By Clare Witts, Director, APAC Market Structure, and Ian O’Connor, Vice President, APAC AES Product, Credit Suisse

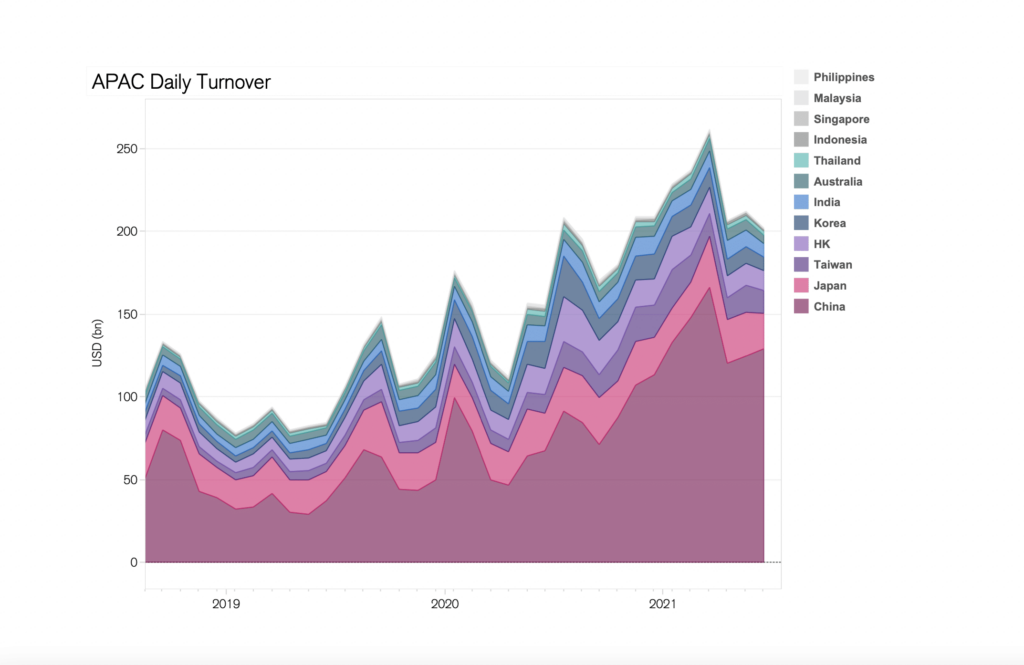

China’s onshore average daily equity turnover jumped by almost 90% in 2021 compared to 2020, soaring to a record high of US$160 billion in September 2021. With trading in mainland China shares now making up over 64% of all equity trading done across the Asia Pacific (APAC) region we look back at some of the drivers for this meteoric change, and forward to what may come next for China trading as the market becomes increasingly institutionalized.

A METEORIC RATE OF CHANGE

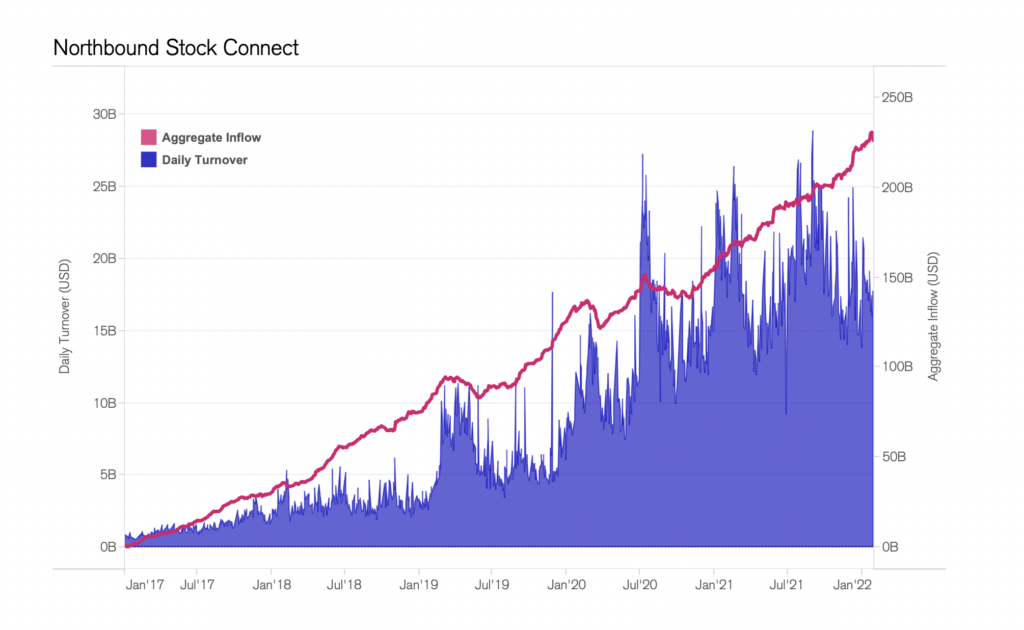

Going back only four years to early 2018, international investors had limited exposure to the China onshore stock market. Foreign holdings accounted for just 3% of the total A-share free-float market capitalization; the daily turnover for Japan was higher than China; and Stock Connect was in its nascent phase with stringent trading caps and less than US$5 billion of daily transaction volume.

Source: Credit Suisse, the BLOOMBERG PROFESSIONAL™ service

Fast forward to now, both domestic and international fund flows have surged, shifting the ownership composition of A-shares; China’s average daily turnover is now more than 4.5 times higher than that of Japan; and the Northbound flow of the Stock Connect’s daily turnover regularly exceeds US$20 billion.

Source: Credit Suisse, the BLOOMBERG PROFESSIONAL™ service

SIGNIFICANT CHANGES IN A-SHARE WEIGHTING IN GLOBAL BENCHMARK INDICES

Global benchmark index providers MSCI and FTSE’s move in 2018 and 2019 to increase the weight of China A-Shares in major global benchmarks resulted in significant change for international investors. To enable this, the rapid development and expansion of the Northbound Stock Connect program not only led to an influx of foreign institutional capital, but also contributed to structural changes in China’s stock market. The QFII and RQFII programs evolved at lightning pace, undergoing frequent changes in a short period of time and culminating in the 2020 abolition of investment quota limitations and the simplification to a single QFI regime. As the QFI program continues to develop, barriers to entry for international investors have been reduced and the number of fund managers applying for licenses continues to rise: data from CSRC shows the total number of approved QFI license holders reached 119 in 2021, up 67% from 71 approved in 2020.

INTERNATIONAL INVESTORS CONTRIBUTE TO INSTITUTIONALIZATION AND MARKET MATURITY

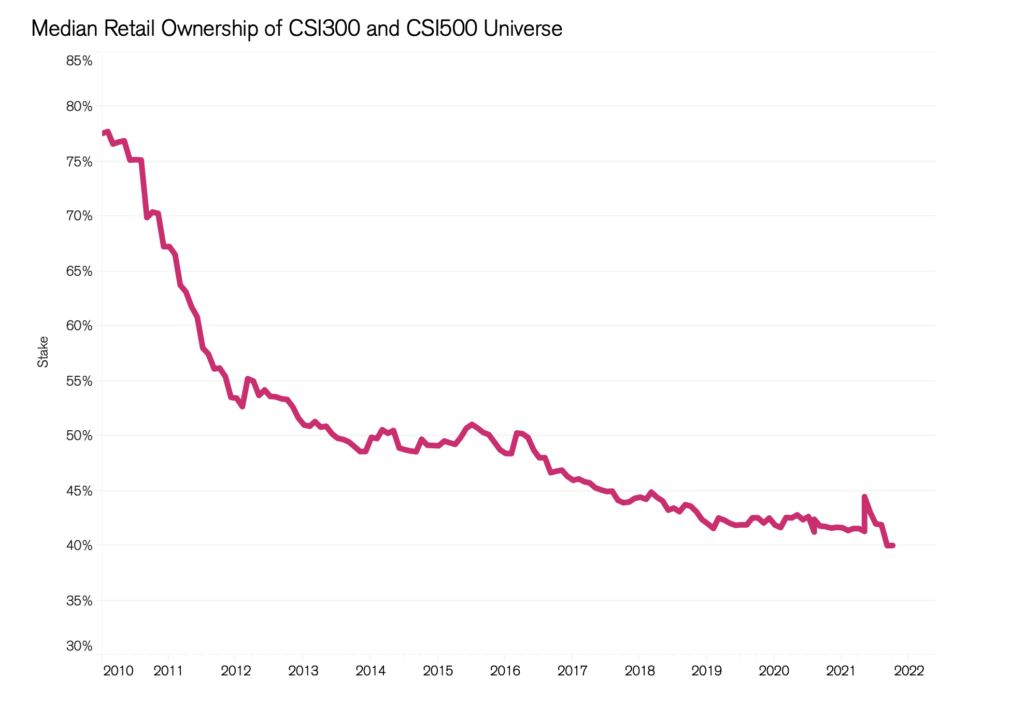

While retail investors remain an important driver of China equity market liquidity, we have seen a continued decrease in median retail ownership in both large and small cap segments of the onshore market. Meanwhile increasing institutional ownership is growing from both the domestic and international markets: domestic mutual funds are now estimated to account for almost 25% of the available A-shares free float; and holdings by international institutional investors are growing even among smaller cap stocks, with foreign ownership of Shanghai STAR board stocks now standing at almost 5%.

We approximate retail ownership as 100 – sum of all the disclosed ownership stakes.

These fundamental structural shifts in the investor base have been accompanied by a series of regulatory developments aligned with the growing institutionalization of the market. Despite perceived tightening in many aspects of China policy making, the latter part of 2021 continued to see regulatory changes designed to support the ongoing international opening up and institutionalization of the market. Most recently, this has included: a focus on the expansion of onshore and offshore derivatives products; a consultation to introduce market making on the Shanghai STAR board; plans to introduce Delivery versus payment (DVP) settlement for onshore trading; and a burgeoning Exchange-traded-fund (ETF) industry.

MARKET MICROSTRUCTURE PLAYING CATCH UP

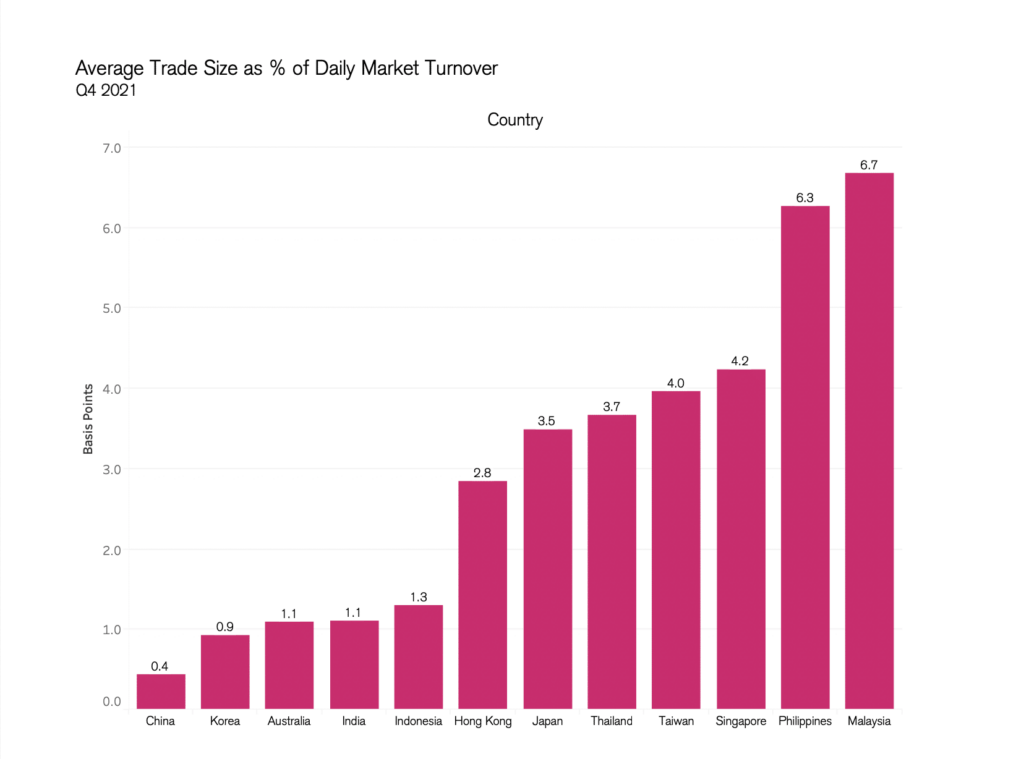

Despite these changes to the macro market structure, China’s microstructure characteristics have not evolved as rapidly and still look very different to almost any other market globally. For example, along with the highest volumes, China has the narrowest spreads of any APAC market except India. We also see fast turnover at the top of the order book, a common feature of markets with high retail participation.

However, two metrics, in particular, demonstrate the impact of some of China’s unique market structures:

China’s order sizes relative to the overall market turnover are at the extreme low end of the range; and

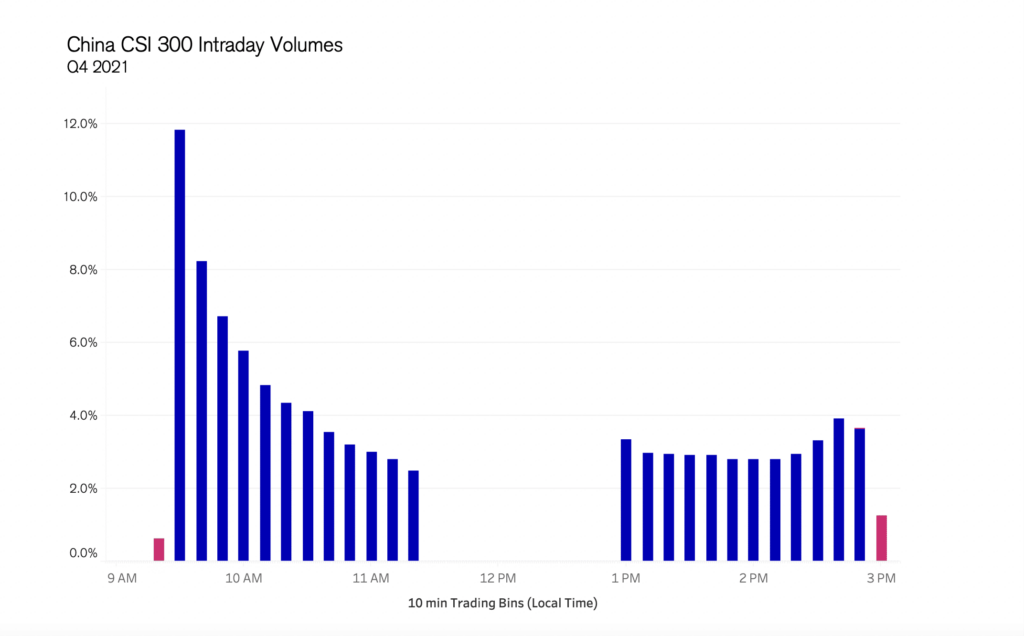

The intraday volume profile has a shape that stands out. Specifically, less than 1-2% of daily volume is transacted in each of the open and close auctions, with almost 12% of daily volume traded during the typically volatile post-open period.

For institutional investors looking to transact at wholesale scale to minimize impact, the constraints of block trading opportunities likely contribute to the small average trade size. There is currently no block trading mechanism available for Stock Connect participants. For QFII investors the block trading window is only open from 3-3.30 pm and requires manual processes that may be challenging for managers with many underlying funds. For institutional managers who are used to continuous block matching in other markets, further development would be welcomed and may increase average trade sizes.

In terms of when during the day liquidity is available, the low volumes in the close auction at first may seem surprising, particularly given growing China A-share inclusion in large global indices. Neither is this a mechanical issue with the auction models. In 2018, as part of ongoing market reform, the Shanghai Stock Exchange followed Shenzhen in introducing an effective closing call auction mechanism. However, this front-loaded trading profile may be explained by several factors:

Firstly, the historical behaviors of the market are based on high retail participation and a recent exponential growth in algorithmic trading. With new liquidity most naturally following the existing liquidity profile, the established volume profile can be hard to shift.

Secondly, cancellation in the auctions is prohibited, leaving institutional investors open to greater risk as price formation occurs and resulting in the majority of institutional orders joining later in the auction period or in continuous trading to manage price uncertainty.

Thirdly, there are differences between the open and close auctions. Open auction duration is ten minutes versus three for the close, and supervision of close trading is particularly stringent, with guidance from the exchanges indicating much lower tolerance of volume participation and price deviation in the close than the open.

But perhaps most importantly, China’s derivatives market is at a far earlier stage than its equity markets, and with the liquidation of derivatives transactions driving much of the cash equity activity around the close in most markets, we are yet to see the typical afternoon volume profile develop in China.

SO WHAT NEXT?

At a policy making level, China’s financial and regulatory agencies continue to emphasize their focus on opening up. Nevertheless, the word of the moment is ‘stability’. In most public statements, both domestic and international investments and trading are welcomed, as long as they are high-quality, stable, and most importantly, contribute to the growth of the real economy. Recent restrictions on some of China’s largest domestic quant trading funds serve as a cautionary tale: expect China policy making around trading to continue to be agile and aligned with political priorities.

A big driver for change in equity microstructure will be the ongoing expansion of the financial derivatives market. The Draft Futures and Derivatives bill is currently making its way through the China legislative process and includes key provisions that are likely to remove a major barrier to international participation. In addition, there is also the ongoing expansion of internationally traded instruments that can be used to hedge China onshore investments, including the recent launch of HKEX’s China A-50 index futures contract. As institutional investors have more instruments to manage their risk and exposure, it seems likely this will support ongoing inflows to the China A-share market as well as the growth of the domestic mutual fund industry.

All of these factors suggest that over the long term, China’s market microstructure will shift to have more characteristics in common with other large markets like Japan. In time, we expect close auction activity to rise with a corresponding shift to the volume profile; and trade sizes to change, particularly if further intra-day block trading mechanisms develop. Credit Suisse provides analysis in our monthly APAC Chartbook as well as dedicated market structure expertise and trading solutions to guide our clients effectively through these developments.

Looking back at how far and how fast China’s equity trading market has evolved in the past few years indicates further change. While policy making walks the tightrope between opening up and maintaining required levels of stability and transparency, we can be sure that trading in China will continue its metamorphosis for years to come.

What Next for Trading China? first appeared in the Q1 2022 issue of GlobalTrading, a Markets Media Group publication.