CME Group’s E-mini Russell 2000 index futures contracts had their second highest daily trading volume this year ahead of the June expiry and the upcoming annual Russell Reconstitution.

Each year index provider FTSE Russell, part of the London Stock Exchange Group, reviews the Russell 1000, 2000 and 3000 indices to take account of market events in the previous 12 months and to ensure that they remain representative of the US equity market. This year the Russell reconstitution is final after the close of the US equity markets on 28 June.

The annual Russell reconstitution is usually one of the most heavily traded days of the year in the cash equities market. However Paul Woolman, global head of equity index products at CME, told Markets Media that investors have also increasingly been using futures to manage their market risk and operational risk, or to position themselves for possible opportunities in the stock additions and deletions.

Woolman said: “If investors fail to rebalance in the correct manner it can lead to tracking error in their portfolio. A future provides access to an index product that provides perfect tracking.”

Investors could enter the future markets in the quarterly expiry on June 21, ahead of the Russell reconstitution.

In the run up to the June expiry, CME’s E-mini Russell 2000 index futures contracts traded 625,000 contracts on 17 June, which was the second highest volume day this year, just behind the prior record of 700,000 contracts traded on 11 March in the run up to March expiry according to the exchange.

Year-to-date average daily volume of E-mini Russell 2000 futures is 218,000 contracts. During the week of expiry in June, average daily volume has risen by nearly two thirds to 353,000 lots.

BTIC functionality

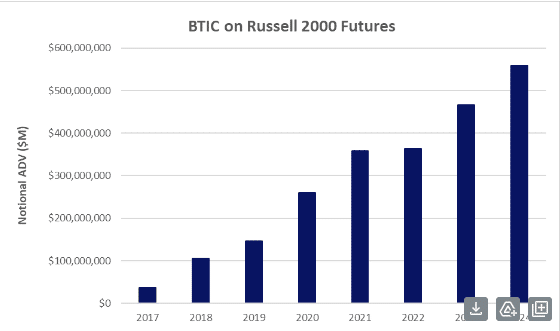

In addition to using the futures roll, clients can also use the basis trade at index close (BTIC) functionality and exchange for physical (EFP) to manage their trading and operational risk ahead of the reconstitution.

EFPs can be transacted at any time during the day and are more flexible as they do not have a minimum size. In privately negotiated EFPs two parties exchange equivalent but offsetting positions in an equity index futures contract and an underlying physical equity, such as a related ETF or basket of shares. One participant buys futures and sells physical shares, and their counterparty does the opposite.

BTIC allows participants to trade futures at a fixed spread to the underlying index level at the close of the US equity market.

Average daily volume of BTIC on Russell 2000 futures in the year to date is 5,500 contracts, up 9% from the same period in 2023 according to CME. There was a spike in BTIC volumes on 21 June during the roll, with 13,600 contracts traded.

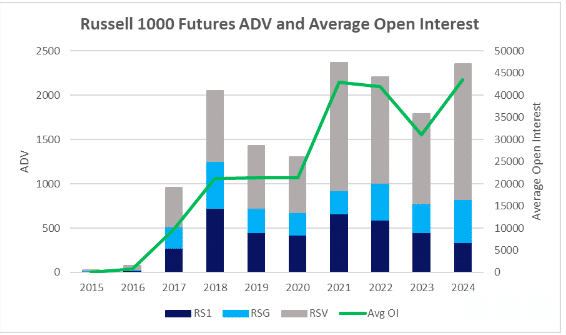

Average daily volume for Russell 1000 futures in the year-to-date is 2,400 contracts, nearly a third higher than in 2023.

Reconstitution changes

Woolman said: “Equity market leadership has come from large caps, which is captured by the Russell 1000. Small caps seem to be a little bit out of vogue but I am sure that will turn around at some point.”

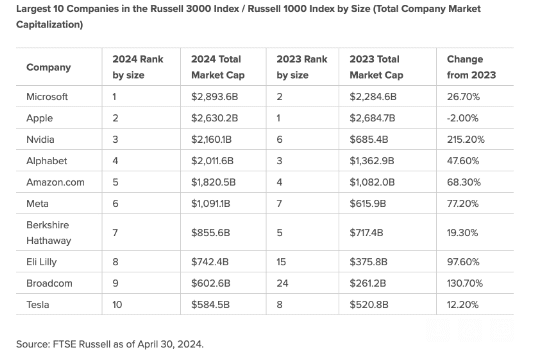

FTSE Russell said large cap growth stocks continued to outperform value stocks in 2024. The Russell 1000 Growth Index returned 31.8% in the year ended 30 April 2024, compared to 13.4% for the Russell 1000 Value Index.

Catherine Yoshimoto, director of product management for the Russell US Indexes at FTSE Russell, told Markets Media: “It is not surprising that the most additions to the Russell 1000 index are from technology.”

Out of the 38 new Russell 1000 members, seven are technology companies, including Super Micro Computer and MicroStrategy.

Super Micro Computer, which graduates from the Russell 2000 Index, is the largest addition by weight to the Russell 1000 Growth Index and classified as 100% growth. Each of the “magnificent seven” US technology companies also remained 100% growth in the reconstitution. Yoshimoto also highlighted that more than 200 companies are being added to the Russell 2000 index, and almost 100 are from the healthcare sector.

The “magnificent seven” companies increased their total market capitalization by 43.5% from $9.2 trillion to $13.2 trillion and Yoshimoto this led to investors’ concerns about concentration and lack of diversity coming to the fore.

“It does feel like we are at an inflection point where a lot of the first half of the year was focused on growth,” she added. “I am starting to hear from clients that they are looking more at value stocks or small caps in order to diversify.”

As a result, FTSE Russell has launched a series of capped indexes, which limits the concentration of companies in the index. Investors can compare the performance of the standard and capped index.

“Some clients, for example, want to see Russell 1000 excluding the top 10,” Yoshimoto said.