Many investors have a long-term outlook as well as a unique, slow alpha trading signal. If that’s the case, trading costs can be minimized by slowly accumulating positions without signaling or holding up the market.

Although placing buy orders on the bid lets you capture a whole spread, it can also signal a trade to the market. For even more patient investors, a strategy that uses hidden orders like iceberg or midpoint orders can work better.

However, even though they are not advertised, many hidden orders are still “firm” at their hidden prices. That means they can still suffer from something traders call adverse selection (what others call getting “picked off”).

Adverse selection happens in less than a millisecond (ms)

Adverse selection occurs when you get a fill only to find out that it’s cheaper to trade at new prices than at the prices where you just traded. For example, consider an order resting on the offer in Chart 1 at $325.01. The trade that happened in the grey box would have filled your order, whether you were hidden or not. But an instant later, the new offer is at a price of $325.02, a better price to sell.

It’s a form of buyer’s remorse, where if only you’d waited a bit longer, you could have sold at a better price. For a trader, it also requires perfect hindsight because trades can easily do the opposite and make your next trade more expensive too.

But there are ways to avoid adverse selection. To do it, you need to avoid being filled by large or “informed” spread-crossing trades.

Nasdaq’s Midpoint Extended Life Order (M-ELO) order type does just that. M-ELO orders all have to wait to activate, which means it will only trade with orders that have been resting at the same place for at least the same amount of time. Given urgent spread crossing orders don’t wait, they won’t interact with M-ELO. So using a M-ELO order makes it more likely you will find other longer-term traders who are also willing to join the market more patiently.

Chart 1: Almost all of what happens to quotes happens in a millisecond

Speeding M-ELO up didn’t affect its features

But how long is “long enough” to avoid those urgent trades?

In prior research, we’ve shown that it takes less than 1ms for spread crossing orders to sweep all quotes in the market and then to update the SIP.

That’s why back in May 2020, we reduced M-ELO’s wait time from 500ms to 10ms. That sounds like a lot, but in reality, it makes no difference to M-ELO’s designed purpose, which is to avoid adverse selection being swept by market orders.

Market data also shows that after a price change occurs, quotes are stable more than 99% of the time. Importantly, once the SIP is updated, the M-ELO orders will reset to the new midpoint price and wait for a new offsetting patient M-ELO to activate at the newly stable quotes. In reality, M-ELO only needs to wait a millisecond to avoid adverse selection and participate with patient orders again.

That means waiting 10ms achieves exactly the same thing as waiting 500ms. It avoids a sweep and resets M-ELO to the new midpoint before an offsetting order will activate.

Speeding M-ELO up didn’t affect its performance

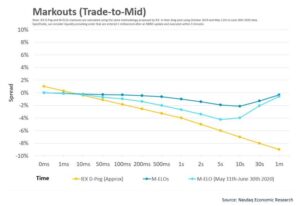

Despite the elevated volatility since the change, M-ELO markouts have only slightly worsened, but importantly is still much better than its nearest competitor, IEX’s D-PEG.

Chart 2: M-ELO’s performance is consistent and still better than IEX’s D-PEG

But given how many quote changes there are in a day in liquid stocks, all those wait times can add up. Consequently, the shorter window means M-ELO is available for more of the day, making it more likely that slow traders will match before algos decide they need to do something else.

In fact, we have seen that buyers and sellers are three-times more likely to get a M-ELO fill now than with the longer timer.

Other data shows that M-ELO benefits from becoming a bigger part of the routing ecosystem too. Our data indicates that for each 10% increase in orders, there is a 15% increase in traded fill rate. In short, the more long-term investors use it, the more likely they would be to find another long term investor on the other side of the trade.

M-ELO: Highest quality fills, lowest information leakage

In fact, the data shows that on average the midpoint is virtually unchanged as much as a minute after a fill. That seems to show that M-ELO interactions result in very high quality fills with minimal information leakage.

Why would any long-term investor not want to add M-ELO to their algos?