The top factor for institutional asset owners in selecting investment managers is scale, according to a survey from data provider Cerulli Associates.

Cerulli said in a report, U.S. Institutional Marketing and Sales Organizations 2024, that the attention of institutional investors is focused on asset managers’ long-term capabilities, expertise, and capacity as they look for investment opportunities in reaction to higher inflation and interest rates.

Investors that took a “watch and wait” approach in 2021 and 2022 are starting to make material changes to asset allocation and risk exposures and enlisting the help of investment consultants and OCIOs (outsourced chief investment officers) according to the survey. More than half, 59%, of institutional investors expect to discuss asset allocation with their investment consultants or OCIOs over the next 12 months and an additional 54% and 50% expect to discuss inflation and capital markets expectations, respectively.

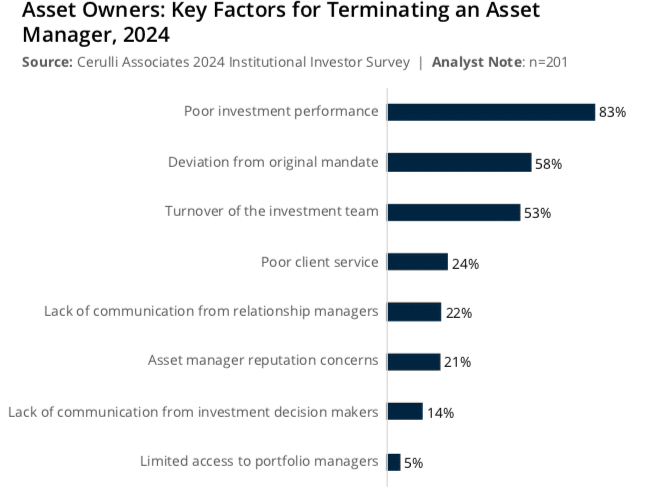

Therefore, Cerulli said asset managers should expect an increase in mandates and terminations in response to significant shifts in the market.

“Proactive conversations with at-risk relationships about capabilities, risk management, and service levels could help prevent outflows,” said the report.

The survey found that the top factors institutional investors consider when selecting an asset manager for an investment mandate include scale (85%), experience with similar clients (55%), and specialization in a specific asset class (53%).

Laura Levesque, director at Cerulli, said in a statement: “Given the abrupt change in the market, asset managers will need to get ahead of any pitfalls to retain clients. In the long run, deviating from stated mandates will be far more likely to get a strategy terminated than short-term poor performance.”

Manager vs machine

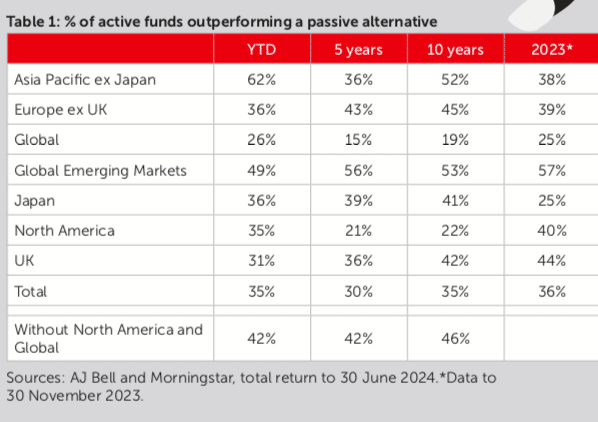

In terms of performance, the latest Manager versus Machine report from investment platform AJ Bell said that relatively few active managers beat a passive alternative in the first half of this year.

“Just 35% of active equity funds in our sample achieved such a feat, almost exactly in line with the figure of 36% in our 2023 report, but hardly a ringing endorsement of the value attached to active management,” added AJ Bell. “This is of course a short time period over which to judge performance, but over 10 years the figure is actually the same – just 35% of funds have beaten the passive machines.”

AJ Bell said average returns of passive funds are heavily influenced by the ongoing outperformance of big US technology stocks which continue to undermine the efforts of active managers.

“It’s notable that excluding these two sectors, a more respectable 46% of active funds have outperformed over the last 10 years, within a statistical whisker of the 50% mark which you might broadly expect to outperform under normal conditions, and before charges are levied,” said AJ Bell.

In addition, retail investors have withdrawn £89bn from active funds since the beginning of 2022, while tracker funds have inflows of £37bn over the same period according to the report.

“A small and not particularly reassuring glimmer of light at the end of the tunnel is that outflows appear to be slowing a touch,” said AJ Bell. “If the run rate for 2024 is maintained, ‘only’ £31bn can be expected to flee active funds by the end of the year, down from £38bn in 2023. These are dark times indeed for the active management industry.”