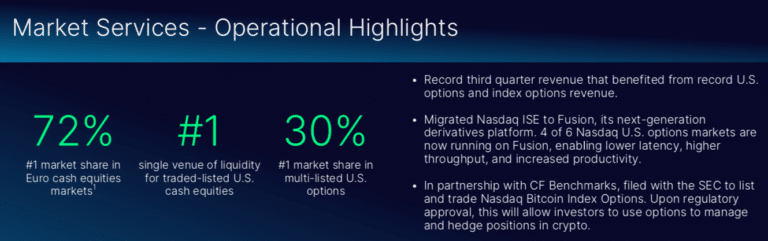

Nasdaq said it has migrated International Securities Exchange (ISE) to Fusion, so that four out of six of its US options markets and one European equity derivatives market are now running on Fusion, its next-generation derivatives platform.

Adena Friedman, chair and chief executive, said on the third quarter results call on 24 October: “Four of our US options markets are running on Fusion, resulting in lower latency, higher throughput and overall increased productivity.”

Brenda Hoffman, chief technology officer of financial technology and market services, said at Nasdaq’s investor day this year that it was the first global exchange operator to migrate a major regulated market to cloud technology. Nasdaq’s MRX Options Exchange and Nasdaq Bond Exchange (NBE) moved to AWS in 2022 and it subsequently migrated GEMX, another options exchange. Performance improved after the migration according to Hoffman with a 10% improvement in latency and tighter determinism.

US equity derivatives achieved record quarterly net revenue in the third quarter of $107m. As a result, net revenue in the market services division grew by 13% from a year ago to a record $266m in the third quarter.

“The growth was driven by higher volumes across US and European cash equities, as well as record revenue for US multi-listed options and proprietary index options in US equities,” added Friedman.

Index business

Friedman described the index franchise as a “true innovation engine” within Nasdaq. The business achieved a fourth consecutive quarter of record average exchange-trade product assets under management of $575bn, and reached $600bn at quarter-end.

The index business had $62bn in net inflows over the trailing 12 months, with $14bn in the third quarter of this year. Index derivatives trading linked to the Nasdaq-100 Index also grew 24% year-over-year.

In the third quarter the index business partnered with clients to bring 35 new investment products to market, including seven insurance annuity vehicles and eight options overlay products. 20 of these new product launches were international.

“We remain focused on international expansion with 57% of new products launched outside the United States,” said Friedman.

In addition, US index options had a record quarter with revenue doubling year over year. Friedman said there are opportunities to expand the trading of index options on US retail platforms and that a lot of demand is also coming from international broker dealers.

In terms of international growth, Friedman highlighted Latin America as one of the regional economies where Nasdaq has been helping financial institutions better navigate regulatory complexity and the modernization of market infrastructure over the last 10 years. In Latin America there are over 10 market operators, and about 50 bank and broker-dealer clients that use Nasdaq technology.

For example, in September this year Nasdaq said it would provide its AxiomSL regulatory reporting solution to Nubank, a digital bank with over 100 million customers across Brazil, Mexico, and Colombia. Nasdaq has over 50 banking and payment services clients in Latin America.

“We look forward to our continued international expansion,” added Friedman.

Artificial intelligence

Nasdaq completed a major milestone during the third quarter with the rollout of AI co-pilot tools to all of its developers, according to Friedman.

The firm also launched an internal generative AI platform that features custom-built skills designed to enhance productivity and efficiency. In less than two months, Nasdaq has deployed about 400 unique skills, with nearly 50% of employees engaging with the platform.

For customers, Nasdaq also launched new AI-enabled products. Nasdaq Verafin, which provides crime fighting technology, enhanced its AI-based Targeted Typology Analytics with new detection capabilities for terrorist financing and drug trafficking activity. The Calypso platform has developed an innovative new methodology to conduct investment portfolio risk calculations and produce predictive analytics, based on advanced machine learning capability.

Nasdaq’s machine learning technology is combined with a sophisticated form of mathematical modelling that can significantly improve the efficiency of conducting the most complex trading and regulatory risk calculations. The new functionality can price financial instruments across millions of scenarios up to 100 times faster while significantly reducing the amount of physical infrastructure required to run those calculations.

Gil Guillaumey, head of capital markets technology at Nasdaq, said in a statement that all financial institutions trading over-the-counter derivatives are required to perform increasingly complex calculations to meet internal risk controls and regulatory mandates. The scale of required computing is driving a rethink about using AI to reduce the cost of compliance.

Financials

Sarah Youngwood, chief financial officer, said on the call that Nasdaq delivered its fourth consecutive quarter of double-digit growth.

“Nasdaq’s performance continues to reflect the quality and diversity of our platforms, driving strong growth across the business with particular strength in index and financial technology,” Youngwood added. “We are continuing to deliver ahead on deleveraging and synergies and are benefiting from significant operating leverage.”

Third quarter net revenue was $1.1bn, 22% more than the prior year period, including a $146m benefit related to the acquisition of Adenza. In June 2023 Nasdaq announced the $10.5bn acquisition of Adenza, a provider of mission-critical risk management and regulatory software to the financial services industry, from private equity firm Thoma Bravo. Adenza consisted of Calypso, which provides capital markets participants with end-to-end treasury, risk, and collateral management workflows, and AxiomSL, which provides regulatory and compliance software.

Friedman said that as Nasdaq approaches the one -year anniversary of the completion of the Adenza acquisition, she is “extremely pleased” with the progress to date.

“The integration continues seamlessly, and we are delivering ahead of plan on net expense synergies and deleveraging,” Friedman added. “Nasdaq is in the early innings of unleashing the power of our financial technology division, and we look forward to building on this momentum.”