By Clare Witts, Head of APAC Market Structure, Credit Suisse

Hong Kong’s connector role will get a boost from imminent Stock Connect expansion

The new multi-million dollar ‘Hello Hong Kong’ global marketing campaign includes airline ticket giveaways, big-name events and spending vouchers. But as the city re-engages with the world after several tough years, when it comes to equity trading, a key policy change will soon provide a real boost. Details were recently announced of an expansion to Stock Connect, which is likely to add around 950 China companies to the Northbound link and enables more companies listed in Hong Kong to be accessed Southbound from China. For international investors, this opens new opportunities and considerations for trading.

Stock Connect has been operating in close to its current form since 2018 when daily quotas were relaxed, with small, incremental enhancements since then. The QFII program has seen a steady stream of applications from international investors largely due to the greater range of stocks that can be accessed. However, the significant administration effort to set up and maintain a QFII license means it is not a feasible access channel for many. Largely for this reason, only China stocks that can be traded via Connect are included in indices run by the major global index providers.

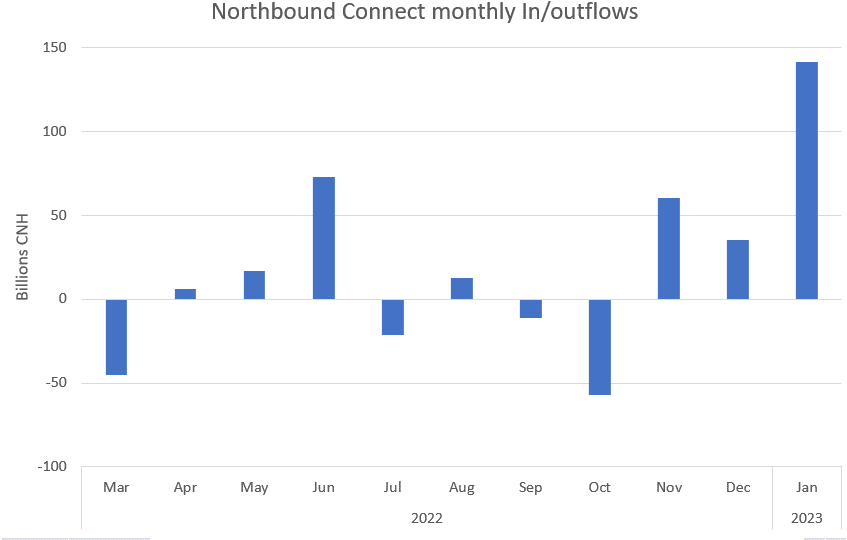

Expansion of Stock Connect has been high on traders’ request lists to provide an easy way to access more China investment opportunities, given the growing concentration in the larger northbound-accessible stocks from both active and passive money. With net inflows on Northbound Connect in January 2023 at an all-time high (see Figure 1), the significant diversification of stocks on the platform is both timely and valuable.

The official list is expected soon. According to Credit Suisse projections (as of time of publication), approximately 950-1,000 names could be added by late 1Q 2023, bringing the total to almost 2,500 A-shares in scope for Connect trading. The additions should include many mid- to small-cap names, so while this may bring in scope a further 15-20% of A-share market cap and turnover, the upside through adding this number of new stocks is far greater:

- Firstly, it creates more potential alpha opportunity for active managers and systematic trading funds, particularly given the predominantly retail investor-base onshore;

- Secondly, if a stock is added to Connect it may then be included in relevant indices based on their eligibility criteria – Credit Suisse analysis indicates this change is likely to add over 30 names to MSCI’s GIMI index and 150 to FTSE GEIS, driving index rebalance trade value of over USD $2bn; and

- Thirdly this has knock-on impact for ETF Connect – after a fanfare launch the number of ETFs trading on Northbound Connect has remained limited, partly due to the criteria that 80% of underlying constituents need to be tradeable on Stock Connect. The expansion of underlying stocks may open up a range of potential new ETF products.

A rule change for Southbound eligibility is also channeling the Hong Kong market in new directions. Including international companies with a Hong Kong listing on Southbound Connect enables them to access new mainland Chinese audiences for both capital raising and marketing. Attracting listings from oil companies, luxury goods brands and international tech firms could help diversify Hong Kong’s current status as a proxy for onshore China, and more importantly, would create differentiated investment opportunities for the trillions of yuan likely to be coming out of China’s growing domestic financial services market in the next few years. If successful, this may trigger a virtuous cycle Hong Kong has been trying to break into for some time. Sometimes cited as a ‘one trick pony’ with a concentration of onshore China companies, a greater variety of IPOs would bring more mainland investment down through Connect and more international investment from offshore, boosting turnover.

There are some chicken-and-egg market structure challenges in this approach, most notably the lack of capacity of the market to absorb mega-caps and provide sufficient liquidity. This is partly caused by a narrow range of different market participants, which in turn is driven by the relatively expensive total costs of trading: high stamp duty costs and other market charges are a deterrent to some institutional investors and contribute to a large portion of retail investing in derivatives warrants rather than cash equities. Finding institutional-sized block liquidity also continues to be challenging, with tight regulatory controls around Alternative Liquidity Pools (ALPs, or electronic dark pools) limiting volume growth in recent years.

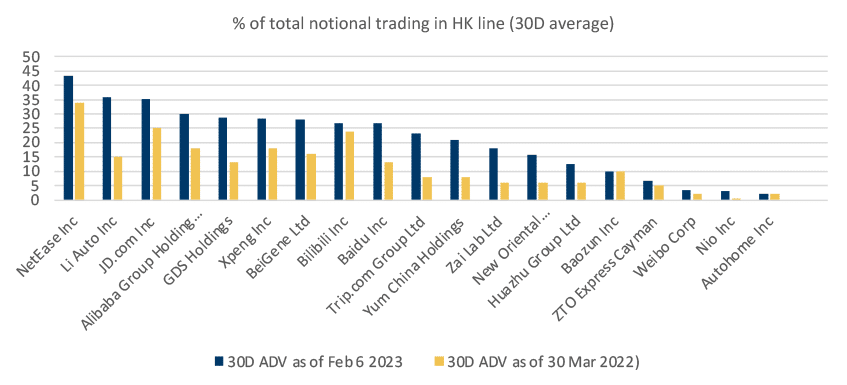

Nevertheless, there has been a steady transition of turnover in HK/US listed companies to the Hong Kong holdings over the past year (Figure 2), suggesting that if the underlying investment value proposition is strong Hong Kong’s current market structure is not a deal breaker to increasing trading volume. And with additional changes this year to reduce the number of holiday days that Stock Connect is closed, as well as introduce RMB/HKD dual counter trading as a further incentive to draw turnover from mainland Chinese investors, near-term momentum on market development is positive.

Geopolitics will continue to be a significant factor in Hong Kong’s role as a connector between China and the world, and there are still many levels of potential market structure reform ahead. However, the current commitment to Connect as a two-way capital access channel is only accelerating, creating some of the most interesting investment and trading opportunities in Asia Pacific this year.