IEX Group believes that its record of protecting market participants from adverse selection and maximizing best execution in equities will be an advantage when it launches an options exchange, subject to regulatory approval.

Bryan Harkins, group president of IEX, told Markets Media: “IEX spent the last decade innovating to build technology that protects market participants from adverse selection and maximizes best execution, and this will be the foundation for our entry into options.”

Founded by the buy side, IEX built the first US equities exchange to power its order types with a machine learning-based mathematical formula, the Signal, also known as the crumbling quote indicator. The Signal predicts which way the market will move in order to protect customers from trading at a price that will imminently become stale.

If IEX receives regulatory approval, it will become the nineteenth US options exchange. In August this year Miami International Holdings launched the newest options exchange, MIAX Sapphire electronic exchange, which will be followed by a physical trading floor next year.

IEX’s proposed options exchange will be an electronic venue that will provide access to the entire multi-listed options market while relying on a pro-rata model. This will be the first time that IEX’s proprietary solutions in equities for risk management and markout optimization will be available for US options trading.

“We asked ourselves why the US needs another options exchange and there are three main reasons,” Harkins added.

The first is that options are one of the fastest growing asset classes in the world and experiencing quite a bit of innovation. Harkins argued that the overall options market is growing, so IEX does not look at entry into the options space as necessarily a zero-sum game.

Second, Harkins believes that the core competencies of IEX have direct applicability to help market participants in the options industry. Third, he said that IEX has people with an innovative mindset that obsess over improving outcomes for liquidity providers, which IEX has done since inception.

Before joining IEX in May this year, Harkins’ roles included head of markets at Cboe Global Markets overseeing equities, derivatives, and foreign exchange trading; and the president of BIDS trading.

Since Harkins joined, John Palmer, the former president of Cboe Digital, has also been hired to lead IEX’s efforts to build out its offerings and technology to serve new markets. Palmer will serve as head of options and lead the new exchange. He will continue reporting to Harkins, who will oversee both IEX’s equities exchange and the new options exchange.

Ivan Brown, who was most recently head of options and business development at the New York Stock Exchange, will lead business development and product design for IEX’s new options exchange.

Ronan Ryan, co-founder and chief operating officer of IEX, said in a statement: “Bryan, John, and Ivan are proven operators who have built successful trading platforms across asset classes. We are committed to bringing together the best people in the trading industry to disrupt the status quo in options trading with a unique market architecture, highly differentiated products, and deep commitment to client relationships.”

Harkins said the project is well underway and the system is being developed. IEX has set its sights on launching the new exchange in 2025, pending regulatory approval, and expects to file its options exchange rules with the US Securities and Exchange Commission in the fall. It will require minimal effort for current members of IEX’s equities exchange onboard to this new venue.

Differentiation

IEX will need to differentiate itself in an already crowded options market.

“We have had detailed conversations with market makers and liquidity providers in the US options space, so we are not simply cloning what we are doing in equities,” Harkins added.

IEX feels its product will have applicability in helping established players better manage risk their quotes, and also for new entrants who Harkins said will find the product unique in helping them enter a market and provide quality liquidity.

Brown told Markets Media that IEX is in continuous dialogue with the industry and has been “encouraged” by the response.

“We want to make sure we bring the right intellectual approach that is consistent with the innovative path that IEX has taken over the last 10 years, but make sure that we are cognisant of the differences in market structure to maximize the effectiveness of what we bring to options,” added Brown

For example, in equities there are 10,000 to 11,000 listed instruments on any given day but in options, there are about 1.5 million strikes a day. Brown described options as a quote-driven market versus an order-driven market in equities.

Therefore, the central role of an options market maker is to provide two-sided quotes on all those instruments across multiple exchanges, which makes the adverse selection challenge even more acute. Additional priorities for the industry are determinism and certainty according to Brown.

He argued that if participants have more confidence in providing aggressive markets, this ultimately results in a better price for the end user. In addition, if market participants can price in less adverse selection into their quote, this drives better performance on the venue, and, ultimately, better results.

“IEX spent the last decade innovating to build technology that protects market participants from adverse selection and maximizes best execution, and this will be the foundation for our entry into options,” Brown added.

IEX has not yet arrived at the final pricing model, because Brown said it has been focusing on differentiation around functionality and the quality of performance and execution. He said: “Ultimately, we will land in a place where we are going to be competitive.”

Equities

In 2020 IEX Exchange also fully launched its D-Limit, discretionary limit order type. D-Limit uses the power of the IEX Signal to move an order out of the way if the price is about to become imminently stale i.e. the order avoids being “run over” when the price is unstable. Over $3.5 trillion of notional value has been traded using D-Limit since inception according to IEX.

Among US equities exchange operators IEX captures between 2.5% and 3% market share according to the firm. Last year IEX Exchange updated the signal and also expanded Version 6 into displayed trading.

Harkins said: “It is really impressive to see our growth in equities over the last few months that has been driven by the obsession over execution quality and enhancing our rebates.”

IEX said it is the third largest displayed liquidity exchange in equities in terms of available liquidity. Harkins said this has “really popped” in the last six weeks as liquidity providers have increasingly adopted IEX’s order protection tools.

“They can trade more confidently and quote more aggressively, so we are leaning into this concept and excited by our momentum,” Harkins added.

Brown continued that the launch of the options exchange is coming at an exciting time for IEX.

“Our core principles in entering the options market are helping liquidity providers and market participants, and obsessing over improving outcomes, which is a playbook that came from equities,” Brown said.

Options growth

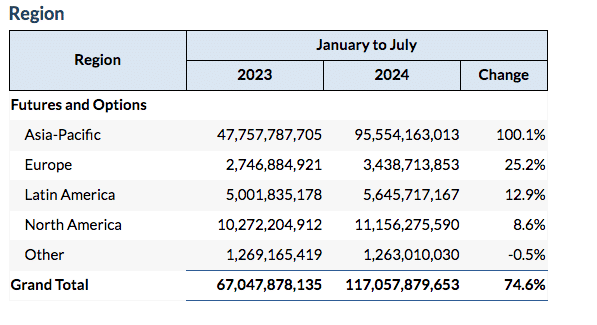

In the first seven months of this year, total exchange-traded options volume for the year was 100.16 billion contracts, up 98.4% from the previous period in 2023, according to trade body FIA.

Harkins said options growth is being driven by increased retail adoption, continued innovation in ways to trade, continued innovation in the index space, and increased electronification. A lot of wealth management platforms are also increasingly using options to create a targeted outcome without having a big appetite for volatility.

“The industry also does a very good job of investor education and the utility of options to manage risk or to sometimes express a view in a more economic way than cash equities does,” he added.

Brown continued that increased adoption means options have become much more of a household name when people think about a tradable asset class, and even exchange-traded funds are incorporating options into their fundamental strategies.

“Growth comes from a confluence of factors that helps spin the flywheel of liquidity begetting liquidity,” said Brown.