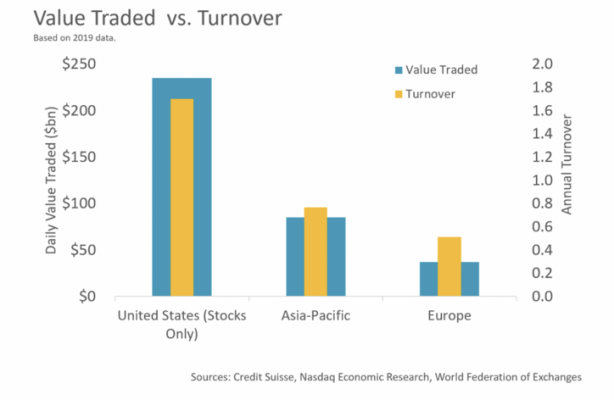

The U.S. stock markets are pretty impressive. They have the most liquidity and lowest trading costs in the world. We’ve just been through a pandemic where the bond markets needed to be rescued by the Federal Reserve (again), and now we are in the midst of a war with a significant impact on Europe and commodities markets. And yet equities markets have functioned well.

Chart 1: U.S. turnover and trading far surpasses other regions

A short search for problems to solve

But if you follow market structure closely, even if only on Twitter, you’ll know that there are always lots of things that are seemingly in need of fixing. Even looking through industry comment letters and white papers finds lots of problems that investors and traders suggest we solve. We’ve also written about many ourselves.

Often, there is widespread agreement that the problems exist.

For example, many suggest that there is an “odd lot” problem (including Blackrock, FIF and MEMX). At first look, the odd lot problem results in an NBBO that misses many of the actual “best” quotes.

The SIP committee even put out a proposal to put odd lots on the tape. The comments, however, offered many different solutions to fix the odd lot problem and highlighted other issues with the market. For example:

- Creating an odd-BBO and an NBBO is seen by some as complex and confusing and may not help investors if best quotes aren’t also protected and used for best-ex calculations.

- Many have proposed that odd-lots should be included in 605 calculations (including Citadel Securities, Virtu and FIF), which would lead some (but maybe not all) to treat odd lots like protected quotes.

- Others worry that adding odd lots to the BBO would result in very small orders (depth) setting the “best” price, even if it didn’t represent a “tradable quantity.” Or, worse, it might allow for manipulation of mid-point prices in wide-spread stocks using just a single share.

- Of course, the SEC’s solution to this was to change the round lot size and force odd lots to be aggregated to a “worst” round price on the tape. That ensures protected quotes are larger than average order sizes. But the odd lot problem remains as a recent academic study shows that algorithms don’t care about round lot conventions much anymore, and better prices will still be available inside the new NBBO.

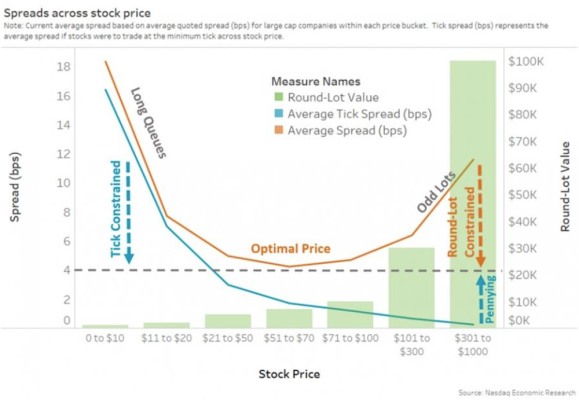

At the other end of the spectrum is the tick-constrained problem. Many have noted that tick-constrained stocks force NBBO spreads to be too high, which is bad (including Robinhood, MEMX, Citadel and Virtu). Data also suggests that artificially wide spreads add to fragmentation and complexity as well as trading costs. We also know that tick-constrained stocks have longer queues, which likely benefit faster traders who are able to get to the top of new queues.

Chart 2: Our one-size-fits-all ticks cause tradability problems that widen spreads

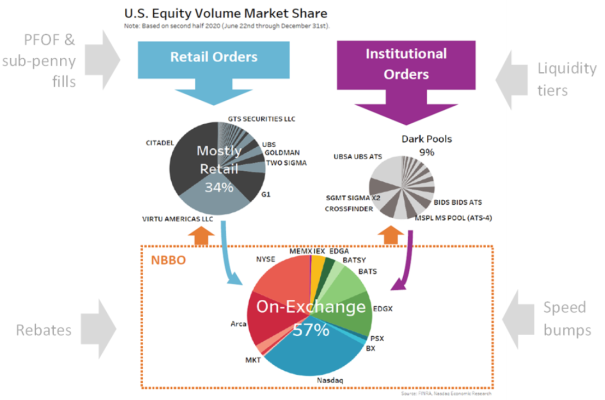

Another issue affecting buy-side trading costs is liquidity, spreads and segmentation. Academic research suggests all three issues are interrelated. A few industry studies suggest segmentation results in inaccessible liquidity that adds to costs (including Babelfish). Other research by BestEx suggests that spreads may already be wider, while a Wellington study suggests lit liquidity is falling, which increases signaling costs for investors trying to work large orders.

In the past, the industry has generally been more concerned about fragmentation and complexity, as it makes finding liquidity without signaling harder and more expensive. Some research shows that less fragmented markets allow investors to interact with each other, which directly lowers the costs of trading. Importantly, we know lower costs to trade also lower the cost of capital for issuers. That’s supported by research that shows that more competitive bid-offer spreads improve trading and reduce liquidity premiums, leading to higher valuations.

Chart 3: Fragmentation and complexity are compounded by differences in trading rules and economics

Of course, access fees and data costs are included in many comment letters as well. However, if the NBBO is important to all investors, supporting best-ex and low trading costs, then the economics of lit quotes should reflect that.

Already, off-exchange venues can earn more in SIP revenues than they pay for data used to price those trades. In fact, the SEC’s approval of fading quotes means even exchanges can earn outsized data revenues off the price formation in other venues from the SIP. Moreover, that revenue plus the adverse selection avoided allows those platforms to charge higher prices for trading. That’s a distortion in trading economics that doesn’t seem fair to the market makers actually setting the prices with firm quotes on other venues. What we know is that rebates remain the most effective way to incentivize a better, actionable NBBO with more liquidity and lower spreads. That’s because rebates are paid directly to the liquidity provider for their quotes that lead to trades.

In addition, some of the current rules claim to support competition for competition’s sake, even if additional venues add a lot to fixed costs for brokers and routers but little to market quality. It’s ironic—and bad accounting—to think that “cost-based” pricing would lower costs if, at the same time, the industry encourages more and more exchanges.

Building a comprehensive list of all the ideas and suggestions would take up too much space for this blog. But one single example, the 2017 U.S. Treasury report on the U.S. capital markets, identified problems with tick constrained stocks, depth for protected quotes, PFOF, fair access, fragmentation and complexity, all of which make it harder for investors to naturally meet for trades, especially in thinly traded stocks, as well as many things the prior SEC has already focused on.

We think our recent white paper fixes a lot of the problems

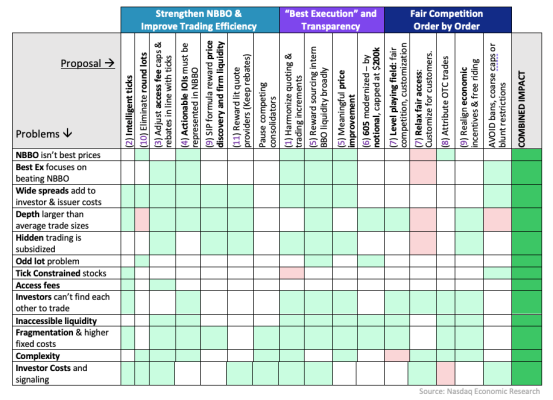

We recently added to this debate by publishing our own white paper, including 11 proposals designed to help markets work more efficiently and better for investors and issuers.

Unfortunately, fixing lots of problems at once is hard, but fixing one thing at a time often creates a new problem somewhere else. Recognizing that there is no “silver bullet” solution, as well as the fact that some piecemeal tweaks can have unintended consequences, we suggest a combination of changes that should work well together to solve many of the problems seen in the market. The matrix shows that even adopting just some of these ideas is likely to help with many of the problems we’ve listed.

In the table below, we grouped our proposals into achieving three different thematic benefits: trading efficiency, transparency and competition. Importantly:

- Some changes strengthen the NBBO and should make markets more efficient.

- Some are focused on “best ex” and transparency.

- Others encourage building a more competitive market.

In the table below, we show how the 11 different proposals work together to tackle many of the market structure “problems” discussed above. The green squares in the matrix below show which problems each solution helps fix. We also show unintended consequences as red squares. However, the overall benefits outweigh unintended consequences across each row, resulting in green combined impact across the board.

Table 1: A combination of proposals for most of the perceived problems

For an example of unintended consequences, many of the proposed odd lot solutions focus on round lot sizes, while tick constrained solutions focus on changing ticks. Even the SEC took the approach of changing round lot sizes while adding aggregating odd lots by venue on the SIP feed. However, that increases complexity with different rules for low-priced and high-priced stocks.

Interestingly there is a growing amount of research suggesting stocks trade optimally when their spread is around 2-ticks (including us, XTX, Academics, ESMA and AMF). For that reason, we repeat our suggestion for intelligent ticks. The benefits of intelligent ticks include the following:

- Tick sizes wider than 1-cent in high-priced stocks can be used to ensure enough depth is at the “BBO.”

- While setting ticks to a target depth level, it would make sense to fit the definitions for “covered stocks” in 605 to match a similar notional depth expected to be at the inside. A side benefit of this would also align “retail” and “block” sized trading cutoffs.

- Wider ticks would change the economics of spread capture (in basis points) to a level that attracts quotes but discourages “pennying” and potential manipulation of midpoints.

- If we say clustering limit orders at better spreads are good for markets, it follows that sub-penny trades off-exchange probably aren’t good for the NBBO.

- Tick sizes less than 1-cent for tick-constrained stocks reduce costs and fragmentation that is currently used to get around expensive spreads and long queues, which likely also benefit the fastest traders over longer-term investors.

- This also helps align spread economics (in basis points instead of cents) across all stock prices. Given that, it also makes sense to align lit-quoting incentives to be consistent to reset access fees to new ticks. That would reduce access fees on low-priced stocks, where they are highest (in basis points) while increasing incentives (in basis points) for higher-priced stocks, which currently have the lowest incentives (in basis points) and much wider spreads.

The right side of the table focuses on competition for solutions that suit investors.

Although fair access is equal, equal is not always fair. As the market has evolved, retail and institutional order flow has increasingly adopted more hidden trading strategies. Those customized solutions usually help investors with lower mark-outs and price improvement. We think our proposals add to ways the market can help join investors and liquidity providers together while also lowering their trading costs.

However, as the red squares in Table 1 show, allowing more markets to tailor solutions to investors will require the SEC to trade off some of its goals for the NBBO, and we admit, some customizations could make it harder for investors to find each other.

Ideas are easy, consensus on solutions is much harder

Although it’s easy to find agreement on issues, it is much harder to find consensus on how to solve the problems. In fact, we often see strong disagreement about different solutions.

There is also often a trade-off between spreads and liquidity, signaling and certainty, economic fairness and equality.

Plus, it’s also hard to forecast reactions, especially when many competitors run platforms with different bundled features and cost benefits – as Europe has found with MiFID.

That’s why we think it’s important to focus on investors but also acknowledge that the ecosystem is interdependent. For example, a lot of academic research has shown that HFT has added liquidity and tightened spreads, reducing investor costs even though they are profitable on their own.

If this was easy, surely, we would have done it already.