By John Ramsay, Chief Market Policy Officer, IEX Group

April 12, 2021

Those who follow equity markets closely know that D-Limit is an order type introduced by IEX in October of last year that is designed to help incentivize displayed quotes by protecting users of the order type from latency arbitrage. It does so by automatically adjusting the order’s price in very small time increments (adding up to several seconds during the trading day). We use a disclosed formula that detects when national best bid or offer prices are changing and displayed quotes are at high risk of being executed at “stale” prices. Latency arbitrageurs seek to selectively trade against displayed quotes in these same fleeting moments. During the more than 99% of the trading day when prices are not in transition, the order type functions like any other limit order. D-Limit has won widespread support and was approved unanimously by the SEC after an extensive approval process. We have published various analyses showing the strongly positive results from the use of D-Limit.

In a recent, widely-promoted publication, Nasdaq Chief Economist Phil Mackintosh launched a broadside attack on IEX and D-Limit. The piece variously asserts that D-Limit has resulted in “inaccessible” quotes on IEX, higher charges to participants seeking to access quotes, and hidden payments to market makers.

The publication is rife with misrepresentations and obvious faulty premises and has already been altered to cover one of the more glaring errors. Ordinarily, we would not see the need to respond to an attack with so many obvious flaws, but given how aggressively it has been promoted and the importance of the topic, we feel compelled to respond. The following is not a comprehensive critique, but it gives our thoughts on the main allegations.

Point 1. Fill Rates

Nasdaq asserts that IEX data shows D-Limit “average fulfillment” of just 25%, drawing a contrast to markets “without a speed bump”, which the author says “should be close to 100% fulfillment.” He then attempts to use this comparison to assert that D-Limit orders lead to “quote fading.”

The comparison is not just wrong, it’s bewildering. IEX published data indicating that D-Limit orders posted to the exchange received an execution for 25% of the shares specified in the orders, on average. Nasdaq then seeks to compare that metric with the experience of a liquidity taker seeking to access displayed quotes.

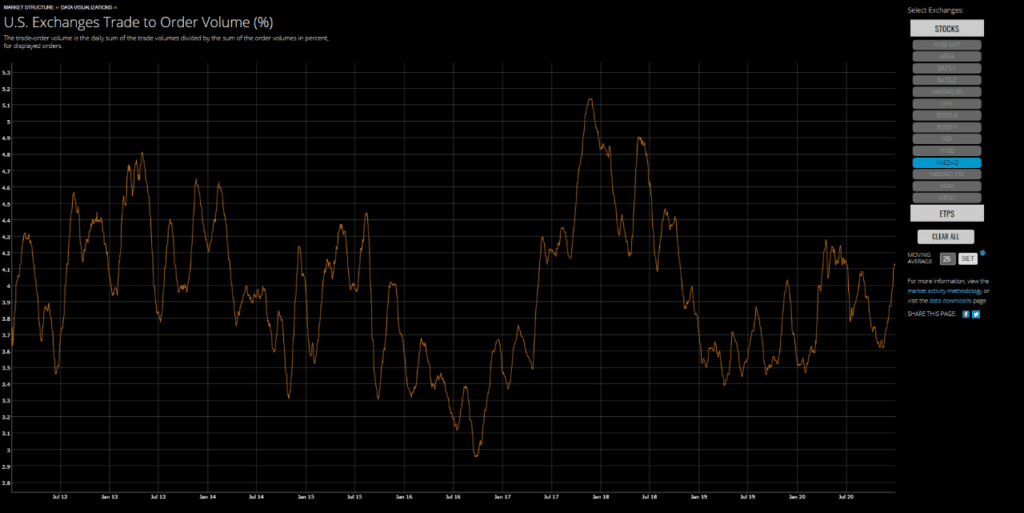

The one thing has nothing to do with the other. A better comparison would have been to the percentage of Nasdaq shares posted to its order book that are executed. Nasdaq did not provide that number. One proxy for that is data published on the SEC’s MIDAS system showing for each exchange the ratio of trade-to-order volume — the volume of displayed shares traded compared to displayed order volumes. For Nasdaq, that ratio is below 5% for stocks (it is much lower than that for exchange traded products, or ETPs). These metrics suggest that Nasdaq’s “fulfillment rate” may well be much lower than that for D-Limit. They show for certain that the comparison Nasdaq sought to make is completely meritless.

What is clear is that D-Limit has reduced the success of latency arbitrage strategies on IEX — that is, after all, the point — but it has not reduced access to liquidity.

We should note that the reference to the 25% fill rate in the Nasdaq blog was removed after it was first widely circulated, but Nasdaq has not provided a corrective statement.

Point 2. Comparisons to Rebate Payments

Nasdaq asserts that the savings D-Limit users receive, in the form of protection from “pick offs,” are equivalent to a “virtual rebate” to market makers on IEX.

Protecting resting orders from latency arbitrage losses does not equate to a “virtual rebate.” It equates to better performance for users of D-Limit. Rebates are paid to broker-dealers, and are generally not passed to the ultimate beneficiary of the order. The benefit from the use of D-Limit, which is available to all IEX Members and their customers, accrues directly to the end user in the form of better prices.

Point 3. Amounts Paid by “Takers” on IEX

The next argument is that parties taking liquidity on IEX end up with higher costs on the assumption that when D-Limit orders are “slid” one tick away from the original price, participants will incur an additional charge, which is tagged as $57 million per year.

It is hard to know what to do with this one because there is no indication of what data sources, or what type of analysis, was relied upon. Who is alleged to incur this cost and how was it derived? Is this an estimate of a loss from the inability to use latency arbitrage? Or is it something else? One is left simply to speculate, but the speculation seems hardly worth the effort.

Point 4. The Use of SIP Data to Show…Something?

The remaining allegations in this sad parade lean on published data from the securities information processors, or SIPs. It is accurately noted that, as IEX’s volume of displayed quotes has increased, the portion of SIP revenue IEX receives related to its quotes, relative to revenue based on executed trades, has increased. But Mr. Mackintosh then makes a bizarrely acrobatic leap (don’t look down!) to suggest, again, that IEX’s quotes, post D-Limit, are now subject to substantial “fading.”

As shown above, D-Limit quotes are as accessible as others in the market. It is hard to see how SIP revenue is relevant to anything in this respect. The formula the SIPs use allocates revenue to exchanges based on how much of the time an exchange is quoting “at the inside”, i.e., by security. So, exchanges receive part of the SIP revenue stream based on quotes, regardless of how often they are executed. And how often quotes are executed depends on a host of factors, including the extent to which an exchange’s quotes are preferenced in relation to those of other exchanges. According to published UTP and CTA SIP data for 2020, Nasdaq’s quote revenues were substantially greater than its trading revenues, and one of its affiliated exchanges collected more than two times more from quoting than trading. That fact is slightly interesting, but probably says nothing more about quote accessibility than Nasdaq’s convoluted insinuation.

As for the SIP system in general, IEX has fought alongside brokers and investors to change the way the SIPs are governed, to include voting representation by all stakeholders, and to limit conflicts of interest. We have also fought to expand the data carried on the SIPs and change the method of distribution to make it competitive, not controlled by NYSE and Nasdaq-affiliated monopolies. After years of effort, the SEC adopted far-reaching changes in all these areas. And Nasdaq, along with the other large exchange companies, promptly sued to block them.

Conclusion

IEX welcomes vigorous dialogue and debate on equity market issues, but to bring light and not just heat, commentary needs to be written responsibly and based on facts that matter to the conclusions that are asserted. Here is one inference we think is fair to make. If a competitor is willing to attack the D-Limit innovation this recklessly, D-Limit must be having just the kind of constructive impact on market transparency and fairness we hoped for.

How Do You Measure a Fill? Nasdaq Attacks With a Dull Knife first published on Medium.

About IEX Exchange

IEX Exchange is a U.S. stock exchange designed to provide superior execution quality and set a new standard for trading. Since launching in 2016, the exchange has grown to be one of the largest exchange operators globally, by notional value traded. To learn more about IEX Exchange and other IEX businesses visit iextrading.com or search IEX.

©2021 IEX Group, Inc. and its subsidiaries. Neither the information, nor any opinion expressed herein constitutes a solicitation or offer to buy or sell any securities or provide any investment advice or service. The information herein is believed to be reliable, but the Firm makes no representation as to the accuracy or completeness of, and undertakes no duty to update, information herein and any and all liability is expressly disclaimed relating to or resulting from use of this information.

The trademarks, service marks, and logos (collectively, the “Trademarks”) displayed on this document include registered and common law Trademarks owned by third parties. IEX’s use of any thirty-party Trademark does not imply any affiliation with or endorsement by its owner(s) nor that such third party has granted any license or right to use such Trademark without written permission from the owner(s). This document has not been prepared, approved, or licensed by any of such third-party owner(s).

This document may include only a partial description of the IEX product or functionality set forth herein. For a detailed explanation of such product or functionality, please refer to the IEX Rule Book posted on the IEX website: www.iextrading.com