This article first appeared in The Startup

The year 2020 had started with a bang for the stock market. On February 12, 2020, the Dow Jones reached an all-time high just over 29,500 points. A few days later, the S&P 500 reached an all-time high close to 3,400 points.

All the signals seemed to be green, and many imagined that the 30,000 points would be quickly reached for the Dow Jones.

And then the unthinkable happened. A pandemic on a scale not seen in decades hit the world. The coronavirus pandemic spread across the world at an incredible speed from the beginning of March.

The economic uncertainty caused by this pandemic then began to cause financial markets around the world to plummet. The extraordinary measures taken afterwards to limit the spread of the coronavirus finally triggered the economic crisis that had been expected for months.

Lockdowns around the world caused a sudden economic downturn. This health crisis naturally required measures on such a scale.

The stock market is artificially inflated by the Fed’s actions

In just one month, the Dow Jones fell from over 29,000 points to a three-year low of 18,591 points:

The situation was exactly the same for the S&P 500.

The Fed then took control by announcing exceptional measures on March 23, 2020:

- The conduct of an unlimited quantitative easing program.

- The lowering of interest rates to zero.

- The lowering of the reserve requirement rate for U.S. banks to zero.

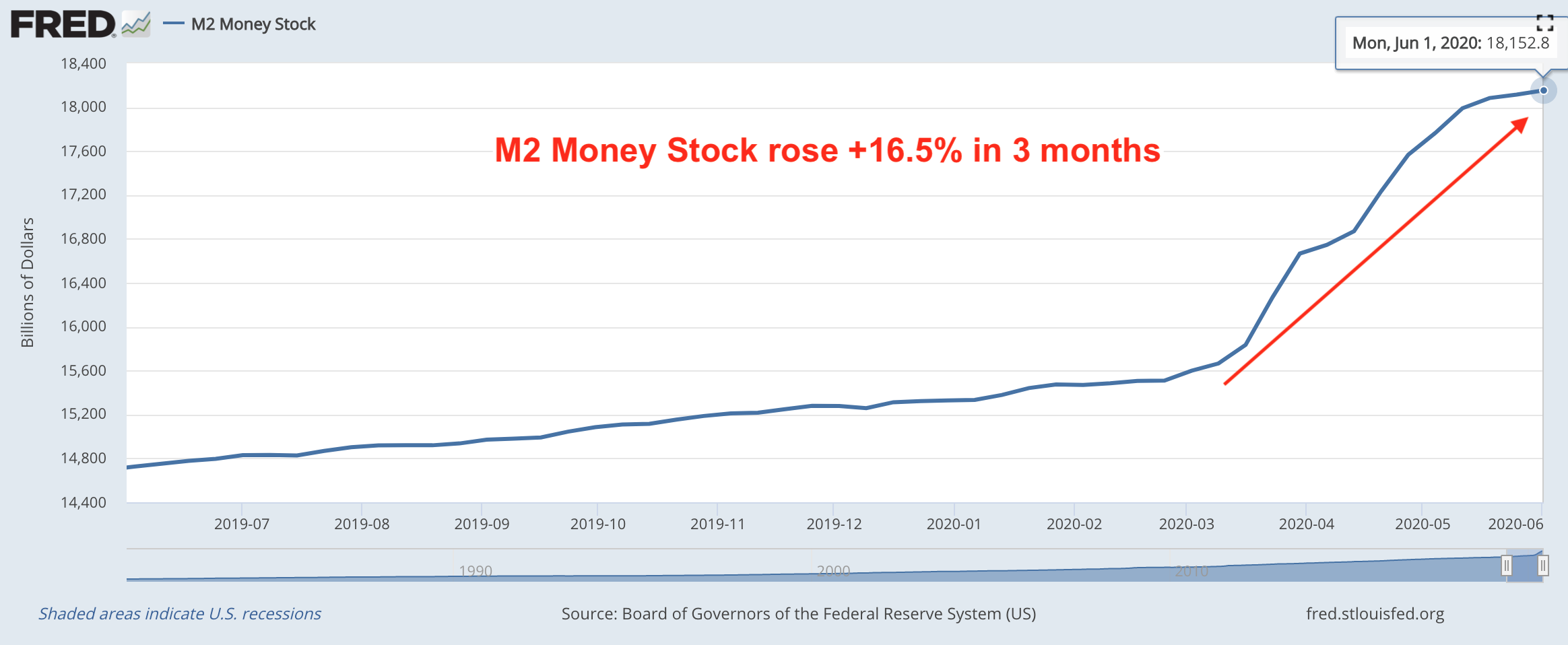

Since these announcements, the Fed has printed nearly 3,000 billion dollars, as shown by the unprecedented increase in the M2 Money Stock:

All the money printed by the Fed was injected directly into the financial markets to support the U.S. economy, as Fed Chairman Jerome Powell explains.

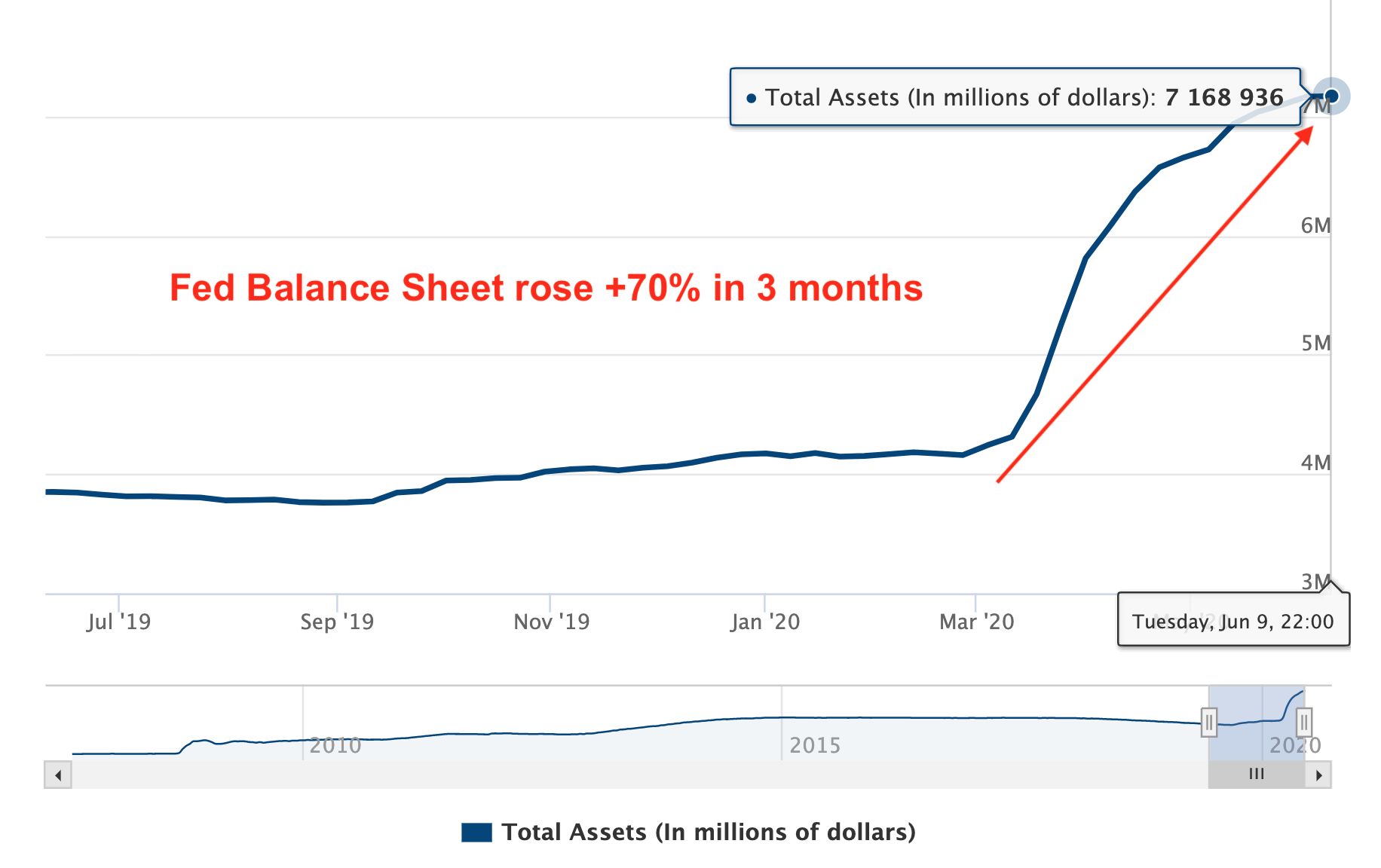

This is confirmed by the unprecedented increase in the Fed Balance Sheet:

The Fed Balance Sheet rose by 70% over the same period, exceeding the $7 trillion mark for the first time in its history.

The Fed is now the world’s largest asset manager ahead of BlackRock.

This is something incredible that no one could have imagined at the beginning of 2020.

The Fed’s actions have resulted in a rapid and incredible rebound on Wall Street. As we are on June 15, 2020, the Dow Jones and the S&P 500 are once again approaching their pre-crisis levels:

Here again, the S&P 500’s situation is completely comparable to that of the Dow Jones.

In addition, many stocks are breaking records, with Tesla, for example, posting +123% since the beginning of the year, or Apple, whose market cap is now close to $1,500 billion.

The stock market is facing the Iceberg Illusion

Looking only at the situation on the financial markets, many people have the impression that the economic crisis of 2020 has been brought under control. For them, the recession will not be as severe as predicted.

Hearing and reading what some optimists think, I have the feeling that the current stock market is facing the iceberg illusion:

A majority of people thus only see the tip of the iceberg. This is in line with the good numbers of the Dow Jones or the S&P 500 since they hit their lowest point in March 2020.

Unfortunately, not all of these people see the reality that corresponds to the submerged part of the iceberg.

What is this reality that many do not see, or refuse to see, concerning the Stock Market?

The reality is that the economic situation is disastrous. This is true for the United States, but also for all the major economic powers in the world.

Here is a non-exhaustive list of what a majority of people do not see right now, and which leads me to believe that the stock market is far from being out of the woods:

1. Great uncertainty surrounding the coronavirus pandemic

The coronavirus pandemic appears to be under control in Asia and Europe. Many countries are reopening their economies step by step, applying barrier gestures that are supposed to limit the risks of a second wave as much as possible.

Unfortunately, the situation is far from being as positive in the United States or South America.

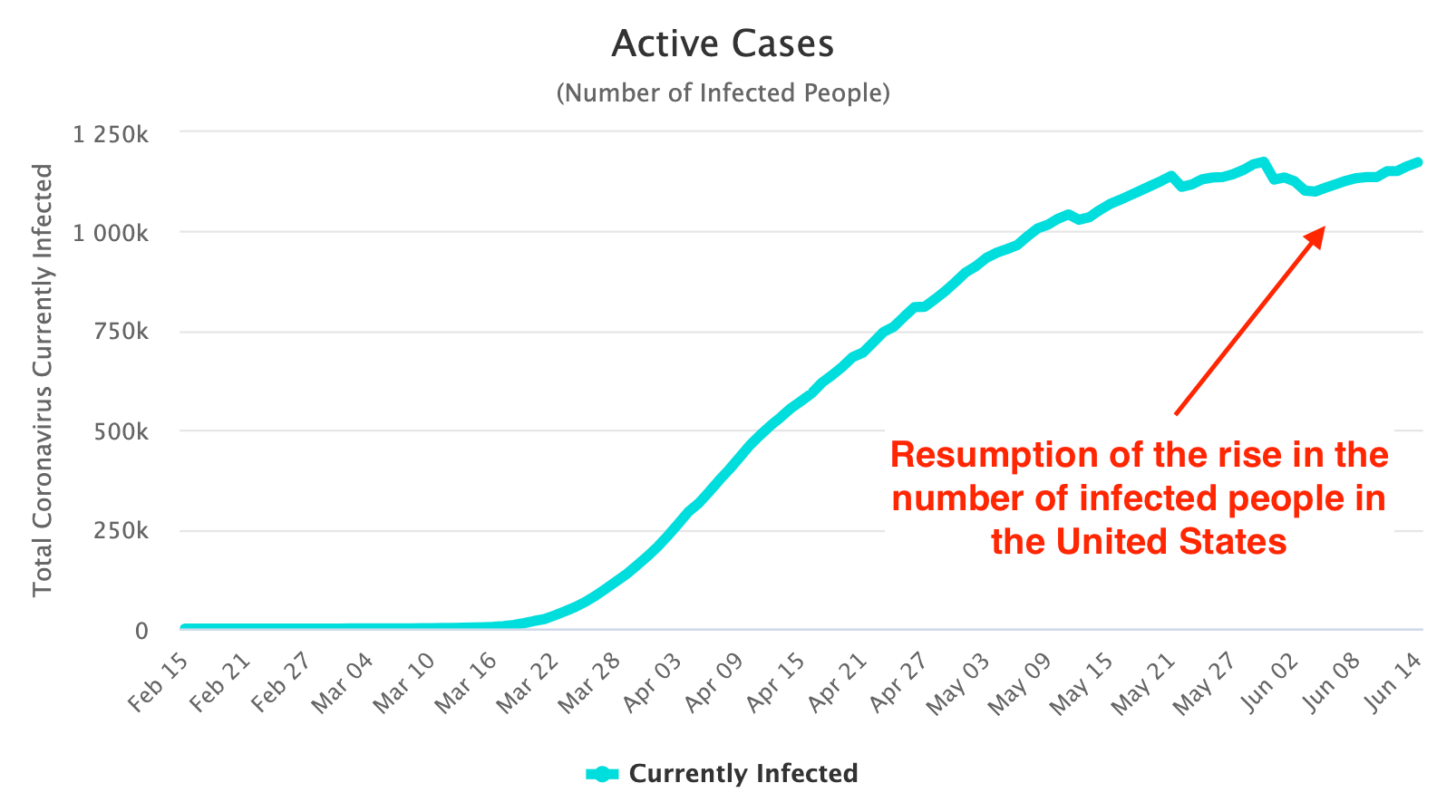

In the United States, we are again seeing an increase in the number of people infected with the coronavirus. We do not even know whether we can speak of a second wave or a first wave that is still uncontrolled:

The news from China isn’t good anymore. The start of a second wave is still to be feared.

As Jerome Powell has rightly pointed out, until a vaccine against the coronavirus becomes available, we will never be safe from a return of the pandemic with all the damage it will cause to the economy.

2. A disastrous economic situation

The economic situation is disastrous. The financial markets are now totally disconnected from the real world. The fault lies with the Fed’s actions, which have artificially inflated them in order to give investors confidence to continue to invest heavily.

U.S. GDP is expected to fall by nearly 7% in 2020. For the G20 countries, the expected range of the decline is between 5 and 15%. The recession is here.

The United States is breaking records in terms of unemployment. The country led by Donald Trump has gone from almost full employment with an unemployment rate of 3.5% at the end of February 2020 to an unemployment rate of 20% currently.

In the space of a few weeks, the number of job seekers in the United States has increased by 40 million.

Applications for corporate bailouts are pouring into the federal government. The federal government has earmarked $500 billion for this purpose. Nevertheless, this will not prevent an incredible number of small businesses from going bankrupt.

In order to support the American economy, the U.S. government has already borrowed more than $3,000 billion. Among the measures announced was a $1,200 stimulus check sent to all eligible Americans. The situation is so catastrophic for millions of people that it is a real wake-up call.

All of this has caused the American debt to grow at an incredible pace. It now exceeds $26 trillion:

At the current pace, it was expected to reach $30,000 billion by the end of the year.

In 2020, having a public debt-to-GDP ratio above 100% has unfortunately become the norm. All this will place a heavy burden on future generations.

The big question now is what will happen the day the Fed will have to stop its quantitative easing program…

3. The beginning of a New Cold War between the United States and China

Since coming to power, Donald Trump has constantly attacked China, which he considers guilty of not respecting the rules of international trade. In order to curb China’s rise to the status of the world’s leading power, Donald Trump has been waging a trade war with Xi Jinping for more than 2 years now.

This trade war between the United States and China was expected to end in the year 2020.

Unfortunately, the coronavirus pandemic has changed things. This pandemic originated in Wuhan, China. That was all it took for Donald Trump to accuse China, and demand financial reparations.

This has rekindled tensions between these two world powers, which are bound to be in a constant confrontation in the years to come.

China wants to become the world’s leading power both economically and militarily. The United States does not want to lose its hegemony over the world. All these will lead us to a New Cold War.

In the years to come, we will witness a bipolarisation of the world that will create incredible uncertainty. And as you well know, the financial markets abhor uncertainty.

4. Deep social unrest in the United States with major political divisions

In addition to these major economic problems, there is deep social unrest in the United States. Society is divided as never before.

The death of George Floyd was the trigger that brought the problems of American society back into the spotlight.

Inequalities that have never really been addressed in decades are leading millions of people to protest across the country. Donald Trump found nothing better than to fan the flames of anger with inflammatory tweets.

Many protests end in riots, and the situation is extremely unstable in the United States. On this issue, one can see a real political division in the country.

The United States clearly lacks leadership with Donald Trump, and the election of November 2020 is already crucial for the future of the country. Indeed, for the moment, Donald Trump seems to be unable to provide answers to the millions of people who are marching in the streets demanding real change.

The current situation on the stock market cannot last forever

A lot of people are having a hard time seeing what I’ve just listed. However, you only have to look up for a few minutes far from the share price charts to see that the current situation is extremely worrying.

For the moment, the stock market is doing well thanks to the Fed’s actions. But sooner or later, the Fed will have to put an end to these actions. The big question is what will happen then.

For me, the fall of the stock market in the coming weeks and months seems inevitable. The disconnection between the stock market and the real economy cannot go on like this forever. And right now, I rather see the stock market reconnecting to the real economy with a big drop.

So be careful what you do on the stock market in the coming weeks.