By David M. Aferiat, Managing Principal and Co-founder, Trade Ideas

2020 saw the emergence of the retail investor as a key player (and now stakeholder) in US equity trading. Prior to Covid, there were several developments which set the table for this trend. And once Covid hit, a perfect storm of commercial models, technology, and retail investor appetite converged into a retail investor movement, driving markets throughout the year. That trend has continued into 2021.

Among these initial, pre-Covid developments was the October 2019 move to zero-based commission trading by Charles Schwab, immediately followed by E*TRADE, TD Ameritrade, and Interactive brokers. This development continues to reverberate and forms the basis for many of the insights later in this paper concerning what retail investors now demand.

Hard on the heels of zero commissions was the acquisition of TD Ameritrade by Schwab and of E*TRADE by JP Morgan. With brokerage commoditized, the provision of ancillary services (mostly in performance information and data) becomes critical for these firms. The technology for this delivery to end individual clients also became more important in the hopes retaining new clients and growing assets under management.

Next, the continued rise of Robinhood impacted both the number of investors and the type of vehicles available. Robinhood has some 13 million subscribers (with a significant number of millennials) and allows for the purchase of fractional shares (sometimes as low as $1). This development is a competitive differentiator, which fuels the equity trading picture by expanding the liquidity available in the system – all from retail. It should be noted before pulling the ability to trade certain issues (including GME) and the resulting class action lawsuit it faces, that Robinhood recently paid a $65 million fine for misleading investors around its lack of transparency around payment for order flow commercial model.

The Retail Picture 2020

The numbers around retail investor activity in 2020 are telling of the shift that has occurred. According to an article in the Financial Times (September 25, 2020)(1) retail activity in 2020 became significant enough that institutional investors can no longer afford to ignore it.

According to Brooke Fox, in that FT article: “The total number of average daily trades across big US retail brokerages, E*TRADE, TD Ameritrade and Charles Schwab has increased by three-quarters since January to 6M, according to Sundial Capital Research. In the process, everyday traders have grabbed a greater share of market liquidity.

They now make up 20 per cent of US equity trades, double the total last year, according to internal estimates at Citadel Securities, the US’s biggest market maker. That share approaches 25 per cent on peak days, says Joe Mecane, its head of execution services.”(2)

By December 2020, the stock market had come back from a March 2020 collapse to experience significant gains. According to Patti Domm, writing for CNBC: “JMP estimates the brokerage industry added more than 10 million new accounts in 2020, with Robinhood alone likely representing about 6 million.”(3)

And in 2021 the Gamestop (GME) short squeeze has begun to percolate questions around the relationship between retail investors and their brokers.

Retail Moving Forward

Retail client retention in an era of commoditized brokerage depends on the ability of investors to access – and for online brokers to provide – services, data, research and information that clients will find valuable, either for individual trades or for overall portfolio construction.

A neutral survey by TradeIdeas ascertained specifically the value of these retention and acquisition elements to individual investors from those of most immediate importance and urgency to least important. Below are some of the results and the insights.

The Retail Servicers Survey

The survey was straightforward, and designed to confirm three significant developments with which retail investors (and by extension online brokers in general) are wrestling. The specific task was to determine the level of satisfaction/dissatisfaction with online broker services and to identify specific areas for improvement, as well as to identify specific services and their relative importance, one against another.

The first question dealt with third party trading and the ability to connect to a broker of the client’s preference and trade.

What this 81.4% response suggests is that independent service and utility providers can be a source of new client acquisition (and their attendant liquidity) for brokerage firms, depending on the robustness of their execution API. However, the downside from the brokers’ viewpoint is that empowered clients may have a new choice as to where to take their trades if they have accounts at multiple brokers.

This is not to say that these third party providers cannot also be accessed as well through a broker’s platform. And increasingly, as these services grow more robust, online brokers seek out third party APIs which they can then integrate into their brokerage platforms rather than the providers’ platforms/GUIs.

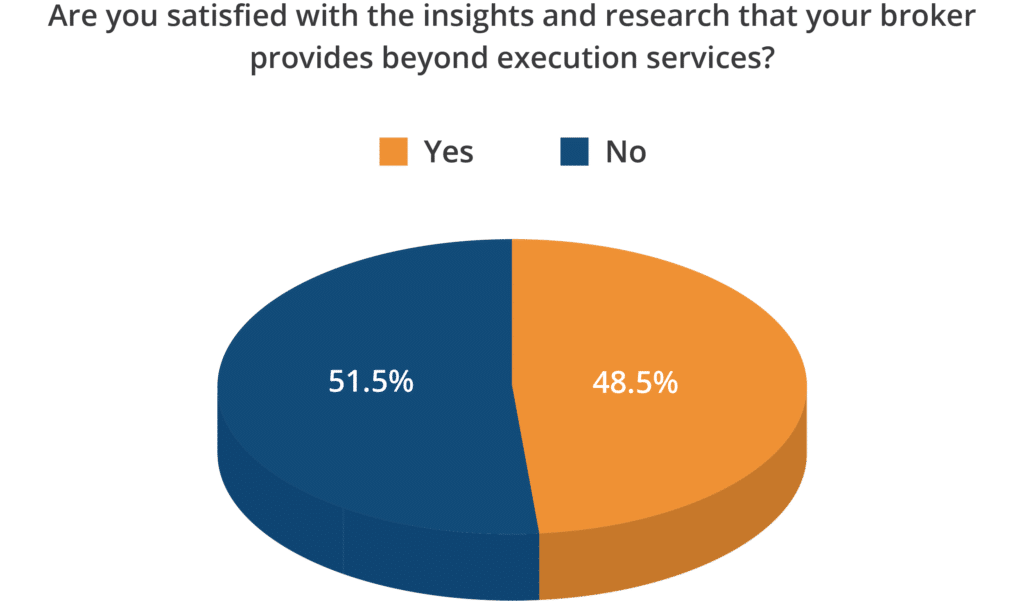

The second question dealt with the relative satisfaction and dissatisfaction with brokers’ information, data, and research provision. The split was fairly even, with some 48.7% of respondents satisfied and 51.5% expressing dissatisfaction.

What these results indicate is opportunity- that in a world of commoditized execution, essentially 1 out of 2 clients are not satisfied with the information they are receiving to inform their trading strategy and decisions making.

Should brokers want to retain and grow the number of clients (and they do), they will need to examination their current services against those desired by clients and to fill in the gap(s). It is this question that was the final issue addressed by the survey.

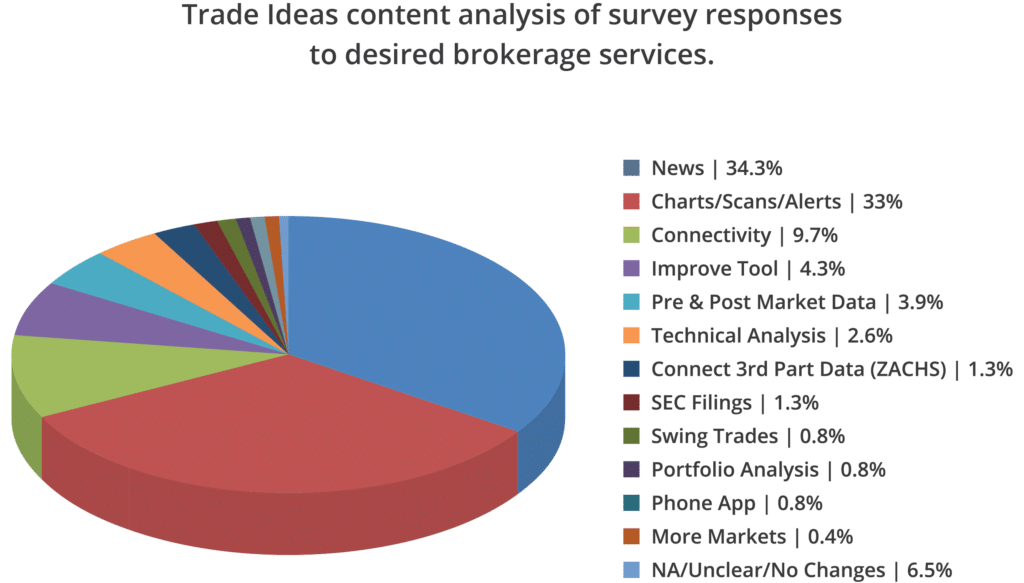

This final question was a qualitative analysis of the services that clients would like to see. The relative importance of each request relative to the others was determined by a content analysis of the number of times a service was mention by respondents.

As can be seen connectivity, news and visualization are the highest rank categories. Interestingly, this ranking ties to the general trends of increased retail importance in the overall market picture. Results reflect the increasing sophistication of clients as traders: real time news indicates that they know news moves prices; visualization means they will rely on the same sophistication that institutional traders routinely accept as the norm: and connectivity shows an immediate need for execution, before the market gets away from them. It also is an indication overall that retail investors sense some recognition of their power to provide liquidity and affect execution price. Accordingly, they are beginning to flex their muscles. Savvy online brokers will not only meet, but anticipate their demands and deliver ahead of time.

1 https://www.ft.com/content/ddc4630c-c27c-47e6-b13e-1e036d16b0f9

2 Ibid

About the Author

David Aferiat, Co-Founder Managing Principal, Trade Ideas, brings more than 25 years of experience in trading, consulting, software, utilities, capital markets, and consumer product industries. Working with senior officers and key decision makers in the boardroom, finance, HR, marketing and trading functions, he has advised both public and privately held companies with revenues ranging from $20 million to $14 billion. Work at Trade-Ideas taps experience in business development, customer acquisition and retention, corporate strategy as well as energy trading and marketing. David holds dual Bachelor of Arts degrees in Economics and French from the University of Texas at Austin and a Masters of Business Administration degree from the Cox School of Business at Southern Methodist University.