Investors are looking for ‘unique liquidity’ as the number of venues and order types in the US is expanding and the increase in retail trading and off-exchange volume means a larger portion of the market is not directly accessible by agency brokers.

Joe Wald, managing director of electronic trading at BMO Capital Markets, told Markets Media that the broker has developed a three-pronged approach to measuring liquidity as market structure has evolved. He continued that quantitatively measuring liquidity has become increasingly important in order to find the natural other side to a trade in the most effective way as volumes of retail trading and off-exchange trading have grown

“I think that is definitely where we see the market going and we see it in every region,” Wald added. “One of the things that we are excited about in terms of our launch in Europe, which is coming soon, is the ability to take these principles and look at the European and UK landscape in a different way.”

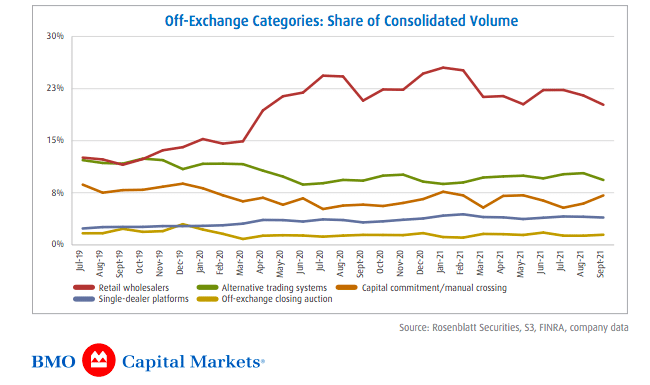

In a paper, Routing’s Role in Harnessing Distinct Liquidity Sources, BMO highlighted that off-exchange market share reached nearly half, 44%, of total equity volume in September 2021. Off-exchange activity includes retail wholesalers, ATS venues, capital commitment, manual crosses, SDP volume, and off-exchange closing volume

In the US retail trades are not executed on exchanges but most are sold by retail brokers to market makers under “payment for order flow” agreements, allowing the brokers to offer no-commission trading to retail. The market makers internalize the flow and capture the majority of the spread, in return for offering retail investors a slight improvement on the exchange price.

In addition brokers are required to connect to all lit equity exchange markets as well as the 22 ATSs that offer conditional order types.

Wald said: “You have a host of different venues that, for the first time, allow an institutional investor and an agency broker to more efficiently find what is ultimately the most important part of a trade which is a natural counterparty on the other side.”

For example the PureStream ATS, in which BMO is a minority investor, prioritizes and matches orders based on their liquidity relevance with a focus on improving cross rates and order completion speed. OneChronos, which will launch soon, identifies itself as a Smart Market, which matches counterparties using mathematical optimization. Cboe Global Markets is introducing periodic auctions from Europe into the US equities market.

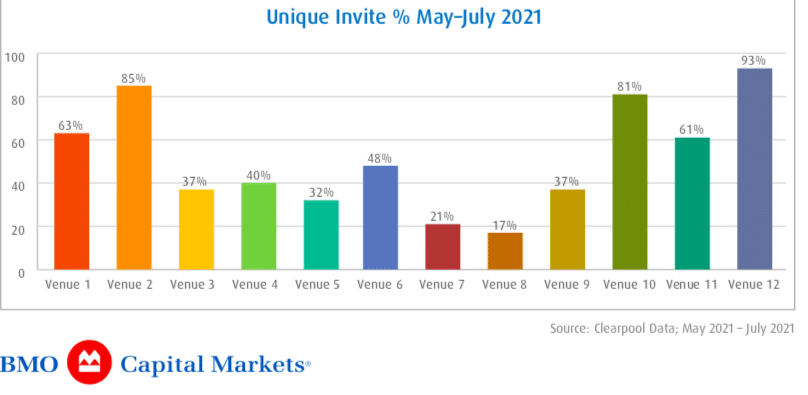

BMO measures the unique invite percentage (how often the venue is responding with unique liquidity); firm up rate percentage; and conditional phase reversion (a measure of market impact) to assess liquidity at venues in real time.

Wald said most electronic trading firms have a rigid routing protocol where they go through venues in a linear fashion to try to find liquidity.

“Using this kind of layers of intelligence and doing this type of internal analysis on every order gives you a huge opportunity to find unique liquidity,” he added. “A standard one-size-fits-all strategy doesn’t do it in today’s market, because different market participants are looking at their execution quality from different perspectives and that is a huge trend that I think will continue. “

BMO reviewed conditional venue performance between May and July 2021 in order to maximize distinct liquidity sourcing within their routing protocols for clients within ARC, the firm’s liquidity seeking algorithm.

The strategy has two legs to seek liquidity with minimal market impact. The first Arrival Price leg ensures the strategy keeps pace with the strategy’s target participation rate and can be customized by the client. The second leg is a dark-conditional ‘bonus’ leg which opportunistically seeks liquidity with minimal impact and can limit exposure to a percentage of the parent order size.

Wald added: “ARC is about a year old and has flourished over the last six to nine months. It has been a huge success story in terms of introducing innovation into the marketplace and in terms of our client growth, and winning quantitatively driven mandates.”

In addition to developing algos to search for unique liquidity, Wald expects that brokers will be given more direct access to retail order flow. For example, Nasdaq changed its opening auction in 2021 to give institutional investors the opportunity to interact with retail flow and introduced a Retail Trading Activity Tracker, while IEX Exchange made enhancements to its retail program.

“Clients have been embracing a deeper analysis of execution quality and that empirical, customizable, collaborative approach is going to take us well into the next few years,” added Wald. “Players that are able to do that are the ones who are going to continue to win market share.”

Block liquidity

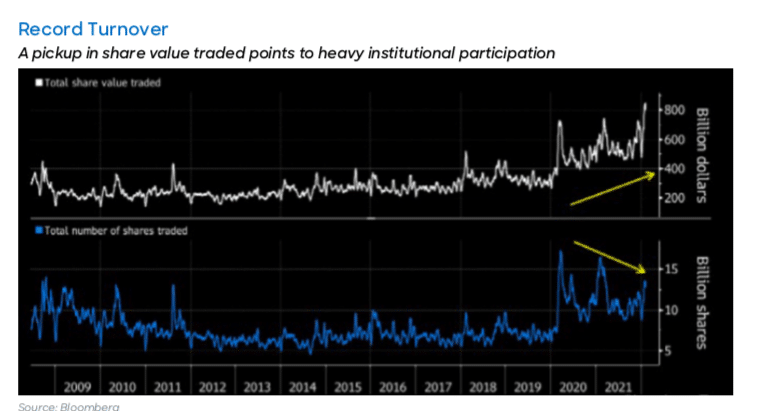

Liquidnet, the institutional dark pool, analysed liquidity in a report Is Block Liquidity in the US as Dry as They Say?, which was published in February 2022.

Jeffrey O’Connor, senior execution consultant, market insight analyst, US equities at Liquidnet, said in the report that one of the more salient data points to reflect the rising cost of trading and drying liquidity, is simply the depth of market in the S&P 500 E-minis market.

“One article cites the September 21 depth of $34m two-sided having moved to $3m today―a tenfold decrease in the most highly traded e-mini contracts,” wrote O’Connor.

He continued that the trend of heavy algorithmic flows, at levels far outsized to what the overall market volumes are, has been happening in pockets of consistency for the past two and half months.

“If we take February 7 as an example, some of the Liquidnet ATS metrics could firmly speak to the fear of block shapes,” he added. “The total negotiated volumes in the pool jumped 120% day-over-day. The magnitude of the shift speaks to how fluid market volume sources are at the moment, and just how fickle things are.”

He continued that data from Trade Reporting Facilities (TRFs), which measure off-exchange volumes, returns to more orderly levels while investment banking volumes are solid.

“As retail heavy names do not tend to be the more expensively priced, this simple trend can speak to more executable volumes to be had (albeit on dropping overall market activity),” said O’Connor.

He continued that as individual situations remain so volatile, particularly during earnings season, simple sentiment readings can be used to help with timing and aggression on a trade.

“Certain quant funds will look for high standard deviation moves, backed up by volume conviction, to support the notion that momentum will continue,” added O’Connor.