CFA Institute study showed that just 10% of portfolio managers had used AI and machine learning within the previous year to help their investment process, and just 8% used them to identify key factors driving markets. But now the business and operational challenges driven by the global pandemic have triggered a massive inflection point in this technology adoption curve among institutional investors.

A pandemic silver lining: Tech adoption

The pandemic changed the industry’s mindset about digital transformation virtually overnight. It wasn’t just about enabling teams to work from home (although that was important during the early days of the pandemic), but coming to recognize that AI-driven research and cloud-based collaboration technology could streamline the research process and deliver better investment insights… and do so faster than the competition.

Hodges Capital is one such firm that went through a transformation during the pandemic. An investment advisory firm based in Dallas since the late 80’s, they have built their business on the back of a proprietary research model. However, the pandemic turned their research process upside down; they simply could not go back to the way they had been working. Suddenly, AI and collaboration technology was no longer a nice to have, but the lynchpin for how they needed to operate and grow.

By relying on AI-enabled document search and sentiment analysis software the team was able to generate better, faster investment details – which included getting a better handle on the reems of unstructured data available. To synthesize the data, Hodges relied on cloud-based systems that gave analysts a unified hub to do their work, share their knowledge, and cross-pollinate ideas. As a result, their analysts improved efficiencies by 25 percent. Immediately, the investment analysis process became significantly more powerful, more of a competitive differentiator, and more likely to get to the ultimate goal – achieving alpha.

According to IDC Program Vice President of AI, Ritu Jyoti, “Companies will adopt AI — not just because they can, but because they must. The companies that become ‘AI powered’ will have the ability to synthesize information (using AI to convert data into information and then into knowledge), the capacity to learn (using AI to understand relationships between knowledge and apply the learning to business problems), and the capability to deliver insights at scale (using AI to support decisions and automation).”

There is no longer a need to debate “if” AI-driven technology can help the investment community; the conversation is about just how much it can impact the output and returns for analysts and fund leaders alike. AI, machine learning, and other cloud-based innovations can deliver the digital transformation everyone has been talking about. These advancements are already reshaping the fundamental research workflow and have done so at scale, helping firms improve their ability to deliver alpha for clients. Adoption of these technologies can position institutional investors for growth – no matter what plot twist happens next.

For the last 20 years David Lichtblau has served as a fintech leader for organizations like StarMine, Thomson Reuters, and ETF.com. Today he leads the team at Sentieo and spearheads the company’s mission to drive the digital transformation of financial research.