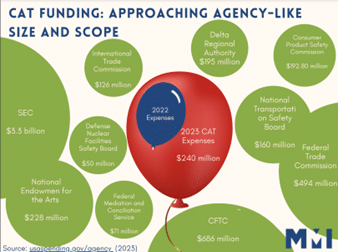

You’ve probably heard of the federal government programs that manage our nation’s nuclear secrets and the safety of your cars, but odds are you haven’t heard of The Consolidated Audit Trail (“CAT”), a public entity that’s every bit as critical to your (financial) well-being. CAT, a centralized database tracking U.S. stock market activity, has a budget that dwarfs that of many federal agencies, and its ever-ballooning costs threaten to eat up the returns of your investments and savings.

CAT was established as a response to the stock market’s 2010 flash crash that saw the Dow Jones Industrial Average plummet 9% in a matter of minutes. The publicly funded CAT initiative was originally viewed as a reasonable vehicle for regulators to collect the data needed to reconstruct market events and monitor for fraud. However, because CAT is not accountable to any federal agency, its budget has swelled to 5x the costs that were originally approved in 2016 with no signs of stopping.

This should concern every taxpayer, not just because we should strive for sensible government efficiency, but also because these costs have recently been approved to be passed through to and paid by U.S. stock market participants. In other words, the enormous, unknown CAT database is about to become an effective tax on any purchase or sale of securities you make, whether you’re managing your retirement fund, building your 401k, participating in a college savings plan or striving toward any other investment goal.

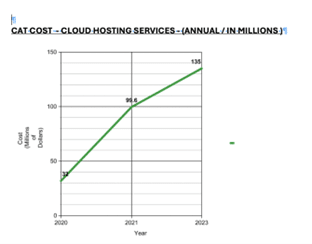

So, how did we get here? Simply put – years of unchecked spending, mounting operational issues, and absolutely no government oversight. One of the most alarming stats of this unique journey to wasteful government spending is that over 90% of CAT’s current costs are related to cloud hosting services. When digging deeper into the latest publicly available CAT financial statement, a single line item includes an eye-popping $135 million a year for cloud hosting services, without further clarification of how this number was arrived. By contrast, this number is 20 to 100 times more expensive than private sector metrics; the very largest companies (with over 1000 employees) spend $1 million to $6 million a year on cloud services. What’s more, the CAT cloud hosting cost has more than quadrupled since 2020.

This is a figure no global corporation would find acceptable and leads one to think who really benefits from this program: American investors, or the cloud hosting government contractors profiting from ginormous fees?

One way to look at the cloud hosting fees is to conceptualize data as a raw material – or resource – to be budgeted and managed. In the case of CAT, data usage and the cost of hosting is analogous to use of a natural resource, such as water. For example, cloud hosting usage is like a garden hose, where you can turn a spigot for water (data) on or off. If you leave a garden hose running all night, but don’t need to water your garden, you are likely to incur a massive bill.

It is valid for the American public to ask- and seek answers – to questions such as: To what extent, if at all, is the data being “rationed” to maximize the use and avoid cloud waste (i.e. are users of CAT data and cloud hosting seeking for more than is necessary to achieve the original goals of CAT, or is the same or similar data already available elsewhere)? Is the cost of cloud services being competitively bid, and what are the profit margins of the government contractors benefiting from the CAT cloud hosting contracts? How does the CAT cloud hosting fee change over time, and how is the usage accounted for? How is CAT avoiding a common industry pitfall of so-called “cloud waste” – apparently at 32% average “cloud waste” – to avoid wasting the corresponding equivalent of $40 million a year of cloud budget? These numbers are not insignificant, and American investors in 401ks, 529s, pensions, and ABLE plans have a right to ensure that their financial well-being, and returns, are not put at risk by unnecessary hidden fees.

For now, it’s worth keeping an eye out on an emerging court case in the 11th Circuit in the next month, in which the American

Securities Association is anticipated to raise questions about the CAT budget, oversight, and controls. Among the legal questions likely to be argued will be the “major questions doctrine,” and the extent to which Congressional oversight and budget controls are required for a government program approaching agency-like size and scale.

In the interim, American savers should ask themselves their own major questions: would you be okay with leaving a garden hose running for the day while you’re off to work? Common sense on these questions should prevail, and apply to the CAT data usage as well.

About the Author

Kirsten Wegner is a lawyer and policy expert on fintech and financial markets. As CEO of Modern Markets Initiative, a Member of the Mosaic Cohort of Progressive Policy Institute, and a member of the Economic Club of Washington, she promotes public education and discourse on trading technologies.