By Phil Mackintosh, Senior Economist, Nasdaq

We previously wrote about the benefits of forward stock splits. Forward stock splits address tradability issues faced by stocks with high stock prices, which tend to have wider spreads and a high proportion of odd lots at better prices.

But what about stocks on the other side of the stock price spectrum – the low-priced stocks?

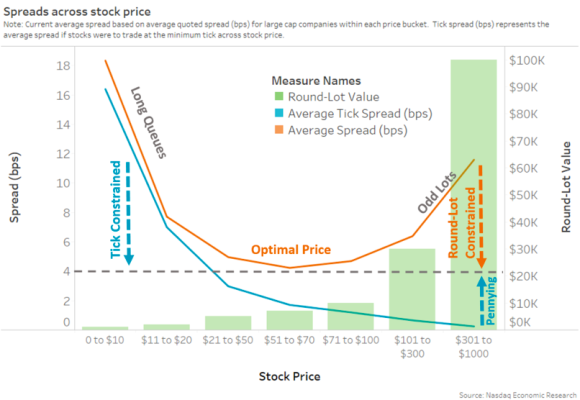

Chart 1: Spreads (in basis points) form a U-shape where both low priced and high-priced stocks have artificially wider spreads than optimally priced stocks

Low-priced stocks tend to have tradability issues too. So-called “tick constrained” stocks have artificially wide spreads and typically longer queues and more fragmentation. That makes it harder for investors to buy stock at the bid, adding to spread costs and time to trade larger orders.

It should follow that reverse splits for the low-priced stocks on the left of the U-shape also lead to improved trading.

Lots of companies reverse split each year

Looking at split data since 2010, we see that over 900 companies have reverse split, an average of over 75 per year.

Interestingly, we also see that most of those were companies priced under $1. We might call those “forced” reverse splits because both Nasdaq and NYSE have Continued Listing Requirements that mandate stock prices be above $1, allowing them to drop below that level for a relatively short period of time.

Chart 2: All (unfiltered) U.S. reverse splits from 2010 to present

However, as we went through all of the reverse splits over the past 12 years, we discovered a number of motivations issuers cited to reverse split, including:

- Attract institutional investors – Stocks below $5 are considered “penny stocks,” which tend to be favored by retail Often these stocks also can’t be used for collateral when margin trading—for example, Fidelity requires that equities and ETFs be priced above $3 for margin borrowing—which also deters institutions.

- Lower transaction costs – Very liquid, low-priced securities face artificially wider trading costs if they are tick-constrained, as we note above. Although here we only consider corporate stocks, ETFs also do reverse splits to maintain optimal tradability, including Vanguard’s S&P 500 ETF (VOO), which completed a 1:2 split in 2013 to reduce trading costs.

- Minimum listing standard – Nasdaq and NYSE both have Continued Listing Requirements that mandate stock prices be above $1. In addition, often stocks with “No Price Data” were trading OTC markets before completing a reverse split in order to be “uplisted” to a national stock exchange.

- Corporate restructuring – Companies may be making structural changes (change of business focus, capital restructuring, etc.) and desire a new, higher stock price to reflect a fresh beginning.

- Merger contingency – Some companies enter into merger agreements but require that the party being acquired have at least a certain stock price level.

Focusing on voluntary reverse splits

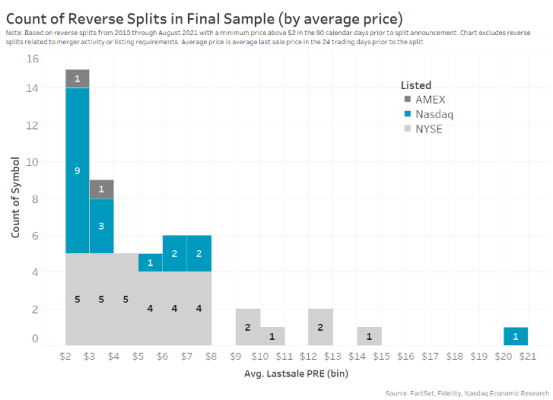

Given our focus on using market structure to improve tradability, it’s more interesting to focus on stocks with a minimum price above $2, which more likely did a voluntarily reverse split. That leaves 53 stocks with pre-split prices ranging from $2 to over $20 (Chart 3, colored by listing venue).

Chart 3: Distribution of reverse splits in filtered sample used for study

Across these stocks, the average split factor was 5x, and the average pre-period price was about $5. The size of the companies ranged from $44 million to $128 billion, where the median market cap was just under $1 billion.

What happens to tradability post reverse split?

Given most companies doing a voluntary reverse split were low priced, there is a high chance that the reverse split pushed the stocks closer to the bottom of the U-shape in chart 1, which should lead to improved tradability.

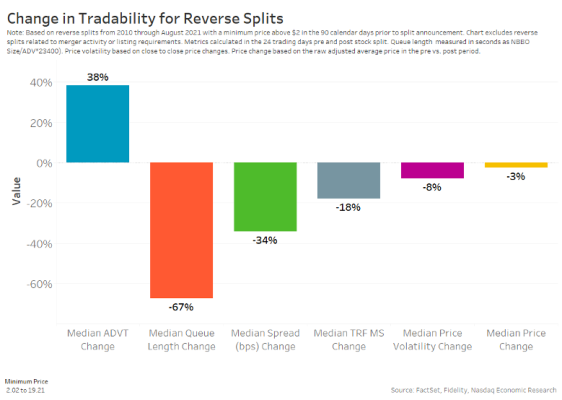

The results show that’s mostly true. In fact, the data shows that typically the reverse split led to:

- Improved liquidity (value traded)

- Shorter queues

- Tighter spreads

- Less dark (off-exchange) trading

- Less price volatility

Chart 4: How tradability changes upon reverse splitting

The data shows that the market cap of the median split also falls slightly, but some research suggests that’s due to weaker fundamentals in those low-priced stocks. We would highlight that those stocks that voluntarily reverse split closer to their “perfect” price (which we talk about more below) perform better than other reverse splits.

Notably, that is consistent with other academic research that finds that stocks generally drift downward post-reverse-split. However, the downward drift doesn’t appear to be extreme enough to erode the benefits of completing the reverse split initially.

Importantly, Chart 4 shows the median change across symbols. That’s because some tickers with very large changes skew in representative results.

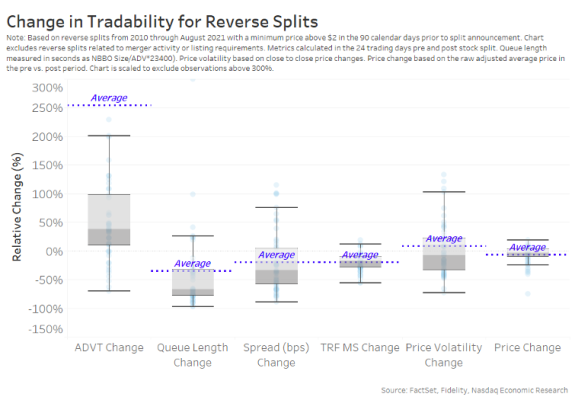

For those interested in more granular data, see Chart 5. In that chart, each dot is a stock, where the light grey box turns to dark grey is the median (shown in Chart 4), which is often very different from the average (blue dotted line).

Chart 5: Distribution of observations in sample

Do all stocks benefit from a reverse split?

Given what we know about spreads from Chart 1, it’s interesting to understand better why some reverse splits led to an increase in spreads, especially when all were such low-priced stocks already.

The answer turns out to bring us back to research we did looking for the perfect stock price. Recall the main point of the perfect stock price formula was to estimate what price would put each stock on the bottom of the U-shape in Chart 1. And remember that the “perfect price” was different for each stock and depended a lot on the liquidity of each stock.

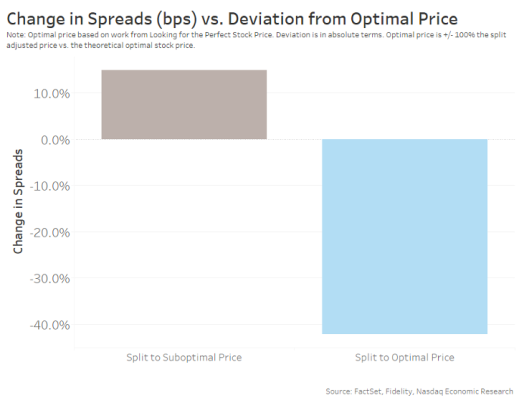

When we apply this math to our sample of reverse splits, we see that companies that split to a level

- Close to the estimated “perfect price” saw spreads tighten

- Relatively far from their “perfect price” saw spreads widen

The takeaway here suggests that it’s important for issuers to try to reverse split to a specific target stock price that supports their liquidity and optimizes their trading characteristics for investors. In short, take the opportunity to also correct our one-size-fits-all market structure because trading matters to investors!

Chart 6: Spreads improved for stocks that got near to their optimal stock price

Why is this important?

Although there are plenty of reverse splits, not all of them are done for the same reason, and many are not done to the right price.

The data shows that if a company does split – even for reverse splits – it is important for investors that they split to the right price. We see the “right” price helps reduce trading costs and fragmentation, allowing investors to trade more efficiently.

Of course, it’s hard to make all stocks split. In that case, Intelligent Ticks can achieve most of the same economics and benefits for investors.

Robert Jankiewicz, Research Specialist for Economic and Statistical Research at Nasdaq, contributed to this article.