We’ve been watching the explosion of stablecoins in the crypto sphere as demand for dollars goes through the roof. We thought it would be interesting to share some of our perspectives, in the below excerpt from an investor newsletter.

In this post, we’ll cover:

- The insatiable thirst for dollars

- The political stakes surrounding central bank digital currencies, also known as CBDCs

- The IMF’s SDR instrument as a potential global reserve currency, and;

- The planned shift away from LIBOR and the general malaise about zero and negative overnight rates in the banking and finance landscape

*Note: header image is artwork by Alec Monopoly

Insatiable Demand for Dollars and Crypto as the Eurodollar

One of the things we’ve long believed is that dollars are the lifeblood of the cryptocurrency ecosystem, as they are the lifeblood of all markets around the world right now. The dollar is effectively the global reserve currency. Eurodollars represent dollar deposits held in foreign banks, and the spread charged by banks for sourcing, buying, and holding these dollars for you is effectively benchmarked using LIBOR.

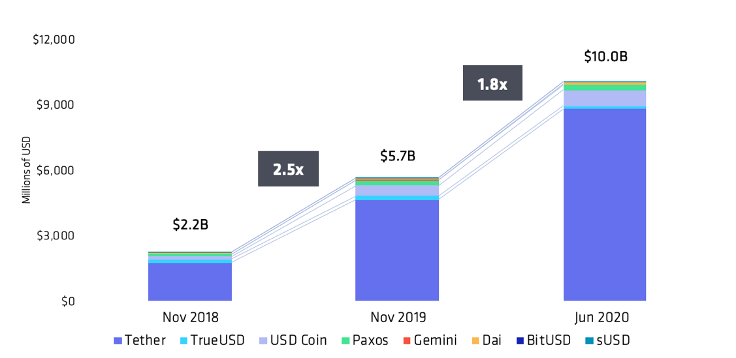

If crypto-collateralized dollar-peg stablecoins are to be the new Eurodollar, then these instruments will also need a LIBOR. In fact, if we look at stablecoin utilization, one trend is abundantly clear: it looks like the demand for dollars is a trend not only in legacy finance, but also in the new frontier of crypto finance. Despite the crypto market being the same size it was nearly 2 years ago in November of 2018, the stablecoin market has grown nearly fivefold in that same time period. It would not surprise us at all if the value of stablecoins grew to exceed that of digital currencies in the very near future.

Dollars on a blockchain, whether backed by dollars in a bank account or collateralized by other digital assets and cryptocurrencies to create a synthetic dollar peg, are incredibly useful in a world where actual dollars are (a) scarce (b)expensive and (c.) politicized.

The Growing Popularity of Stablecoins

One of the key themes we’re exploring is the use of crypto-collateralized stablecoins with a dollar peg as a way to extend correspondent banking, payments, and investment opportunities into global markets. In a way, it’s a natural extension of the Eurodollar market. In a world with zero or negative interest rates, the appeal of a digitally native, highly portable and fungible dollar-equivalent isn’t so hard to imagine.

While still a small market relative to the global Eurodollar market, the rapid growth and proliferation of stablecoins has been an eye-opening experience for central banks and the commercial banks who rely on them for liquidity. Just look at the continued dominance of Tether, a stablecoin pegged to USD. Tether currently has a float in excess of $8B, and throws off at least $200M in fees per year. Tether is probably the most important asset in the function of the digital currency ecosystem.

Why CBDCs are the Antithesis of Cryptocurrencies

On to CBDCs! We’ve written a lot about this topic, and Meltem wrote a personal blogpost about the upcoming Digital Currency Wars.

Over the past few weeks, there have been several hearings in Congress about the prospects of creating a digital dollar, perhaps even one “on a blockchain” (whatever that means, honestly we aren’t clear on this ourselves). The Chinese DCEP project has made significant strides, and last week, Xi Jinping established that ultimately digital Renminbi would be interoperable with other public blockchain assets. There’s a lot of confusion about what CBDCs are and how they would work, one of the common claims is that CBDCs are *just like* cryptocurrencies, except they operate within the bounds of legal and regulatory oversight.

In fact, CBDCs are the antithesis of cryptocurrencies like bitcoin.

Bitcoin is an attempt to separate state and money.

CBDCs are money owned and operated by the state for the benefit of the state.

For example, China’s digital renminbi will create one single digital payment system that is supported by the majority of commercial banks and the central bank, and could potentially have the side effect of minimizing the USD shadow economy, capturing data on payment flows and implementing more effective controls. This could be levying tax on these flows that have historically happened outside the system, limiting daily transactions between wallets, or perhaps even blocking certain individuals from using the digital payment system.

You don’t necessarily need a digital currency or a blockchain to do this — notably, India removed high value bills from circulation in 2016, as an effort to “curtail the shadow economy and reduce the use of illicit and counterfeit cash.” The ban on higher value bills was coupled with a digital payments and digital identity scheme, and the demonetization effort was intended to boost adoption of these schemes.

And again, China has already implemented a financial surveillance system without the use of a blockchain, but by digitizing the renminbi they can also begin exporting their surveillance not only to Chinese citizens, but to any participants using the digital RMB system over the coming years. Surveillance capitalism isn’t just for corporates — everyone can play!

A Currency Basket Known as SDR: Special Drawing Rights and Why They’re Interesting for CDBCs

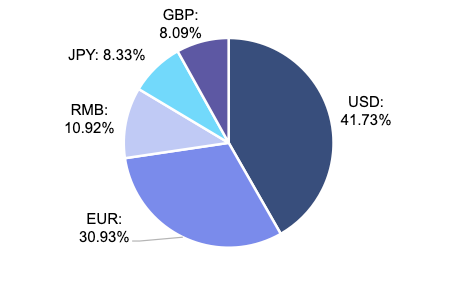

On to SDRs! Special drawing rights, or the SDR, is an international reserve asset that was created by the IMF. The value of the SDR is based on a basket of five currencies — the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.

How an SDR is Made

Now, it’s important to note that the SDR was created as a supplementary international reserve asset in the context of the Bretton Woods fixed exchange rate system. The collapse of Bretton Woods system in 1973 and the shift of major currencies to floating exchange rate regimes lessened the reliance on the SDR as a global reserve asset. Effectively, the rise of the petrodollar following the oil embargo of 1973 led to the rise of the U.S.dollar as the global reserve currency and in many ways the SDR has taken a back seat since then. (FYI: see this video on the topic of the petrodollar)

But now, SDRs are back in the spotlight, baby! In April, in response to the recent CoVid crisis, the IMF proposed to issue $500B in new SDRs. The US, which holds veto power in IMF matters, blocked the issuance. So right now, in a world where everyone wants and needs those sweet, sweet greenbacks, only 14 countries are able to get access to Fed swaplines and tap into the global supply of dollars. Other countries are left to fend for themselves, particularly emerging economies who have been disproportionately impacted by the effects of CoVid and their heavily dollarized economies.

One thing many people don’t appreciate about the SDR is that it has its own interest rate, the SDRi. The SDRi is the interest paid to members on their SDR holdings and charged on their SDR allocation. Unlike LIBOR or other daily or real-time rates, SDRi is set weekly based on a weighted average of representative interest rates on short-term government debt instruments in the money markets. One proposal underway is to make the IMF a bank for SDRs, whereby it would borrow SDRs from developed economies and lend them out to emerging economies which need them. So effectively, SDRi could has the potential to become a global rate benchmark.

One development we’ve been tracking for several years now is the IMFs keen interest in digital currencies. It doesn’t take too many intellectual jumps to see that the SDR lends itself well to digitization, especially as its constituent currencies themselves may become increasingly digitized and interconnected. In fact, if we look at Facebook’s Libra and its initial proposal to form a basket of global currencies, it was actually a form of this SDR approach. The SDR story is just beginning to unfold, but our bet is the IMF will be a strong contender in the race for global reserve currency.

LIBOR, Ameribor, and Rate Setting Mechanisms

Lastly, we come to rates. Although we know LIBOR is set to be phased out starting in December of next year, for the purpose of simplicity, let’s stick with LIBOR in this analysis. The London Interbank Offered Rate has historically set the price at which banks lend to one another. The rate was set by a small group of large banks, and was famously subject to manipulation and fraud, as LIBOR is a base rate that informs pricing of many, many other types of financing arrangements. In crypto, we have historically lacked any sort of formal rate. The emergence of a lending market in the crypto ecosystem has created informal rates, but there isn’t one standard overnight rate that defines the industry.

One of the interesting things we’ve been looking at across our business, but especially on the capital markets side with our trading desk, is the importance of overnight rates. Effectively, crypto needs LIBOR if it intends to be a currency substitute, and if we intend for individuals, companies, and nation-states to hold it on their balance sheets.

In the last few months, we’ve seen a number of innovative new approaches emerging around rate setting in both legacy financial markets and crypto markets. Relying on a group of private banks to submit quotes for a rate is positively archaic, especially when we have technology that allows for creation of a real-time rate that can be set by the market at large. The way rates are set is no longer fit for purpose. A relic of the 20th century, there are now a number of experiments underway to prove how blockchain technology can actually solve, like, a real problem. Allow me to explain…

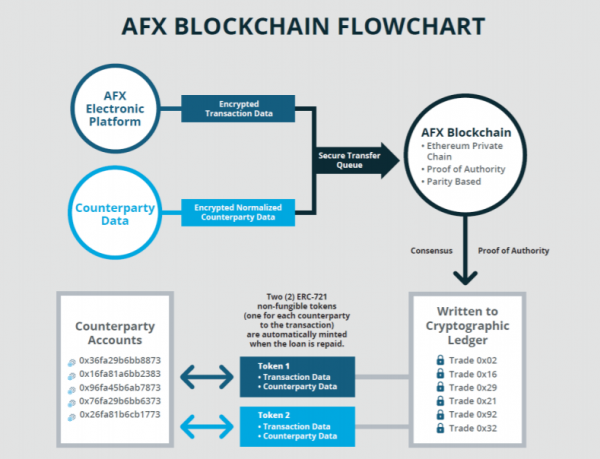

In legacy financial markets, a new Ethereum-based index has been proposed by the American firm AFX. It aims to create a new version of Ameribor and to set the rate using real-time data from each market transaction to set rates. Effectively, in the case of Ameribor, AFX will mint two non-fungible tokens for each party in a transaction. Unlike bitcoin, which is fungible, meaning every token is the same, these non-fungible tokens contain information about the transaction and the counterparty. The tokens are automatically minted by the AFX Blockchain when a transaction begins, and using the parity smart contract language are automatically settled when the transaction ends.

I Guess We Could Put Ameribor on a Blockchain?

The idea is that AFX will use a private, permissioned blockchain to gather real-time data about interbank lending rates, effectively making it impossible to manipulate LIBOR because instead of someone entering a number in a spreadsheet once a day, LIBOR would instead be automatically informed by real rates from bank transactions. So in this instance, the ledger would be used as a mechanism to capture real-time, verifiably correct data. The details are all still quite fuzzy, and honestly, they don’t actually need a blockchain, but that’s another matter entirely.

However, crypto enthusiasts were thrown into a tizzy when Jerome Powell, the Chairman of the Federal Reserve, commented that he felt such a mechanism could be a welcome upgrade to LIBOR and rates in general by verifying inputs used to set rates are a reflection of actual paid rates in the market. JEROME POWELL, Mr. Printer himself, talking about blockchain, y’all. Pinch me, I’m dreaming.

Leaving that world aside, let’s step into the world of cryptocurrency. There’s been much ado in the world of “decentralized finance” aka DeFi on a new concept known as automated market makers (AMMs). Some examples include Uniswap, Balancer, and Compound — but effectively what we’re seeing is the use of market incentives to set market rates in the DeFi ecosystem. If this sounds unintelligible, don’t worry. We have a translation machine…

There are a ton of people who own a bunch of cryptocurrencies that just sit idle in their wallets. Wouldn’t it be great if people could earn some yield on those assets? What a bank effectively does is take deposits and lend them out to earn yield. Meltem wrote a long post about the race for assets under custody last month that talks about bank deposits, if you’re interested. In the crypto space, a new concept called liquidity mining enables users to earn fees on their Ethereum-based (ERC-20) idle assets. Users can deposit their portfolios into an AMM and earn fees as other users obtain leverage using their portfolio as collateral. However, since this is blockchain-land, instead of using paper agreements and getting mired in internal complexity, everything is transparent, visible, and openly auditable. People create liquidity pools comprised of different types of assets, say 50% ETH and 50% wBTC (wrapped bitcoin, or bitcoin put on the ethereum blockchain), and then make these LPs (liquidity pools) available to people and projects who want to borrow. Rates for borrow and lend vary in real time, and people will adjust their allocations of assets to optimize for yield since you can swap one token for another easily using a decentralized exchange.

Users can deposit their entire portfolios into, say, Balancer’s self-rebalancing LPs & earn fees as other users trade borrowing against their portfolio. And in the process, a free market for rates is created. One that leverages real-time supply and demand of various types of collateral. So in effect, what you can do is create a market of rates across asset types, instead of relying on a single rate. And that is a pretty interesting concept!

In Closing

There’s much change afoot in the structure of the global economy. From currencies to rates, everything seems to be rife for digitization and disruption. As always, we are watching with a keen eye…

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine, Markets Media Group or its staff. Traders Magazine welcomes reader feedback on this column and on all issues relevant to the institutional trading community.